Sturdy enhancements in private auto insurance coverage outcomes helped drive the U.S. property and casualty insurance coverage trade to its second-highest internet underwriting achieve in any quarter since at the least 2000, based on an S&P International Market Intelligence evaluation.

Simply 12 months from its worst-on-record begin to a calendar 12 months – with a mixed ratio of 102.2 – the trade generated a ratio of roughly 94.0. Mixed ratio is a measure of underwriting profitability wherein a ratio beneath 100 signifies a revenue and one above 100 represents a loss.

Whereas quarterly statutory knowledge is inadequate to calculate mixed ratios on the line-of-business stage, S&P beforehand estimated {that a} direct incurred loss ratio of roughly 71.3 p.c within the private auto sector would have produced break-even underwriting leads to the primary quarter.

“Making use of the identical methodology to the first-quarter results of 66.7% yields an estimated mixed ratio of 95.6,” S&P mentioned. The trade’s full-year 2023 personal auto mixed ratio was 104.9.

On a consolidated foundation throughout enterprise traces, incurred losses elevated solely modestly, whereas internet premiums earned continued to rise quickly. This displays the mixture of continued top-line power in lots of business traces of enterprise and what S&P referred to as “the toughest personal auto pricing atmosphere in 47 years.”

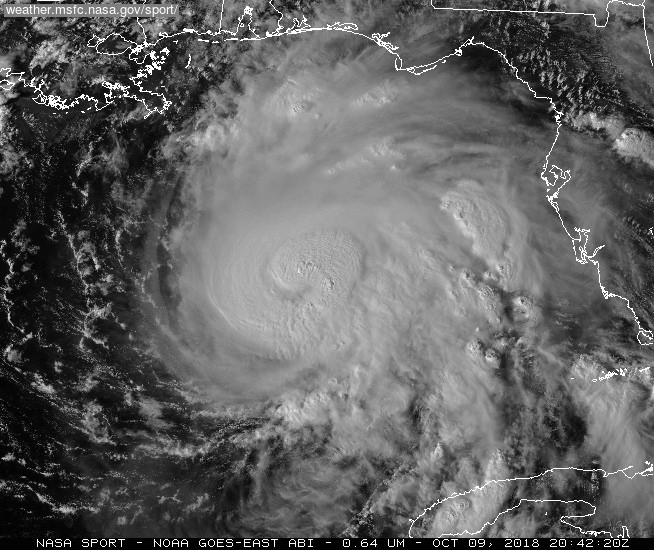

The trade additionally benefited from comparatively delicate disaster exercise in contrast with the comparable prior-year interval.

Whereas these sturdy first-quarter outcomes are noteworthy, it should take time to know whether or not they symbolize the beginning of a pattern. A number of extreme convective storm occasions have already got occurred within the second quarter, and the 2024 Atlantic hurricane season is forecast to be “extraordinarily energetic.”

Private auto’s latest enhancements comply with 2022 outcomes that have been among the many worst lately. The variety of drivers on the street has returned to pre-pandemic ranges, and the dangerous driving conduct that led to excessive losses through the pandemic has not improved. Extra accidents with extreme accidents and fatalities have pushed up claims and losses when it comes to each automobile injury and legal responsibility, attracting higher legal professional involvement and authorized system abuse.

Compounding these loss drivers has been traditionally excessive inflation, which places upward stress on the fabric and labor prices for each the auto and property traces.

Favorable first-quarter outcomes are excellent news, however it’s necessary for policyholders and policymakers to keep in mind that the present exhausting market wasn’t created in a single day. It is going to take time for insurers’ efficiency and drivers’ charges to stabilize.