Edited excerpts:

Q1. Bosch has introduced a €6 billion goal for software program and AI revenues by early 2030. What are the highest AI-powered merchandise or platforms that can assist obtain this, and what is the timeline for his or her mass adoption?

A: There are such a lot of completely different software program initiatives we have now. Sooner or later, there shall be nearly no product that’s software-free. Every thing will embody superior software program. The problem is that pure software program companies are tough as a result of many automotive platforms as we speak can’t run these sorts of software program—however that is altering. OEMs at the moment are adopting software-defined car methods.Considered one of our key choices is a Automobile Movement Administration software program package deal. It integrates damping, braking, steering, and linear acceleration to supply a holistic driving really feel. You’ll be able to modify the automotive for sportiness, consolation, or security—like an anti-seasickness mode for kids or a secure mode for youthful drivers. These are the sorts of software-driven options we count on to see extra of going ahead.

Q2. Bosch lately introduced a €250 million fund for AI and vitality startups. Is that this about constructing in-house AI power or a broader acquisition technique?

A: We love collaborating with startups. Typically, we do purchase them—however that’s uncommon. What’s extra vital is working with them and investing in ones we discover fascinating. They bring about a unique tradition and experience. In India too, there is a vibrant startup scene and a few younger folks favor startups over huge corporations like Google.

If we purchase these startups, the unique folks might depart. So, we concentrate on collaboration, and it’s plenty of enjoyable. Now we have an initiative referred to as Open BOSCH, the place we give them enterprise and assist with gross sales, which is an enormous problem for startups.

Q3. Are you able to share some examples of startups Bosch is working with?

A: I’ve seen many investments, however I don’t need to identify a particular one. There are various—additionally in India. We work with Chinese language, Singaporean, American, and European startups. We’re presently working our fifth fund — and it’s going properly. There may be an impartial funding group dealing with this fund that takes its personal selections.

This fall. Has Bosch been late to the automotive AI celebration or are you proper on time?

A: Truly, we began very early, aiming straight for full autonomous driving. However we realised it’s an costly enterprise—you want fleets and billions in funding. So we reset our focus to assisted driving. On the identical time, AI applied sciences like language fashions and sensor fusion emerged, giving us highly effective new instruments. In the meantime, China adopted Stage 2 ADAS at scale, and we stayed energetic in that market. Now, we’re seeing our technique repay.

In India, full autonomy is difficult because of street circumstances, however assisted driving shall be useful.

Q5. What made mass adoption of ADAS programs potential in China?

A: I’d say three factors–Generative AI and fusion tech modified the whole lot and Chinese language customers shortly tailored to sensible options and screen-based interfaces. Furthermore, China’s infrastructure is great—making it best for automotive innovation.

We’re now seeing related tendencies in India. Tata, Mahindra, and others are introducing smarter automobiles. Persons are spending extra, and this can result in wider adoption of ESP programs and assisted driving modes.

Q6. Given India’s cost-sensitive market, how will superior driving options be adopted by the mass market?

A: It needs to be mass market—in any other case it received’t work. If it stays a luxurious, it received’t scale. The purpose is to supply inexpensive and beneficial options.

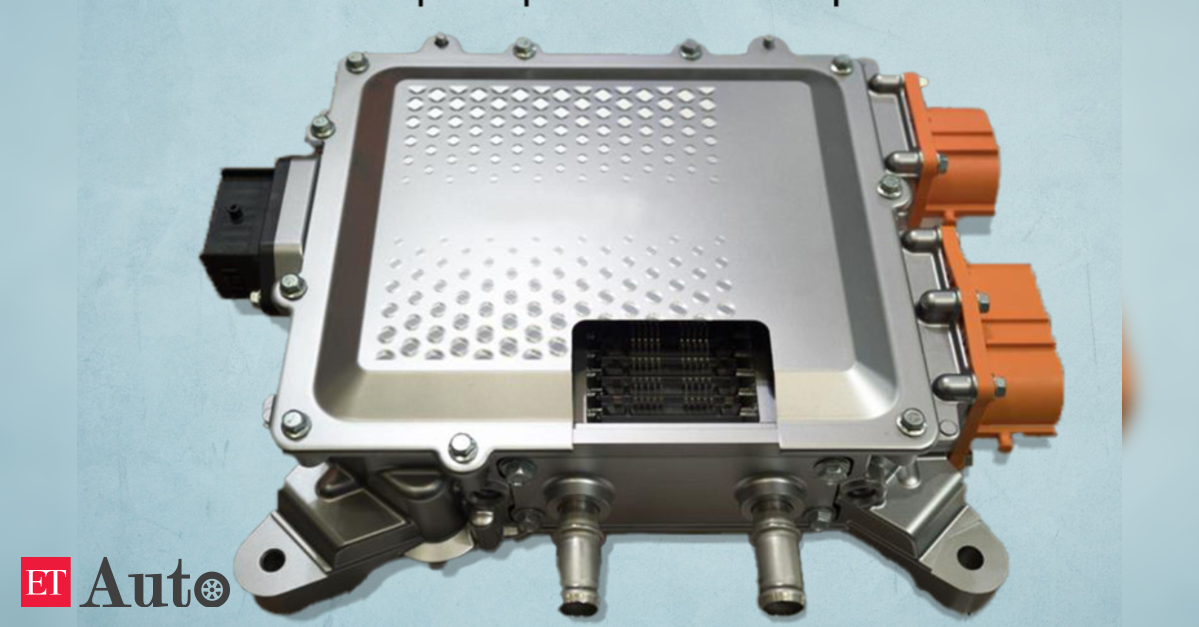

Sure, you want additional sensors and computing, so there’s a value. However by integrating programs, like utilizing the infotainment processor for ADAS too, we are able to scale back value. It is all about balancing performance and worth.

Q7. Bosch has robust investments in China. How do you handle geopolitical tensions and regulatory restrictions associated to AI and knowledge sharing?

A: We function independently throughout areas. We help world collaboration, however rules generally don’t permit cross-border knowledge use. So, we have now separate, succesful groups in India, China, Europe, and the US.

India has an enormous, gifted software program group, together with a devoted AI unit in Bengaluru. They’re amongst our greatest.

Q8. What share of Bosch’s world AI work is being pushed out of India?

A: I can’t give a particular share, however we have now very massive groups in India—over 20,000 software program professionals. Many world algorithms and platforms are developed by these groups, who’re additionally deeply built-in with Germany and US operations.

They’re extremely expert in AI growth, tooling, and coding automation, and so they even work on software program past automotive—like medical and enterprise purposes.

Q9. Do you’ve any new high-tech or AI-focused manufacturing investments plans for India?

A: Sure. India is evolving in electrical powertrains and software program purposes. Our Bengaluru campus has shifted from manufacturing to software program and system engineering. India is now considered one of our most dynamic development markets, and we’re pushing investments right here, whereas remaining frugal and centered on volume-driven development.

Q10. Bosch lately had layoffs. Have been they associated to AI transformation?

A: No, the layoffs had been extra about structural shifts in powertrain manufacturing. The worldwide market is plateauing round 90 million vehicles per 12 months, and manufacturing has shifted from Europe to China.

Additionally, electrical powertrains want 10 occasions fewer hours than diesel engines. Despite the fact that software program wants extra folks, AI instruments enhance effectivity. So, the necessity for adjustment is ongoing and can proceed.

Q11. How is Bosch’s enterprise outlook for 2025?

A: It’s a really difficult 12 months. India is doing properly. The US started robust however faces uncertainty. Europe continues to be discovering its manner.

The worldwide automotive market is stagnating, and client and development sectors are weak. The 12 months just isn’t over, however each sector is going through challenges.

Q12. What’s your perspective on the uncommon earths provide challenge?

A: It should be politically resolved. Uncommon earths are important and never replaceable. Everybody wants them. It’s a balancing act between regulation and demand, and we hope it will get solved within the coming months.