New gentle business car (LCV) registrations shrank by -12.1% to 156,048 items within the first half of 2025, in line with the newest figures printed right now by the Society of Motor Producers and Merchants (SMMT)

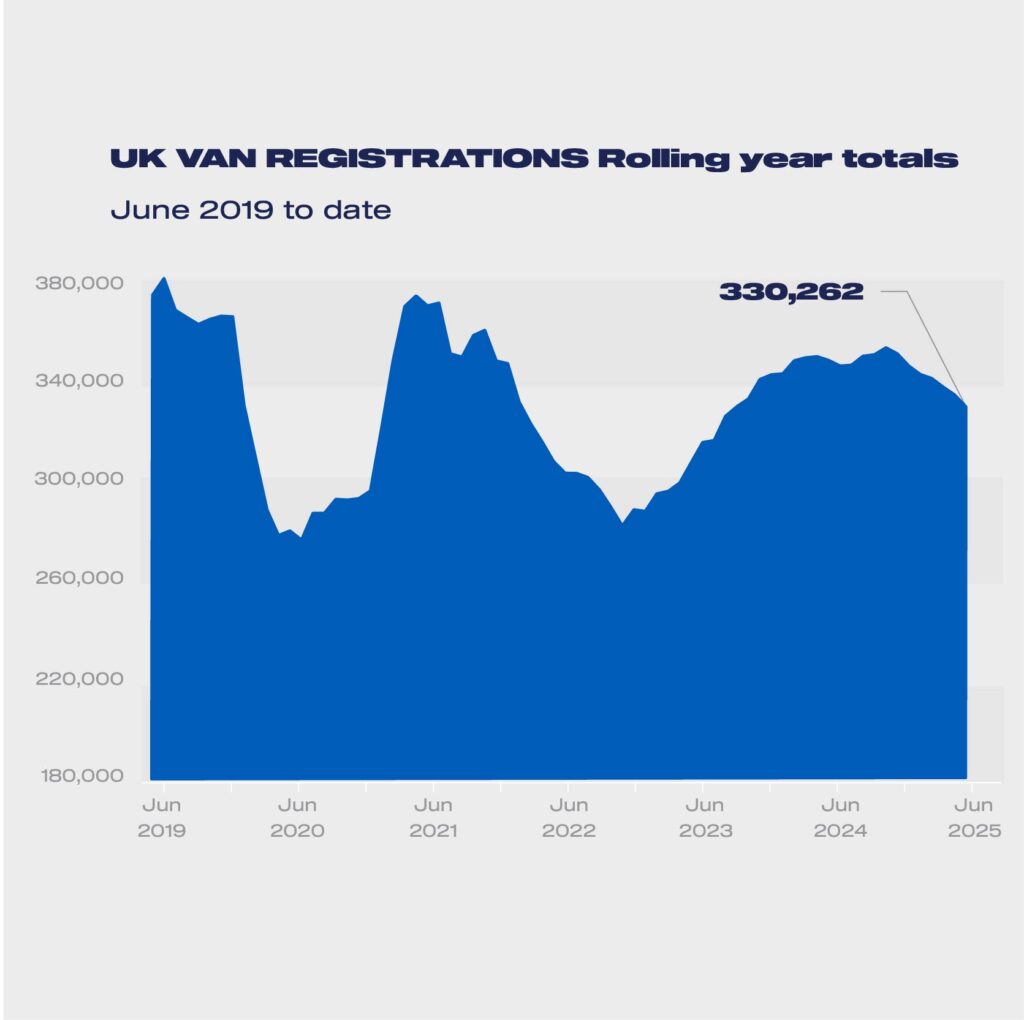

New gentle business car (LCV) registrations shrank by -12.1% to 156,048 items within the first half of 2025, in line with the newest figures printed right now by the Society of Motor Producers and Merchants (SMMT). With a -14.8% drop in June, the market declined for the seventh consecutive month,1 rounding off the worst opening half-year efficiency since 2022 amid a troublesome financial surroundings and weak enterprise confidence to put money into fleet renewal.2

Yr-to-date efficiency was led by declining demand for the most important vans, by -14.8% with 99,790 registered, in addition to deliveries of medium sized vans, down -20.9% to 26,408 items. 4×4 uptake additionally fell, by -6.0% to 4,041 items. There was development, nonetheless, in demand for small vans, up 30.7% to 4,907 items, however couldn’t soften the general market decline as a decrease quantity section.

Registrations by section in June

| Jun-25 | Jun-24 | % change | |

| Pickups | 2,754 | 2,776 | -0.8% |

| 4x4s | 742 | 638 | 16.3% |

| Vans <=2.0T | 983 | 806 | 22.0% |

| Vans > 2.0-2.5T | 4,193 | 7,169 | -41.5% |

| Vans >2.5-3.5T | 19,501 | 21,677 | -10.0% |

| All Vans to three.5T | 28,173 | 33,066 | -14.8% |

| Rigids > 3.5 -4.25 t (BEV solely) | 175 | 48 | 264.6% |

| Rigids > 3.5 – 6.0t (Different) | 880 | 556 | 58.3% |

| All rigids | 1,055 | 604 | 74.7% |

Registrations by section year-to-date 2025

| YTD-25 | YTD-24 | % change | |

| Pickups | 20,902 | 19,008 | 10.0% |

| 4x4s | 4,041 | 4,297 | -6.0% |

| Vans <= 2.0t | 4,907 | 3,753 | 30.7% |

| Vans > 2.0 – 2.5t | 26,408 | 33,398 | -20.9% |

| Vans > 2.5 – 3.5t | 99,790 | 117,164 | -14.8% |

| All Vans to three.5T | 156,048 | 177,620 | -12.1% |

| Rigids > 3.5 -4.25 t (BEV solely) | 928 | 492 | 88.6% |

| Rigids > 3.5 – 6.0t (Different) | 4,520 | 3,465 | 30.4% |

| All rigids | 5,448 | 3,957 | 37.7% |

High new fashions in June

| Greatest sellers | June | |

| 1 | TRANSIT CUSTOM | 4555 |

| 2 | TRANSIT | 2878 |

| 3 | TRAFIC | 1477 |

| 4 | SPRINTER | 1414 |

| 5 | HILUX | 1163 |

| 6 | TRANSPORTER | 1130 |

| 7 | EXPERT | 1083 |

| 8 | CRAFTER | 1002 |

| 9 | RANGER | 961 |

| 10 | TRANSIT COURIER | 902 |

High new fashions 12 months to this point 2025

| Greatest sellers | Yr-to-date | |

| 1 | TRANSIT CUSTOM | 24826 |

| 2 | TRANSIT | 13886 |

| 3 | RANGER | 10327 |

| 4 | VIVARO | 6266 |

| 5 | SPRINTER | 6250 |

| 6 | TRAFIC | 5793 |

| 7 | HILUX | 5302 |

| 8 | PARTNER | 5205 |

| 9 | BERLINGO | 5128 |

| 10 | CRAFTER | 4792 |

There was additionally sturdy uptake of latest pickups within the half-year interval, up 10.0% to twenty,902 items, nonetheless, that obscures two consecutive months of decline following April’s introduction of latest fiscal measures to deal with double cabs as automobiles for profit in form and capital allowance functions. The change in remedy is placing further prices on key enterprise sectors, constraining new orders of the zero and decrease emission fashions that are getting into the market, and holding extra polluting automobiles on the highway for longer. The change will even scale back whole tax revenues given the decrease registration volumes. SMMT continues to induce authorities to postpone the measure for a minimum of one 12 months in order that trade and operators can higher plan and put together for the change.

Producers proceed to speculate massively in cutting-edge zero emission LCVs and there are actually nearly 40 totally different battery electrical van (BEV) fashions to select from – up from 28 in the primary half of final 12 months.3 The market is responding, with BEV demand up 52.8% and 13,512 items registered in 2025,4 boosted by a 97.0% leap in deliveries in June. Within the 12 months to this point, new BEV purchases stay at simply 8.6% of the general market, nonetheless, little greater than half the 16% share mandated by authorities for 2025 with substantial floor to make up within the second half of the 12 months – a spot which authorities should assist to plug.

Registrations by gasoline kind in June 2025

| Gasoline Kind | Jun-25 | Jun-24 | % change | % MTD Whole | % MTDLY TOTAL |

| BEV < 3.5t | 2,828 | 1,476 | 91.6% | 10.0% | 4.5% |

| BEV Rigids > 3.5 -4.25 t | 175 | 48 | 264.6% | 0.6% | 0.1% |

| DIESEL < 3.5t | 23,719 | 30,803 | -23.0% | 83.7% | 93.0% |

| OTHERS < 3.5t | 1,626 | 787 | 106.6% | 5.7% | 2.4% |

| Whole | 28,348 | 33,114 | -14.4% | ||

| Gasoline Kind | YTD-25 | YTD-24 | % change | % YTD Whole | % YTDLY Whole |

| BEV < 3.5t | 12,584 | 8,353 | 50.7% | 8.0% | 4.7% |

| BEV Rigids > 3.5 -4.25 t | 928 | 492 | 88.6% | 0.6% | 0.3% |

| DIESEL < 3.5t | 135,040 | 164,601 | -18.0% | 86.0% | 92.4% |

| OTHERS < 3.5t | 8,424 | 4,666 | 80.5% | 5.4% | 2.6% |

| Whole | 156,976 | 178,112 | -11.9% |

The Plug-in Van Grant stays a lifeline for trade, so we await additional particulars of the continuing assist introduced within the Complete Spending Evaluation. Many companies are nonetheless being held again, nonetheless, by a scarcity of entry to appropriate business car charging at public, depot and shared hub places. Market regulation is just workable if ample operators can swap so authorities should guarantee higher entry to LCV-suitable infrastructure throughout the nation. Preferential remedy for depot grid connections can be a needed step, given some websites might face waits of as much as 15 years, and constant and environment friendly implementation of native planning coverage would give fleets the boldness they should transition their operations to zero emissions.

Mike Hawes, SMMT Chief Government

Half a 12 months of declining demand for brand spanking new vans displays a tough financial local weather and weak enterprise confidence and the truth that this downturn comes simply as trade invests closely to broaden its zero emission LCV providing is especially regarding. Decarbonisation stays a shared ambition however with the EV market greater than a 3rd beneath this 12 months’s goal, daring measures are wanted to drive demand. Accelerated CV infrastructure rollout, faster grid connections and streamlined planning are actually important.

1Since a -8.3% decline in December 2024.

2New LCV registrations, January-June 2022: 144,384 items.

3https://www.smmt.co.uk/demand-for-new-vans-down-in-july-but-2024-market-remains-at-three-year-high/.

4SMMT’s BEV LCV registration knowledge displays the Automobile Emissions Buying and selling Scheme, through which BEVs weighing >3.5-4.25t contribute in the direction of every producer’s goal, along with these weighing ≤3.5t.

SOURCE: SMMT