Throughout the nation, People are being compelled to rethink main monetary choices within the face of rising prices, excessive rates of interest, and ongoing financial uncertainty, in accordance with Guardian Service.

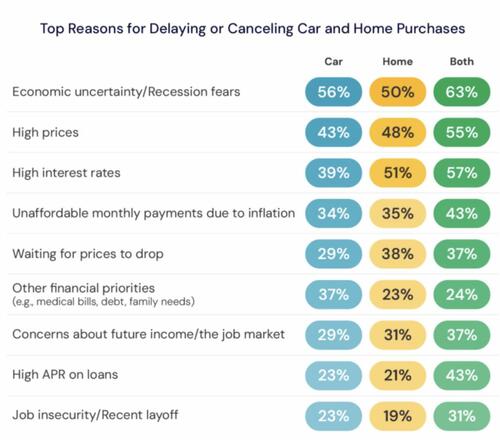

In a current survey of 1,000 individuals, 35% mentioned they’ve delayed or canceled a giant buy this yr—mostly a house (22%) or a automotive (8%). Millennials (40%) and Gen Z (32%) had been particularly prone to put plans on maintain. The main causes? Widespread anxiousness in regards to the financial system (63%), excessive rates of interest (57%), and unaffordable costs (55%).

Some are shifting expectations completely—12% have scaled again their “dream dwelling” objectives, and practically 1 in 4 now see renting as a greater monetary transfer than shopping for in 2025.

These shifting priorities prolong past big-ticket gadgets to on a regular basis protections like insurance coverage. When budgets are stretched, even important protection can really feel expendable. Almost 1 in 4 People (24%) mentioned they’ve lowered protection for a house or automotive to save cash, and 29% reported downgrading or canceling a minimum of one sort of insurance coverage over the previous yr.

Automobile insurance coverage noticed the most important cuts, with 15% scaling again and eight% switching from full protection to legal responsibility solely—strikes that cut back prices but additionally enhance monetary threat.

The choices behind these adjustments typically stem from a need to create short-term monetary aid, even on the expense of long-term safety. “A 3rd of People mentioned they might quickly go with out insurance coverage to cowl important bills,” and 1 in 5 would contemplate dropping protection completely if premiums proceed to rise.

Guardian Service writes that on the identical time, insurance coverage continues to be broadly valued—77% mentioned automotive insurance coverage is crucial, and 57% mentioned the identical for renters or owners insurance coverage. Belief, nonetheless, stays a difficulty, with solely 37% saying they absolutely belief insurers to come back by means of when one thing goes improper.

The research is evident: as People alter their budgets and weigh robust trade-offs, they’re displaying a transparent willingness to prioritize instant wants over long-term plans.

Loading…