Tesla CEO Elon Musk remarked in early 2024 that Chinese language carmakers may “demolish” international opponents if commerce boundaries didn’t exist—a candid admission highlighting the intensifying strain from gamers like BYD, that are aggressively scaling their international presence.

In a world racing towards electrification, the highlight usually lands on Tesla or Western EV insurance policies. But behind that glare lies a rising ecosystem quietly inbuilt China. On the coronary heart of this transformation is BYD Electronics & Semiconductors, a division of BYD Group that not often seeks consideration however wields rising affect throughout automotive, client electronics, and semiconductor provide chains.

For the informal observer, BYD is greatest often called an EV powerhouse. It surpassed Tesla in international EV gross sales in late 2023 and continues to dominate the Chinese language market—the world’s largest. However this seen success is underpinned by a extra elementary power: BYD’s means to construct a lot of what it makes use of — from energy modules and sensors to shows and chipsets. That functionality resides inside BYD Electronics and its semiconductor offshoot.

Sanjeev Keskar, CEO of Arvind Consultancy and former MD of Arrow India, famous, “The best way Chinese language corporations are constructing self-reliance for China is one thing to be careful for. Going ahead, will probably be attention-grabbing to see if international automotive Tier 1 suppliers start adopting BYD’s semiconductor merchandise.”

An origin story rooted in scale

BYD Electronics started in 1995 as a cell phone part producer and was publicly listed in 2007. Its development has been marked by regular vertical integration, supplying top-tier corporations akin to Apple, Samsung, and Huawei, as reported by Nikkei Asia in 2023. The corporate manufactures handset frames, PCBs, and full system assemblies for these manufacturers.

Its evolution coincided with BYD Group’s shift towards EVs. Fairly than depend on exterior provide chains, BYD selected to internalize key applied sciences — enabling seamless integration of onboard chargers, infotainment models, and silicon chips.

In 2023, BYD Electronics reported income of CNY 107.2 billion (~USD 15 billion), with 20% year-on-year development and a web revenue of CNY 1.86 billion, in line with filings on the Hong Kong Inventory Trade (HKEX).

PVG Menon, Advisor at ESDM India, commented, “This isn’t to remove from BYD’s arduous work and innovation. However such success from a vertically built-in product firm is atypical and couldn’t be achieved with out plentiful affected person capital and an aggressively supportive authorities coverage.”

Semiconductors: From technique to self-reliance

A lot of BYD’s strategic benefit comes from BYD Semiconductor, spun off in 2020. It was born of the identical philosophy underpinning a lot of BYD’s success: vertical integration.

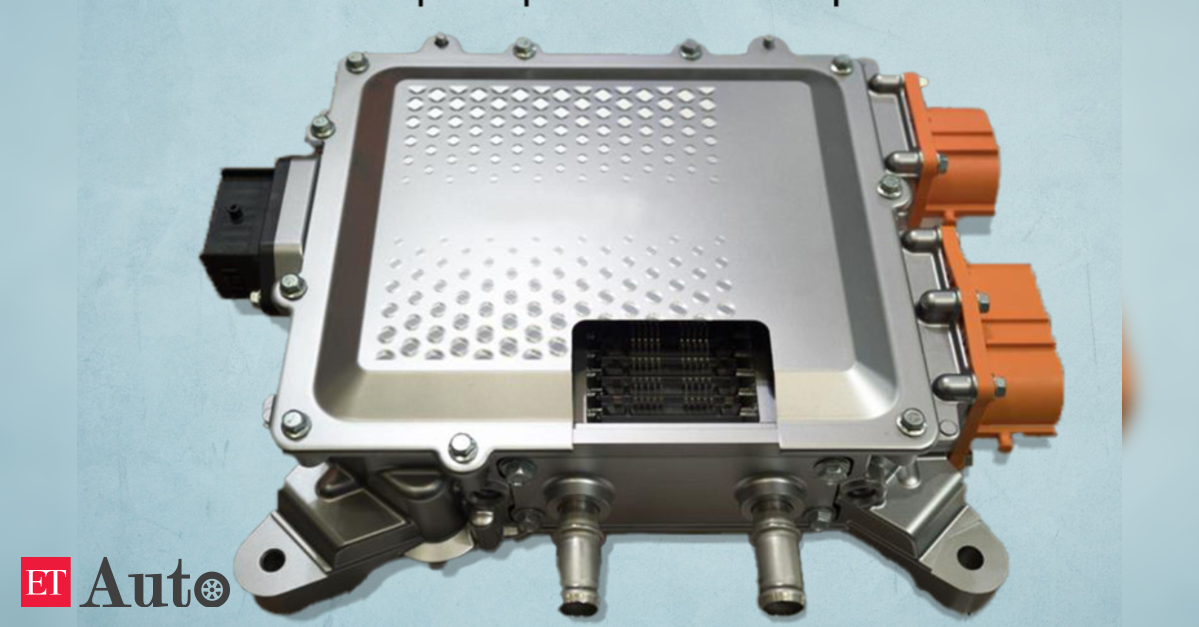

Key merchandise embrace IGBT (Insulated Gate Bipolar Transistor) modules and SiC (Silicon Carbide) energy gadgets — each important for EV powertrain techniques. By 2021, BYD was producing 100,000 wafers per 30 days and had shipped over 1,000,000 IGBT modules, in line with firm bulletins.

Its 1200 V/1040 A SiC module, launched in 2022, enabled BYD to decide to utilizing SiC know-how throughout all future EV fashions — boosting vitality effectivity, charging speeds, and battery longevity, as famous by Yole Développement in 2023.

Management at dwelling, ambitions overseas

China’s automotive chip market is hotly contested. In response to IHS Markit and IC Insights, BYD Semiconductor held a 19–20% market share in IGBT modules in 2023 — second solely to Infineon (~27%). Some latest reviews even recommend that BYD has overtaken Infineon within the Chinese language market, although ET Manufacturing couldn’t independently confirm these claims.

A key enabler of this development is BYD’s captive automobile manufacturing. With over 4.27 million EVs bought in 2024, as famous by the China Affiliation of Vehicle Producers (CAAM), its inner demand drives scale for its chip operations — a mannequin of alignment that Indian corporations may draw classes from.

Very like Tesla’s open-source charging commonplace, BYD is now promoting its modules, shows, and chips to different OEMs. Its USD 2.2 billion acquisition of Jabil’s China manufacturing unit — reported by Reuters in August 2023 — expanded its EMS (electronics manufacturing providers) attain throughout smartphones and IoT gadgets.

Menon added, “China has diligently pursued an built-in and holistic method to growing management in important applied sciences. This can be a nice proof level of that success.”

This cross-pollination throughout product classes — from EVs to client electronics — allows BYD to function a resilient, multi-sector manufacturing infrastructure.

Totally different than India

India’s semiconductor technique, backed by PLI schemes and over USD 10 billion in incentives, focuses totally on constructing fab capability. In distinction, BYD’s method presents a distinct blueprint: begin with actual product demand, combine vertically, and let quantity economics drive chip manufacturing — some extent highlighted in a number of McKinsey and Brookings reviews on industrial coverage.

For Indian OEMs like Tata Motors, Ola Electrical, and Hero MotoCorp, and part makers like VVDN, Sona Comstar, and Dixon, BYD’s mannequin could provide a compelling different — one which blends chip design with end-product management.

That stated, BYD’s journey isn’t with out hurdles. The proposed IPO for its semiconductor arm on Shanghai’s STAR Market was delayed in 2021, as reported by the South China Morning Publish, amid tighter regulatory scrutiny. Moreover, BYD continues to depend on older 4–6 inch wafer nodes, which can restrict efficiency in comparison with opponents adopting 8-inch platforms, in line with TrendForce in 2023.

Nonetheless, its momentum is tough to miss. New services in Brazil, Hungary, and Southeast Asia — and reported plans for Mexico and Thailand (Nikkei Asia) — sign a rising international EMS ambition, with semiconductors and electronics enjoying an more and more central position.

In India, BYD is commonly seen by means of a slender lens — centered on its electrical buses or early EV forays. However to really perceive its scope, one should look past the autos — to the chipsets, modules, shows, and management techniques it builds largely in-house.