Wildfire threat is strongly conditioned by geographic issues that adjust broadly amongst and inside states. The most recent Triple-I Points Temporary exhibits how that truth performed out in 2024 and early this yr and discusses the significance of granular native information for underwriting and pricing insurance coverage in wildfire-prone areas, in addition to for much-needed funding in resilience.

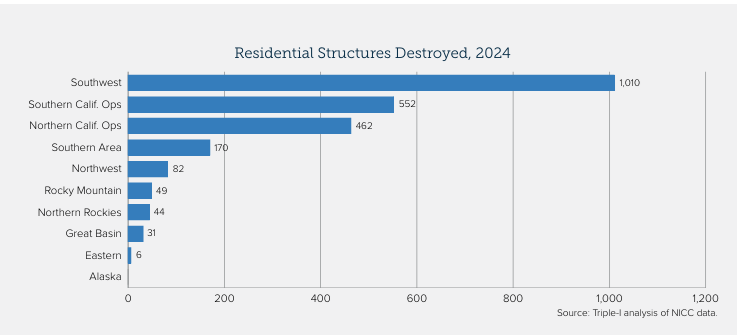

The 2024 wildfire season within the South and Southwest was significantly extreme, marked by such occasions because the Texas and Oklahoma Panhandle fires in February and March and vital blazes in Arizona and New Mexico. The Southwest accounted for the biggest variety of residential buildings destroyed by wildfire, and three of the highest 5 areas for houses destroyed have been within the South.

California accounted for the biggest variety of houses in danger for excessive wildfires. Within the first half, the state skilled an above-average variety of fires, although most have been contained earlier than rising to “main incident” dimension. Subsequent rains suppressed subsequent wildfire situations – and brought on substantial flooding.

However this rain contributed to an accumulation of fuels in order that, when hurricane-force Santa Ana winds whipped via Los Angeles County in early January 2025, the situations have been proper for fast-moving blazes to tear via Pacific Palisades and Eaton Canyon.

Temperature, humidity, wind, and topography fluctuate too broadly for a single “one dimension matches all” mitigation strategy. This underscores the significance of granular information gathering and scrupulous evaluation when underwriting and pricing insurance coverage. Additionally it is vital that insurers proactively interact with numerous stakeholder teams to advertise funding in mitigation and resilience.

A current paper by Triple-I and Guidewire – a supplier of software program options to the insurance coverage trade – makes use of case research from three California areas with very completely different geographic and demographic traits to go deeper into how such instruments can be utilized to establish properties with enticing threat properties, regardless of their location in wildfire-prone areas.

Be taught Extra:

Getting Granular to Discover Decrease-Threat Properties Amid Wildfire Perils

P&C Insurance coverage Achieves Finest Outcomes Since 2013; Wildfire Losses, Tariffs Threaten 2025 Prospects

Regardless of Progress, California Insurance coverage Market Faces Headwinds

California Finalizes Up to date Modeling Guidelines, Clarifies Applicability Past Wildfire

California Insurance coverage Market at a Crucial Juncture