By Mary Sams, Senior Analysis Analyst, Triple-I

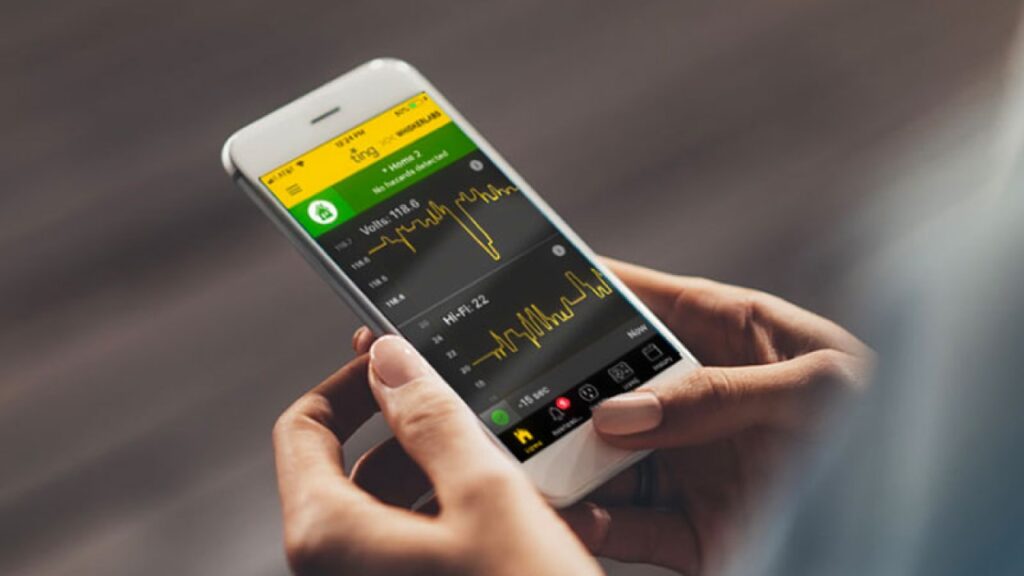

Private cyber threat – traditionally seen as synonymous with “identification theft” – has developed with the rise of internet-connected units within the house. These units can open the door to malware that may seize management of a home-owner’s information and expose them to extortion and different threats. Phishing and monetary scams have been discovered to generate the best losses for owners.

Insurance coverage for these perils exists, however adoption has not grown consistent with the rising peril. Triple-I and Hartford Steam Boiler (HSB) just lately carried out analysis to raised perceive why and what insurers can do about it. The survey discovered that private cyber insurance coverage – whereas presenting a gross sales alternative – entails instructional challenges for brokers and customers.

Triple-I surveyed retail brokers of house owners insurance coverage, since private cyber protection is usually offered as an endorsement to owners’ insurance policies. These brokers are very educated of house owners’ dangers that can lead to bodily injury to property, in addition to theft and legal responsibility coverages.

“Brokers see the storm,” mentioned Neil Rekhi, product supervisor for private cyber insurance coverage at HSB, “however owners can’t envision the injury till it’s too late.”

Whereas 84 p.c of brokers surveyed mentioned they acknowledge the worth of private cyber insurance coverage, the survey discovered a notable hole between brokers who really feel snug promoting it and people who don’t.

This hesitation is mirrored by client skepticism. The examine discovered that 56 p.c of brokers report their prospects both don’t perceive or don’t agree with the worth proposition of private cyber insurance coverage merchandise.

“There’s a major disconnect between agent perceptions of buyer wants and precise buyer perceptions of product worth,” famous Dale Porfilio, Chief Insurance coverage Officer at Triple-I.

Gross sales efforts stay sturdy, with 77 p.c of brokers having introduced private cyber insurance coverage choices to owners prior to now month. Nonetheless, client adoption charges proceed to lag, highlighting a basic communication breakdown.

Closing the private cyber safety hole would require a three-pronged strategy: client training, agent/dealer coaching, and a data-driven strategy to product improvement,” says Triple-I CEO Sean Kevelighan.

Study Extra:

FBI: Elder Fraud Up; Bolsters Case for Private Cyber Insurance coverage

U.S. Cyber Claims Surge Whereas World Charges Decline: Chubb

Digital Cost Development Faces Rising Cybersecurity Threats: Chubb

Cyber Insurance coverage Market Continues Speedy Development as Threat Administration Methods Enhance

Digital Instruments Assist Company Revenues, However Cybercrime Issues Might Hamper Adoption