The Docs Firm mentioned it has entered an settlement to amass ProAssurance Corp. for $1.3 billion, taking the corporate non-public.

Birmingham, Alabama-headquartered ProAssurance is a specialty insurer with experience in medical legal responsibility, merchandise legal responsibility for medical expertise and life sciences, and staff’ compensation insurance coverage. The Docs Co. of Napa, California is the nation’s largest physician-owned medical malpractice insurer.

The transaction is anticipated to shut within the first half of 2026. Upon completion, ProAssurance’s widespread inventory will now not be listed on the New York Inventory Change, and ProAssurance will change into a completely owned subsidiary of The Docs Co., making a mixed firm with property of roughly $12 billion.

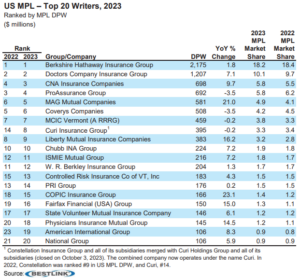

Ranking company AM Finest mentioned The Docs Firm Insurance coverage Group is the second-largest author of medical skilled legal responsibility (MPL) insurance coverage within the U.S. based mostly on 2023 direct premiums written (AM Finest mentioned it’s within the technique of gathering 2024 information). ProAssurance is the fourth largest. Berkshire Hathaway is first with greater than 18% market share. Along with ProAssurance, Docs Co. would have almost 16% of the MPL market.

AM Finest added it doesn’t anticipate the transaction to have an effect on the monetary energy ranking of A (Glorious) for the The Docs Co. The monetary energy ranking of A (Glorious) for ProAssurance additionally stays unchanged, the company mentioned.

Beneath the phrases of the settlement, ProAssurance stockholders will obtain $25.00 in money per share, representing roughly a 60% premium to the closing value per share of ProAssurance widespread inventory on March 18, the final buying and selling day previous to the deal announcement on March 19.

The Board of Administrators of ProAssurance unanimously permitted the deal and can suggest shareholders do the identical.

“Healthcare is a group sport, and the groups are getting bigger. As a way to present them the perfect conceivable service requires a mission-based firm with nationwide scale, assets, and dedication to all medical professions and healthcare suppliers,” mentioned Richard E. Anderson, chairman and chief govt officer of The Docs Co., in a press release. “The addition of ProAssurance to The Docs Co. considerably enhances our skill to serve healthcare professionals now and properly into the long run.”

“Each ProAssurance and The Docs Co. have been based by physicians in response to the medical legal responsibility disaster of the Seventies,” based on Ned Rand, ProAssurance’s president and chief govt officer.

“This shared historical past has helped each corporations fulfill our shared mission to guard others and given us related working philosophies and cultures,” he added. “Bringing the strengths and capabilities of our corporations collectively now will enable our groups to proceed to serve at the moment’s healthcare suppliers with the required scale and breadth of capabilities.”

In a report on the MPL market printed Might 2024, AM Finest mentioned insurers on this line of enterprise proceed to face most of the similar challenges because the final a number of years – a rising frequency of high-severity losses pushed by social inflation elements in addition to staffing shortages, development in various care services, and an erosion of tort reform in some jurisdictions.

Subjects

Carriers

Fascinated with Carriers?

Get automated alerts for this subject.