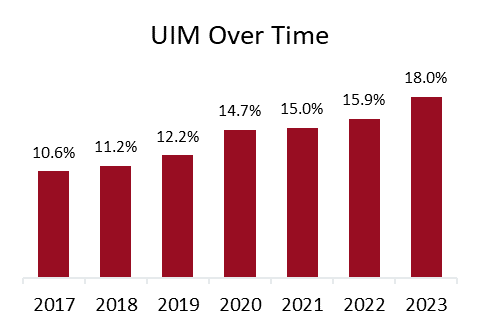

In 2023, regardless of almost common authorized necessities to have auto insurance coverage, multiple in seven drivers (15.4 %) nationally had been uninsured, and multiple in six drivers (18.0 %) had been underinsured, in line with the brand new report, Uninsured and Underinsured Motorists: 2017–2023, by the Insurance coverage Analysis Council (IRC), affiliated with The Institutes. Throughout the fifty states and the District of Columbia, one in three drivers (33.4 %) had been both uninsured or underinsured in 2023, a ten share level enhance within the mixed price since 2017.

Utilizing knowledge submitted by 17 insurers — representing roughly 55 % of the personal passenger auto insurance coverage market countrywide — this newest report estimated the prevalence of uninsured (UM) and underinsured (UIM) by evaluating the frequency of UM claims and UIM claims, respectively, to the frequency of bodily damage (BI) claims. Findings included an evaluation of traits and contributing elements to variations in UM and UIM charges throughout states.

The IRC analyzed UM, UIM, and BI legal responsibility publicity and declare rely knowledge from taking part corporations for 2017 by 2023. Due to the disruption of the pandemic shutdowns, the adjustments over time had been break up into three intervals (particulars outlined within the report).

Key IRC findings embrace:

- UM charges diverse considerably throughout the nation (50 states and the District of Columbia)

- Practically each state noticed an increase within the UM price in 2020 with the onset of the pandemic, however the expertise from 2020 to 2023 was combined.

- Each state, apart from New York and the District of Columbia, skilled an increase in UIM price between 2017 and 2023.

- Many states with excessive UM charges usually even have excessive UIM charges. Nonetheless, some jurisdictions, corresponding to Nevada and Louisiana, mix below-average UM charges with excessive UIM charges, whereas others, such because the District of Columbia, have excessive UM charges however low UIM charges.

- A number of elements, together with financial elements, insurance coverage prices, and state insurance coverage legal guidelines and rules, are related to variations in UM and UIM charges throughout states.

After the preliminary shock of the pandemic, the UM price elevated steadily.

Earlier than the disruption of the COVID-19 pandemic, UM charges had been falling in most states. From 2017 to 2019, solely 11 jurisdictions noticed a rise. UM declare frequency fell barely in 2020 to 0.11 claims per 100 insured autos, however the decline was a lot smaller than the drop in BI declare frequency. UM declare frequency recovered shortly and, within the years since 2020, has grown quicker than BI declare frequency (39 % in contrast with 29 %).

Consequently, the UM price has elevated steadily, reaching 15.4 % in 2023. The vary of the UM charges spanned from a low of 5.7 % in Maine to a excessive of 28.2 % in Mississippi. Outliers embrace eight states with UM charges above 20 % and 11 states with charges decrease than 10 %.

States with above-average BI declare frequency and UM declare frequency tended to have increased UM charges. But, some states with low UM declare frequency charges have a comparatively excessive UM price. In Michigan, for instance, strict no-fault guidelines restrict the variety of BI claims, so the ratio of UM-to-BI declare frequencies is excessive. Decrease UM charges tended to happen in states with increased revenue, decrease unemployment charges, decrease insurance coverage expenditures, low minimal limits, and an absence of stacking provisions.

UM charges had been increased in states that don’t require UIM protection. In 2023, the UM price was 14.9 % in states that don’t require UIM insurance coverage, in contrast with 11.6 % in states that require it. The place UIM protection isn’t required by regulation, UM charges had been considerably increased within the years captured on this examine, with the speed in 2023 at 18.9 % in states that don’t require UIM insurance coverage, in contrast with 13.3 % in states that require it.

Practically one in 5 accidents with accidents concerned losses greater than the at-fault driver’s protection limits.

Over the examine interval, almost each jurisdiction skilled a rise in its UIM price. The one exceptions had been a small decline (0.9%) within the District of Columbia and a 6.6 % decline in New York. The most important enhance occurred in Colorado, the place the UIM price rose 24.4 share factors. Different states with above-average will increase included Michigan, Kentucky, and Georgia.

UIM declare frequency confirmed a small enhance between 2017 and 2019 earlier than dropping barely in 2020. Within the years for the reason that onset of the pandemic, with the severity of auto damage claims on the rise, UIM declare frequency has elevated markedly, reaching 0.17 claims per 100 insured autos in 2023. Since 2020, the expansion in UIM declare frequency was double the expansion in BI frequency. Consequently, the UIM price has elevated considerably, rising to 18.0 % in 2023.

IRC evaluation confirmed that traits related to decrease UIM charges included increased revenue, decrease unemployment charges, decrease insurance coverage expenditures, excessive or medium minimal limits, lack of stacking provisions, and use of a limits set off for UIM protection somewhat than a damages set off. States with excessive UM charges usually even have excessive UIM charges. Florida, Colorado, and Michigan all rank comparatively excessive for each measures, whereas Maine, Massachusetts, and Nebraska all rank comparatively low.

“The rise in UIM charges factors to increased UIM premiums sooner or later, worsening affordability and probably growing the chance of extra uninsured drivers. This demonstrates the advanced interconnectedness of those two coverages as insurers defend customers from inadequate protection by at-fault drivers,” stated Dale Porfilio, president of the IRC and chief insurance coverage officer on the Insurance coverage Data Institute (Triple-I).

Whereas state legal guidelines concerning necessary necessities for uninsured and underinsured motorists fluctuate, almost all states have a laws framework that requires all drivers to have some auto legal responsibility insurance coverage to drive a motorized vehicle. Drivers in most states are additionally required to buy further safety to offer protection if the at-fault driver can not afford to pay for the harm they triggered. Nonetheless, legislators in a number of states have enacted “no pay, no play” legal guidelines, which ban uninsured drivers from suing for noneconomic damages corresponding to ache and struggling. A handful of states have packages to help lower-income drivers, and drivers can examine with their state’s insurance coverage division to see if they’re eligible.

To be taught extra about UM/UIM traits, learn the IRC report, Uninsured and Underinsured Motorists: 2017–2023, and take a look at the Triple-I Backgrounder on Obligatory Auto/Uninsured Motorists.