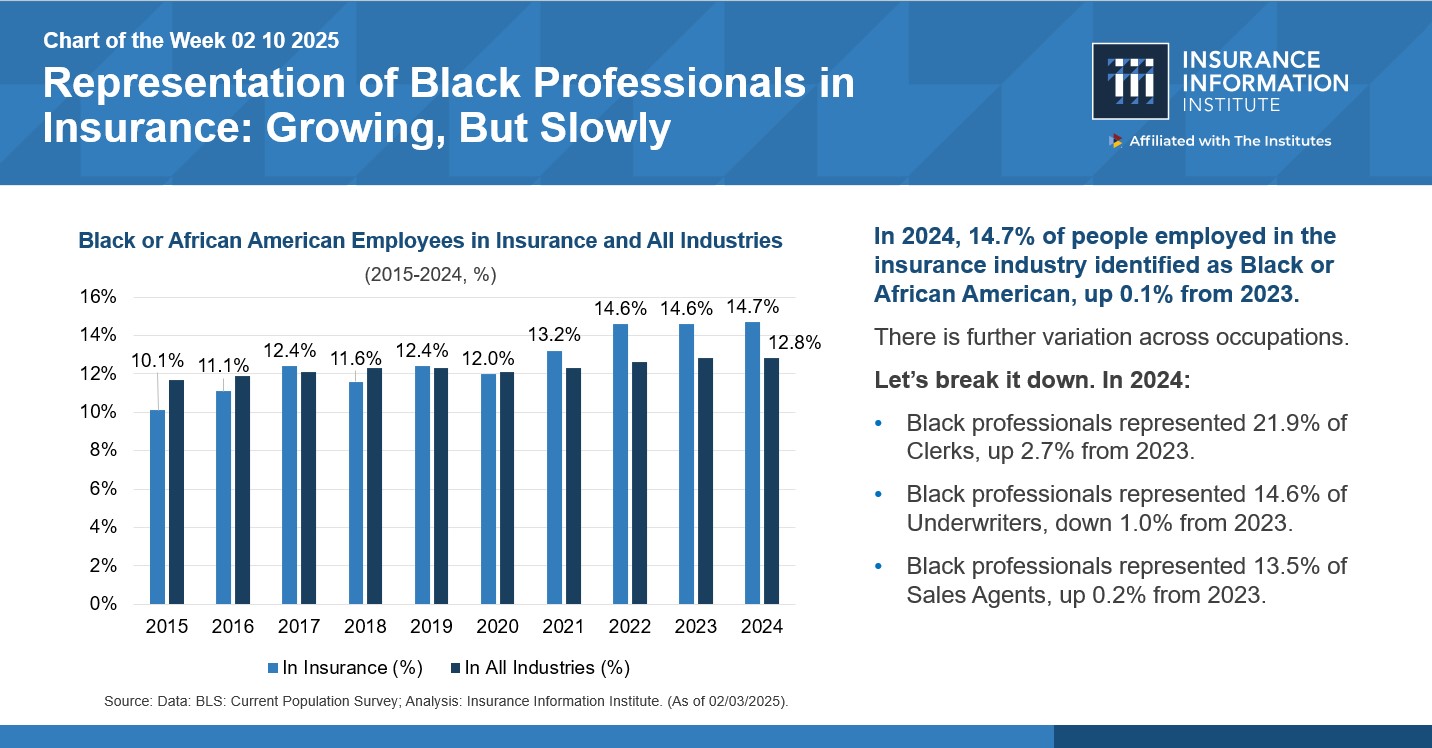

On February 10, Triple-I launched its newest Chart of the Week (COTW), “Illustration of Black professionals in Insurance coverage: Rising, However Slowly.” Citing information from the Bureau of Labor Statistics, the chart reveals that in 2024, Black professionals comprised 14.7 p.c of the insurance coverage business, only a 0.1 p.c enhance from 2023 however nonetheless significantly up from 9.9 p.c a decade in the past. Triple-I’s snapshot exhibits some occupation classes: underwriters comprised 14.6 p.c, brokers 13.5 p.c, and claims and coverage processing clerks 21.9 p.c.

The newest BLS information additionally exhibits Black illustration amongst claims adjusters, appraisers, examiners, and investigators is at 20.9 p.c. Final 12 months’s model of the chart revealed (utilizing information from 2020) that Black professionals accounted for only one.8 p.c of senior executives on the high ten US insurers. (In 2024, Black CEO illustration throughout the Fortune 500 was only one.6 p.c, an all-time excessive.) Total, insurers have welcomed Black professionals at proportions commensurate with their proportion of the general US workforce however haven’t managed to make headway within the C-suite.

In response to BLS information cited in an AM Greatest report, whole employment within the business had surpassed 3 million by August 2023. Nonetheless, employers may face huge attrition as 1000’s of employees (together with their management expertise and information) retire from the workforce within the coming years.

Attracting and retaining high expertise stays a key enterprise technique for organizations that wish to hold delivering world-class outcomes and progress. Because the insurance coverage business collects revenues from nearly each family in America, a workforce that displays this monumental market can faucet right into a range of thought and expertise to assist handle the business’s challenges, together with making merchandise reasonably priced and obtainable to cowl a broad vary of dangers.

A Boston Consulting Group examine revealed that firms with above-average range of their management groups reported innovation income at charges 19 share factors greater than these with below-average range in administration. Once more, the flexibility of the business’s growing old workforce to attach with youthful generations shall be pivotal. US millennials and Gen Zers command practically $3 trillion in spending energy annually.

Progress in the direction of various expertise recruitment and retention objectives can hinge upon cultivating a office the place all staff really feel welcome, supported, fulfilled, and empowered to continue to grow professionally. Nonetheless, an absence of range on the C-suite stage can undermine efforts to include pushed and career-focused candidates, particularly amongst millennials and GenZ professionals. Rising generations are cautious of glass ceilings and might want proof that inclusion and fairness come from the highest.

Information signifies that firms are inclined to make use of Black professionals extra usually in jobs that don’t usually result in greater roles as a substitute of taking deliberate and strategic efforts to extend Black illustration in areas near facilities of revenue and strategic decision-making. These staff are taken out of the road of sight for getting tapped and groomed for alternatives that may result in the C-suite. Insurers eager on Black expertise growth can open alternatives for Black staff to study what’s above that mid-level administration ceiling and make connections. Organizations reminiscent of Black Insurance coverage Trade Collective (BIIC) provide this and different kinds of strategic help to the business for advancing, retaining, and empowering Black expertise on the govt stage.

“The momentum is evident—BIIC is not only shaping the dialog however actively driving significant change throughout the insurance coverage business,” says Amy-Cole Smith, Govt Director for BIIC and Director of Variety at The Institutes.

Since its inception three years in the past, BIIC has endeavored to help Black leaders throughout the danger administration and insurance coverage business in full partnership with a few of the largest insurance coverage organizations. To this point, 22 organizations have joined forces with BIIC to advance this mission.

Cole-Smith says, “By fostering mentorship, management growth, and strategic networking alternatives, BIIC is creating tangible pathways for Black professionals to ascend into govt roles, affect key business choices, and pave the best way for future generations.”

Along with participating over 4,000 professionals by way of its bespoke content material designed to boost consciousness and foster dialogue of key matters related to this mission, BIIC has additionally supported over 135 rising, mid-level, and senior Black skilled leaders by way of its Govt Management Program, a collaboration with Darden Govt Schooling and Lifelong Studying.

“Via its dedication to fairness, inclusion, {and professional} excellence, BIIC is just not solely elevating particular person careers but additionally remodeling the business’s management panorama, making certain that various views and voices form its future,” in accordance with Cole-Smith.