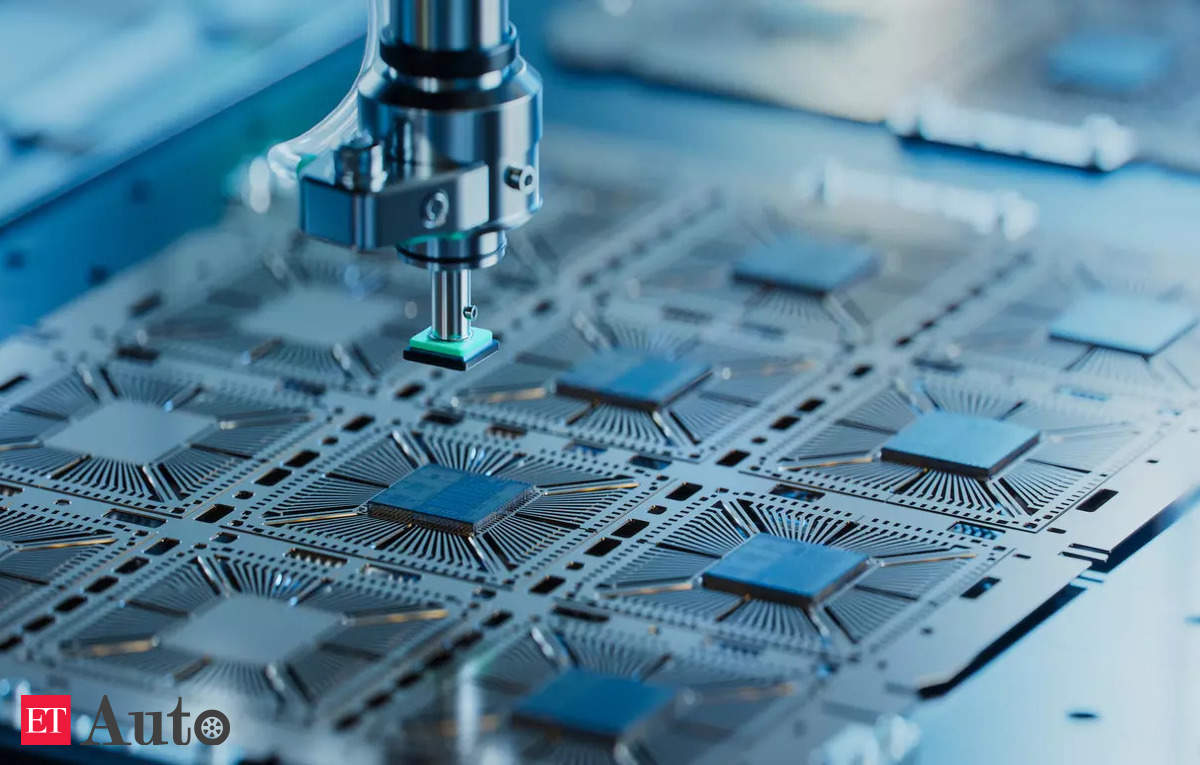

Chipmaker Analog Gadgets topped analysts’ estimates for fourth-quarter income and revenue on Tuesday, helped by sturdy demand for its semiconductors utilized in client electronics and a restoration in orders from the auto trade.

Shares of the Wilmington, Massachusetts-based firm rose 7% in premarket buying and selling.

Demand for client electronics has recovered from a post-pandemic lull, whereas traits within the auto section are additionally bettering.

The auto trade had been grappling with a listing glut because of sluggish demand, translating to decrease manufacturing and fewer orders for semiconductors, which harm enterprise at Analog previously few quarters.

The auto section accounts for 29% of the corporate’s enterprise, and the patron unit, about 16%.

“After a quick decline in general bookings throughout our third quarter, orders picked up steadily all through the fourth quarter, significantly within the automotive finish market,” CFO Richard Puccio mentioned.

Income at Analog Gadgets’ client section jumped 31% to USD 379.7 million within the quarter ended November 2, above analysts’ common estimate of USD 346.6 million, based on information compiled by LSEG.

Its auto section income fell 2% to USD 717 million, however beat analysts’ common estimate of USD 653.8 million.

Analog Gadgets’ per-share revenue of USD 1.67 beat estimates of USD 1.64, whereas its income of USD 2.44 billion topped estimates of USD 2.41 billion.

Rival Texas Devices additionally beat third-quarter revenue estimates final month, helped by a restoration in orders partly because of bettering demand from China’s auto market.

For the primary quarter of 2025, Analog Gadgets projected income of USD 2.35 billion, plus or minus USD 100 million, consistent with estimates.

It additionally forecast adjusted per-share earnings of USD 1.53 on the midpoint, which was beneath Wall Road estimates of USD 1.56.