The industrial auto insurance coverage line has struggled to realize underwriting profitability for years, even earlier than the inflationary situations which have been affecting property/casualty traces extra lately. This development has been accompanied by regular progress in internet written premiums (NWP).

This weak spot in underwriting profitability has been pushed by a number of causes, in line with a brand new Triple-I Points Transient. One is the truth that autos – each industrial autos and private autos they collide with – have change into more and more costly to restore, due to new supplies and elevated reliance on sensors and laptop methods designed to make driving extra comfy and safer. This well-established development has been exacerbated by supply-chain disruptions throughout COVID-19 and persevering with inflation within the pandemic’s aftermath.

Distracted driving and litigation traits even have performed a task.

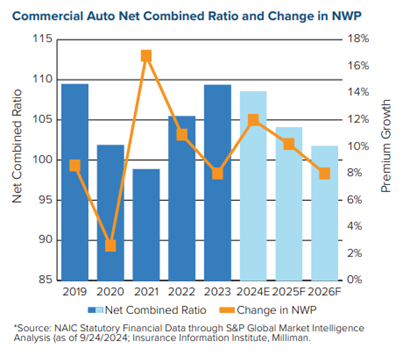

Nonetheless, Triple-I sees some gentle on the horizon for industrial auto when it comes to the road’s internet mixed ratio – a typical measure of underwriting profitability calculated by dividing the sum of claim-related losses and bills by earned premium. A ratio underneath 100 signifies a revenue and one above 100 signifies a loss.

Because the chart beneath reveals, the estimated 2024 internet mixed ratio for industrial auto insurance coverage has improved barely since 2023, and additional enchancment is anticipated over the subsequent two years.

These projected enhancements are based mostly on an expectation of continued premium progress – due extra to aggressive premium fee improve than to elevated publicity – as the speed of insured losses ranges off.