German automaker Volkswagen Group will make investments as much as USD 5 billion in U.S. electric-vehicle maker Rivian as a part of a brand new, equally managed three way partnership to share EV structure and software program, the businesses mentioned on Tuesday.

Shares of Rivian surged 30% in prolonged buying and selling on the Nasdaq after the announcement, boosting the corporate’s inventory market worth by greater than USD 3 billion.

The auto business faces a vital time as EV startups grapple with a slowdown in demand amid excessive rates of interest and dwindling money, whereas conventional automakers have struggled to construct battery-powered autos and superior software program.

Volkswagen will initially make investments USD 1 billion in Rivian and an extra USD 4 billion in investments later, the businesses mentioned.

The funding will present Rivian the funding essential to develop its less-expensive and smaller R2 SUVs which are set to roll out in 2026 and its deliberate R3 crossovers, CEO RJ Scaringe informed Reuters.

It’s going to additionally assist Rivian – at the moment recognized for its flagship R1S SUVs and R1T pickups – flip money flow-positive.

The partnership will assist Volkswagen speed up plans to develop software-defined autos (SDV), with Rivian licensing its current mental property rights to the JV.

Volkswagen mentioned earlier this 12 months it was sticking with plans to launch 25 EV fashions in North America throughout its group manufacturers by 2030, even because it acknowledged slowing development within the phase.

“Their current cost-cutting was one factor to work on, however they had been undoubtedly going to wish one thing to get them previous the launch of the R2s. This undoubtedly helps prolong that vary,” mentioned Sam Fiorani, vice chairman at analysis agency AutoForecast Options.

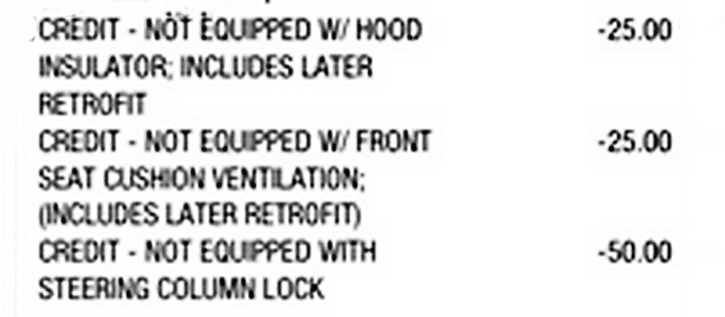

Rivian has been overhauling its manufacturing course of, together with eradicating tools from its plant and components from its autos, which has led to a 35% discount in value of supplies for vans and financial savings of “comparable magnitude” for its different strains, Scaringe informed Reuters throughout an unique tour of its facility in Regular, Illinois, on Friday. Merchants have wager closely that Rivian’s inventory will fall, with an equal of 18% of its shares not too long ago offered brief, in line with information from S3 Companions.