Owners insurance coverage premium development in Florida has slowed for the reason that state carried out authorized system abuse reforms in 2022, in keeping with a Triple-I evaluation.

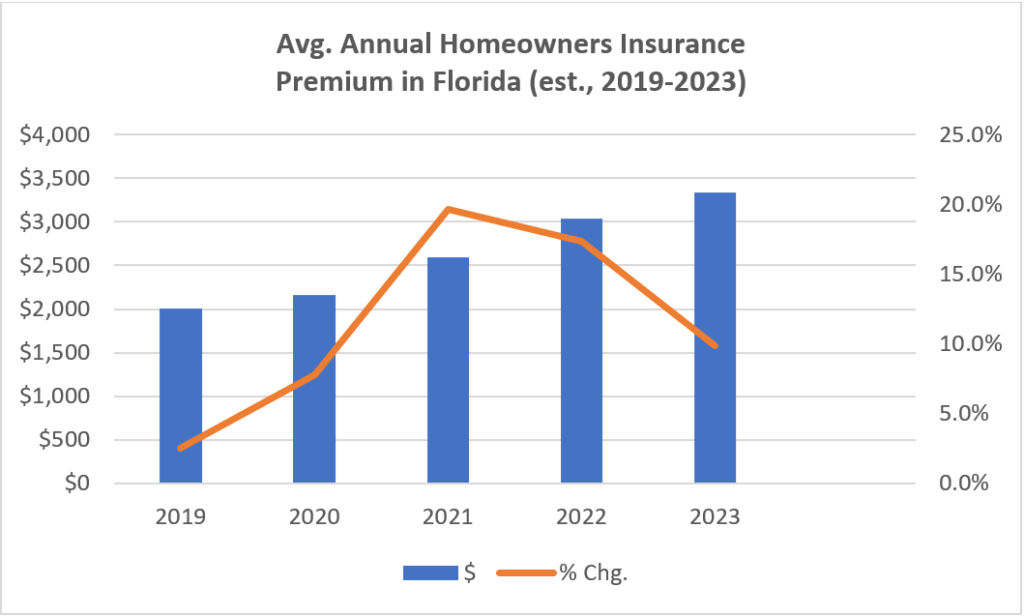

As proven within the chart under, common annual premiums climbed sharply after 2020. This was due partially to inflation spurred by the COVID-19 pandemic and the battle in Ukraine in addition to longtime challenges within the state with declare fraud and authorized system abuse.

Supply: Triple-I evaluation of NAIC and OIR knowledge

In keeping with the state’s Workplace of Insurance coverage Regulation (OIR), Florida accounted for practically 71% of the nation’s owners claim-related litigation, regardless of representing solely 15% of house owners claims in 2022, the yr Class 4 Hurricane Ian struck the state. In that very same yr, and previous to Ian making landfall within the state as a primary main hurricane since 2018’s Hurricane Michael, six insurers declared insolvency. Hurricane Ian grew to become the second largest on document by insured losses, largely due to the extraordinary litigation prices estimated to end in Florida within the aftermath.

The Florida Legislature responded to the rising disaster by passing a number of items of insurance coverage reform, primarily tackling issues with project of advantages (AOB), bad-faith claims, and extreme charges. For instance, the brand new legal guidelines eradicated one-way legal professional charges in property insurance coverage litigation, forbid utilizing appraisal awards to file a bad-faith lawsuit, and prohibited third events from taking AOBs for any property claims. The laws additionally ensures transparency and effectivity within the claims course of and encourages extra environment friendly, more cost effective options to litigation.

A surge in litigation

Litigation spiked when backlogged courts reopened following the pandemic, then once more when the reforms had been handed in 2022 and 2023, as plaintiffs’ attorneys raced to file fits forward of implementation of the laws.

This enhance in litigation, mixed with persistently robust inflation, contributed to elevated loss prices and premium will increase. In 2022, common owners premium charges rose greater than 17 %, to $3,040. Premiums continued to rise in 2023, though at a lowering charge, as inflation has moderated and authorized reforms have kicked in.

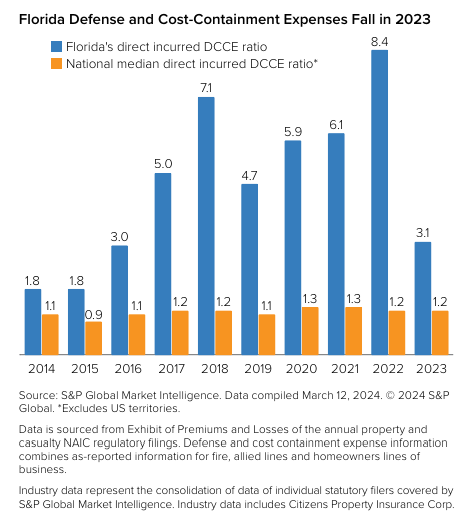

There are early indicators that the reforms are starting to bear fruit. In 2023, Florida’s protection and cost-containment expense (DCCE) ratio – a key measure of the influence of litigation – fell to three.1, from 8.4 in 2022, in keeping with S&P World. In greenback phrases, 2023 noticed $739 million in direct incurred authorized protection bills – a significant decline from 2022’s $1.6 billion. For perspective, incurred protection prices within the two largest U.S. insurance coverage markets in 2023 had been $401.6 million in California, adopted by $284.7 million in Texas. Because the chart under exhibits, Florida’s DCCE ratio – even throughout its greatest years – frequently exceeds the nation’s.

As insurers have failed or left the state, Residents Property Insurance coverage Corp. – the state-run insurer of final resort and at the moment Florida’s largest residential insurance coverage author – has swelled with new enterprise and lawsuits. Residents’ depopulation efforts to maneuver policyholders to non-public insurers contributed to coverage counts falling to 1.23 million by the tip of 2023.

It’s vital to do not forget that all premium estimates are based mostly on one of the best data accessible on the time and precise outcomes could differ attributable to adjustments in market circumstances. For instance, earlier Triple-I projections that common annual owners premiums in Florida would exceed $4,300 in 2022 and $6,000 in 2023 assumed vital charge will increase can be wanted to revive profitability to the state’s owners market. These projections didn’t assume legislative reform or that Residents would grow to be the state’s largest owners insurance coverage firm, with many dangers priced under the admitted and extra and surplus markets. Our projections additionally assumed inflation would proceed to develop at charges much like these prevailing on the time.

In gentle of the reforms and moderating inflation, we at the moment are reporting decrease common annual premiums of $3,040 (2022) and $3,340 (2023). The Florida OIR has reported common premium charge filings are working under 2.0 % in 2024 year-to-date within the non-public market. Additional, OIR indicated eight home carriers have filed for charge decreases and 10 have filed for no enhance this yr. Moreover, eight property insurers have been permitted to enter the Florida market, with extra anticipated this yr.

Triple-I’ll proceed to watch and report on the evolving property insurance coverage market in Florida.