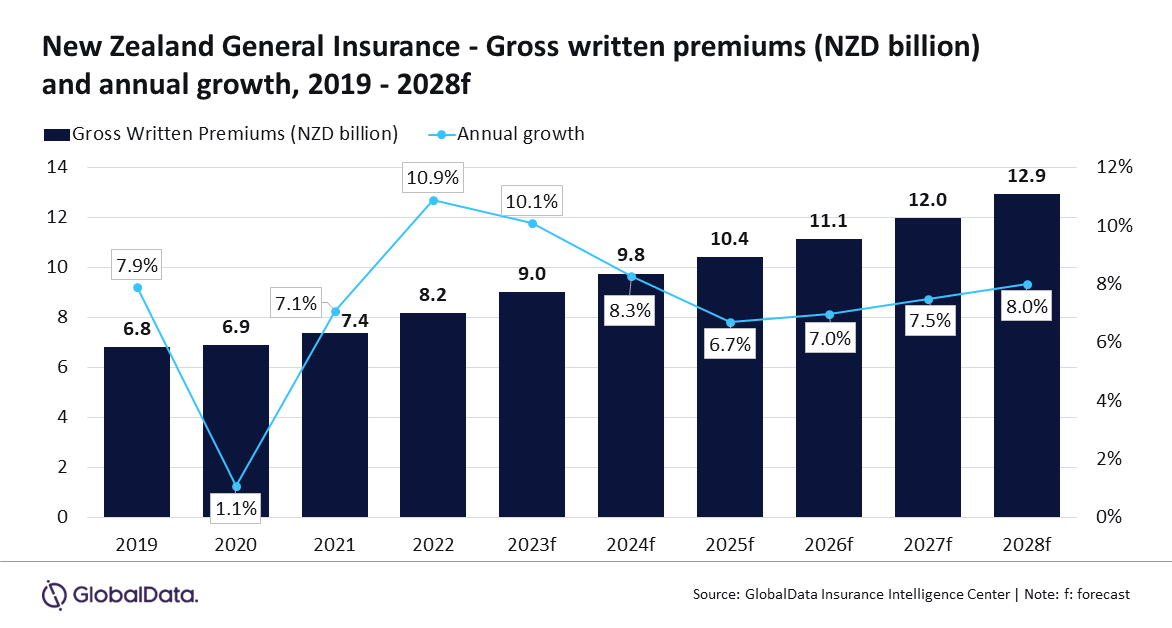

The business is seen to climb 8.3% in 2024.

The New Zealand basic insurance coverage business is projected to expertise important progress, with a compound annual progress price (CAGR) of seven.3% from NZ$9.8b in 2024 to NZ$12.9b in 2028, by way of gross written premiums (GWP), in response to forecasts by GlobalData.

“New Zealand’s basic insurance coverage business is predicted to witness a progress of 10.1% in 2023 after rising by 10.9% in 2022. The expansion is supported by an increase within the demand for pure catastrophic (nat-cat) insurance coverage insurance policies because of a rise within the frequency of utmost climate occasions and a rise in premium costs throughout many of the insurance coverage strains pushed by inflation,” Sneha Verma, Insurance coverage Analyst at GlobalData stated.

In 2024, the business is predicted to develop by 8.3%, primarily pushed by property and motor insurance coverage strains, which collectively contributed practically 75% of the overall basic insurance coverage GWP in 2023.

Property insurance coverage holds the biggest market share, accounting for 41.7% of the final insurance coverage GWP in 2023, with a progress price of 9.8% fueled by the elevated demand for nat-cat insurance coverage insurance policies because of the nation’s vulnerability to excessive climate occasions.

The rise in weather-related claims has led reinsurers to lift reinsurance charges, subsequently rising premium charges for residence and agriculture insurance coverage insurance policies, additional supporting property insurance coverage progress.

Notably, contents and residential insurance coverage premiums noticed important will increase in 2023, attributed partly to modifications within the Earthquake Fee Cowl (EQC) restrict, which doubled protection for pure calamities from $150,000 to $300,000.

“Excessive inflation has additionally performed a serious position in a rise in property insurance coverage costs. The annual inflation in New Zealand stood at 4.7% in 2023, a lot increased than the goal band of 1% to three% set by the Reserve Financial institution of New Zealand. Property insurance coverage is predicted to develop at a CAGR of seven.9% throughout 2024-2028,” Verma stated.

ALSO READ: The worldwide insurance coverage market initiatives a 4.5% CAGR enhance by 2027

Motor insurance coverage, the second-largest line of enterprise with a 32.9% market share in 2023, can also be anticipated to develop, pushed by premium price will increase influenced by inflation and excessive declare payouts following Cyclone Gabrielle.

Automobile insurance coverage prices in 2023 surged by 30% on common in comparison with the earlier 12 months, reaching $1,190 within the third quarter.

Legal responsibility insurance coverage, accounting for a 9.1% share of basic insurance coverage GWP in 2023, is predicted to develop steadily, supported by obligatory lessons of insurance coverage comparable to skilled indemnity insurance coverage and the rising frequency of cyber-attacks.

Cyber incidents rose by 20% in 2023 in comparison with the earlier 12 months.

Marine, aviation, and transit (MAT), together with different basic insurance coverage strains, made up the remaining 16.4% share of the final insurance coverage GWP in 2023. General, the business is poised for important enlargement over the forecast interval.

“A gradual restoration within the economic system after the pandemic and rising premium costs will assist the expansion of the New Zealand basic insurance coverage business over the following 5 years. The insurers’ profitability is predicted to stay risky because of excessive claims arising from frequent pure disasters and a subsequent enhance in reinsurance charges.” concluded Verma.