World insured losses from pure catastrophes in 2023 exceeded US$100 billion for the fourth consecutive yr – a sign of the brand new norm for nat cat losses, in keeping with Swiss Re.

Different record-breaking numbers for 2023 included the full of insured-loss-inducing catastrophes (which hit a file 142), and the insured price ticket for extreme convective storms (SCS), which reached US$64 billion for the primary time, mentioned the report revealed by Swiss Re Institute, Swiss Re’s analysis unit. (The report is titled “Pure catastrophes in 2023: gearing up for at this time’s and tomorrow’s climate dangers“).

Though the earthquake in Turkey and Syria was final yr’s costliest disaster with estimated insured losses of US$6.2 billion, occasion frequency from extreme convective storms was the principle driver of 2023’s nat cat losses, mentioned Swiss Re. (The report describes SCS as an umbrella time period for a spread of hazards together with tornadic and straight-line winds, in addition to giant hailstones.)

The report mentioned that 85% of whole SCS insured losses originated within the US and losses are rising the quickest in Europe the place they’ve topped US$5 billion in every of the final three years.

A lot of the record-breaking numbers of pure catastrophes had been introduced by medium-severity occasions, which Swiss Re defines as occasions with losses within the vary of US$1 billion–$5 billion. The variety of medium-severity occasions, which may embody SCS, has grown by a median of seven.5% every year since 1994, nearly double the three.9% enhance of all catastrophes.

“After tropical cyclones, SCS have turn into the second largest loss-making peril. As with different perils, rising exposures on account of financial and inhabitants progress, and urbanisation are the principle forces driving SCS losses greater,” the report continued.

Hailstorms are the principle contributor to insured losses from SCS, chargeable for 50%–80% yearly of all SCS-driven insured losses, Swiss Re mentioned, pointing to the instance of northern Italy the place storms with large hail stones introduced insured damages of US$5.5 billion in 2023.

World Safety Hole

Final yr, financial losses from pure catastrophes reached US$280 billion, that means that 62% of the worldwide losses had been uninsured, amounting to a world safety hole of US$172 billion in 2023, up from US$153 billion in 2022 and the earlier 10-year common of US$134 billion. (Financial losses embody all injury, each insured and uninsured).

Swiss Re mentioned international insured losses from pure disasters outpaced international financial progress over the previous 30 years. “From 1994 to 2023, inflation-adjusted insured losses from pure catastrophes averaged 5.9% per yr, whereas international GDP grew by 2.7%. In different phrases, during the last 30 years, the relative loss burden in comparison with GDP has doubled,” mentioned a press launch accompanying the report.

Swiss Re forecasts that annual insured losses will develop by 5%-7% over the long run, which is in step with precise loss will increase during the last 30 years.

“A number of components recommend losses will proceed to rise: property exposures proceed to develop, particularly in areas of already high-value concentrations. Publicity progress additionally tends to be centered in areas of upper disaster danger corresponding to flood plains or on coastlines,” the report mentioned. “To this point, the impression of adjusting climates has been small. Nevertheless, we anticipate that the contribution from extreme climate and different occasions will doubtless rise. By extrapolating the aforementioned long-term progress development, we estimate that at this time’s insured losses might double in 10 years.”

Accumulation of Property in Susceptible Areas

“Even with no historic storm on the dimensions of Hurricane Ian, which hit Florida the yr earlier than, international pure disaster losses in 2023 had been extreme,” commented Jérôme Jean Haegeli, Swiss Re’s group chief economist, in an announcement.

“This reconfirms the 30-year loss development that’s been pushed by the buildup of property in areas susceptible to pure catastrophes. Sooner or later, nonetheless, we should contemplate one thing extra: climate-related hazard intensification,” he added. “Fiercer storms and larger floods fuelled by a warming planet are on account of contribute extra to losses. This demonstrates how pressing the necessity for motion is, particularly when taking into consideration structurally greater inflation that has prompted post-disaster prices to soar.”

In its conclusion, the Swiss Re report mentioned: “To raised cope with the losses of at this time and put together for the climate of tomorrow, loss potential must be diminished in order that insurance coverage is extra inexpensive, safety gaps are narrowed and the enterprise of insurance coverage stays sustainable. Reducing loss potential requires local weather change mitigation, loss discount, and prevention and adaptation actions to minimise publicity and vulnerability to hazards.”

Different findings from the report embody:

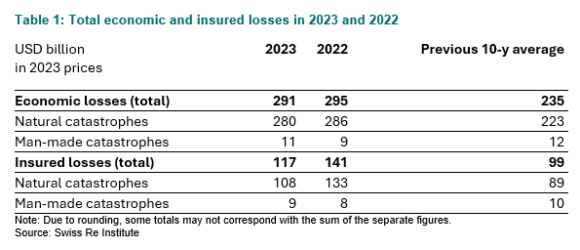

- Complete insured losses, which embody pure catastrophes (US$108 billion) and man-made losses (US$9 billion) had been $117 billion for 2023.

- Complete financial losses for the yr had been $291 billion, which comprised pure catastrophes costing $280 billion, and man-made occasions costing $11 billion.

- The most expensive trade occasion, the earthquake in Turkey and Syria, had insured losses of US$6.2 billion, however given the area’s low insurance coverage penetration, 90% of all property injury was uninsured.

- The Turkey and Syria earthquake was the largest humanitarian catastrophe of the yr, claiming near 58,000 lives.

Supply: Swiss Re

Subjects

Revenue Loss

Swiss Re

Focused on Revenue Loss?

Get automated alerts for this matter.