Two payments proposed in Illinois this yr illustrate but once more the necessity for lawmakers to raised perceive how insurance coverage works. Illinois HB 4767 and HB 4611 – like their 2023 predecessor, HB 2203 – would hurt the very policyholders the measures purpose to assist by driving up the associated fee for insurers to jot down private auto protection within the state.

“These payments, whereas supposed to deal with rising insurance coverage prices, would have the alternative affect and sure hurt shoppers by lowering competitors and growing prices for Illinois drivers,” stated a press launch issued by the American Property Casualty Insurance coverage Affiliation, the Illinois Insurance coverage Affiliation, and the Nationwide Affiliation of Mutual Insurance coverage Firms. “Insurance coverage charges are at first a operate of claims and their prices. Reasonably than working to assist make roadways safer and cut back prices, these payments search to vary the state’s insurance coverage ranking legislation and prohibit using components which are extremely predictive of the danger of a future loss.”

The proposed legal guidelines would bar insurers from contemplating nondriving components which are demonstrably predictive of claims when setting premium charges.

“Prohibiting extremely correct ranking components…disconnects value from the danger of future loss, which essentially means high-risk drivers can pay much less and lower-risk drivers can pay greater than they in any other case would pay,” the discharge says. “Moreover, altering the ranking legislation and components used is not going to change the economics or crash statistics which are the first drivers of the price of insurance coverage within the state.”

Triple-I agrees with the important thing issues raised by the opposite commerce organizations. As we have now written beforehand, such laws suggests a lack of information about risk-based pricing that’s not remoted to Illinois legislators – certainly, comparable proposals are submitted every now and then at state and federal ranges.

What’s risk-based pricing?

Merely put, risk-based pricing means providing completely different costs for a similar degree of protection, primarily based on danger components particular to the insured particular person or property. If insurance policies weren’t priced this fashion – if insurers needed to provide you with a one-size-fits-all value for auto protection that didn’t take into account car sort and use, the place and the way a lot the automotive will probably be pushed, and so forth – lower-risk drivers would subsidize riskier ones. Threat-based pricing permits insurers to supply the bottom attainable premiums to policyholders with essentially the most favorable danger components. Charging increased premiums to insure higher-risk policyholders permits insurers to underwrite a wider vary of coverages, thus bettering each availability and affordability of insurance coverage.

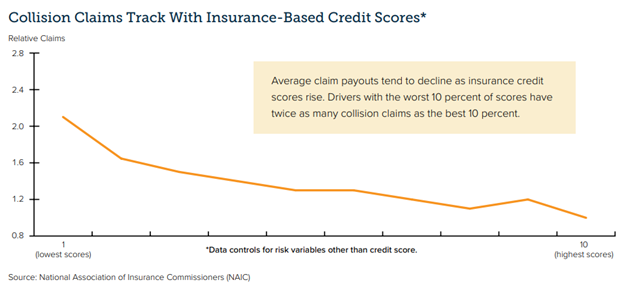

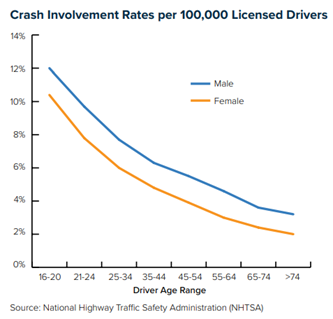

This easy idea turns into difficult when actuarially sound ranking components intersect with different attributes in methods that may be perceived as unfairly discriminatory. For instance, issues have been raised about using credit-based insurance coverage scores, geography, dwelling possession, and motorized vehicle information in setting dwelling and automotive insurance coverage premium charges. Critics say this could result in “proxy discrimination,” with folks of shade in city neighborhoods typically charged greater than their suburban neighbors for a similar protection.

The confusion is comprehensible, given the complicated fashions used to evaluate and value danger and the socioeconomic dynamics concerned. To navigate this complexity, insurers rent groups of actuaries and knowledge scientists to quantify and differentiate amongst a variety of danger variables whereas avoiding unfair discrimination.

Whereas it might be exhausting for policyholders to imagine components like age, gender, and credit score rating have something to do with their probability of submitting claims, the charts under exhibit clear correlations.

Policyholders have cheap issues about rising premium charges. It’s essential for them and their legislators to grasp that the present high-rate setting has nothing to do with the appliance of actuarially sound ranking components and the whole lot to do with growing insurer losses related to increased frequency and severity of claims. Frequency and claims tendencies are pushed by a variety of causes – equivalent to riskier driving conduct and authorized system abuse – that warrant the eye of policymakers. Legislators would do effectively to discover methods to cut back dangers, comprise fraud different types of authorized system abuse, and enhance resilience, somewhat than pursuing “options” to limit pricing that may solely make these drawback worse.

Be taught Extra

New Triple-I Points Transient Takes a Deep Dive into Authorized System Abuse

Illinois Invoice Highlights Want for Schooling on Threat-Based mostly Pricing of Insurance coverage Protection

How Proposition 103 Worsens Threat Disaster in California

Louisiana Nonetheless Least Inexpensive State for Private Auto, Owners Insurance coverage

IRC Outlines Florida’s Auto Insurance coverage Affordability Issues

Schooling Can Overcome Doubts on Credit score-Based mostly Insurance coverage Scores, IRC Survey Suggests

Colorado’s Life Insurance coverage Information Guidelines Supply Glimpse of Future for P&C Writers

It’s Not an “Insurance coverage Disaster” – It’s a Threat Disaster

Indiana Joins March Towards Disclosure of Third-Occasion Litigation Funding Offers

Litigation Funding Regulation Discovered Missing in Transparency Division