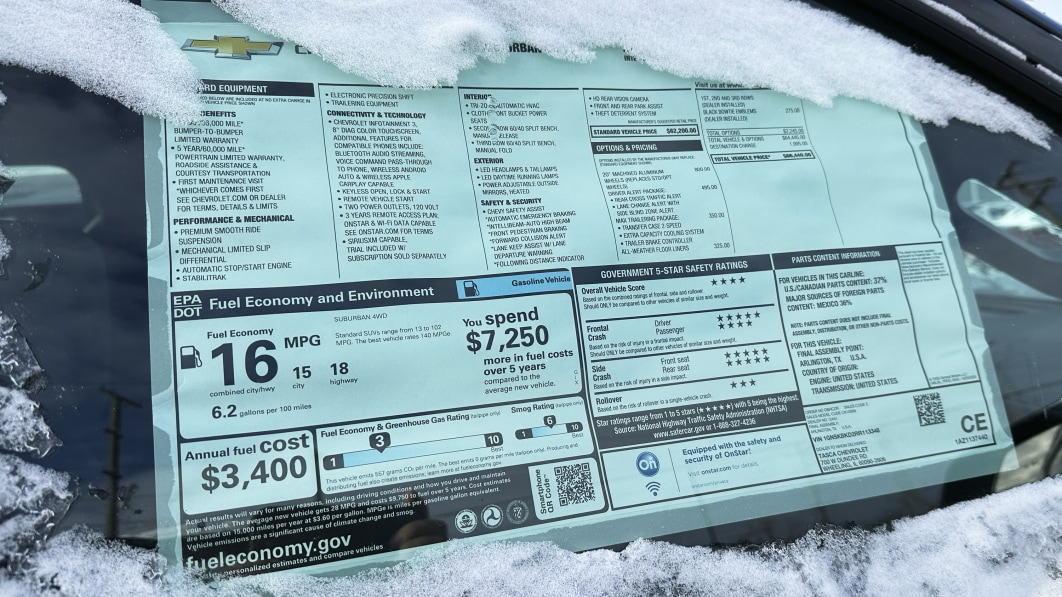

A number of U.S. auto retailers reported dour fourth-quarter earnings this week, as value cuts and incentives to lure in consumers put a pressure on new-vehicle margins. Larger car manufacturing, which has eased provide, has additionally trimmed seller margins, auto retail chain executives mentioned this week.

That is in distinction to excessive costs that auto sellers commanded over the previous few years, profiting from sturdy demand for brand spanking new autos and quick provides of well-liked fashions because of provide chain bottlenecks.

“Reductions and incentives on new-vehicles proceed to rise, and that’s placing downward strain on pricing and profitability for sellers and automakers alike,” a Cox Automotive report confirmed on Tuesday.

However regardless of decrease costs and better incentives, U.S. new-vehicle gross sales tempo slowed within the first month of the 12 months, the report mentioned.

Electrical autos (EV) have additionally been a reason behind concern for retailers. They’ve needed to shell out extra to market EVs, which have seen various ranges of demand owing to their greater upkeep prices and decrease resale values.

To make issues worse, EV costs have come down considerably within the U.S. previously 12 months, led by value cuts at Tesla, Cox added.

“New car margins proceed to say no, however the charge of moderation within the fourth quarter, which was about $120 monthly was extra modest than earlier quarters,” automotive retailer AutoNation CEO Mike Manley mentioned on an earnings name on Tuesday.

Whereas seller Lithia Motors’ new car margin fell to 7.9%.

Nonetheless, retailers confirmed confidence of their after-market service items, lifting their earnings from upkeep associated to new autos, with extra know-how and software program including an additional layer of complexity.

Shares of Sonic Automotive, which missed fourth-quarter estimates on Wednesday, had been down about 5%. AutoNation’s shares had been additionally marginally down, whereas these of Lithia had been barely up.