Total borrowing ranges within the U.S. rose modestly throughout the closing three months of final 12 months as extra kinds of borrowing bumped into hassle, particularly on the auto entrance, whilst total difficulties remained under ranges seen earlier than the onset of the COVID-19 pandemic.

Whole family debt climbed by $212 billion within the fourth quarter of 2023 to $17.5 trillion, the New York Federal Reserve stated on Tuesday in its newest quarterly Family Debt and Credit score Report.

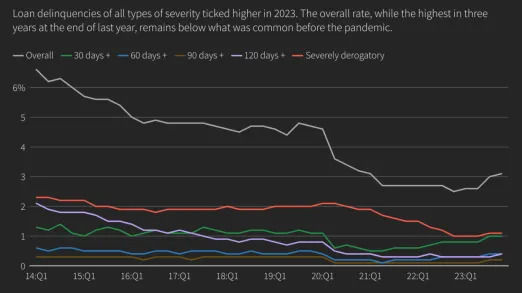

Amid the rise in debt, delinquency charges and the transition into troubled standing have been each greater. The New York Fed stated 3.1% of excellent debt was in some sort of delinquency, up one-tenth of a share level from the third quarter. However total delinquency charges have been 1.6 share factors decrease than within the final quarter of 2019 earlier than the pandemic struck.

The New York Fed report describes credit score situations in an economic system that has been rising strongly amid traditionally low ranges of unemployment and rising incomes. However on the similar time, inflation has been excessive and the U.S. central financial institution has raised rates of interest aggressively and stored short-term borrowing prices excessive, which in flip has made credit score costlier and difficult to handle for debtors.

A few of these points manifested in delinquency transition charges for every type of debt besides scholar loans, which elevated on the shut of 2023, with 8.5% of bank card loans and seven.7% of auto loans operating into hassle. Scholar mortgage funds are at the moment in an uncommon scenario given what had been a interval of forbearance and forgiveness for a lot of debtors, amid a return to funds for a lot of debtors.

Delinquency charges have been rising from historic lows reached close to the top of 2022, and households got here into the pandemic with robust stability sheets that have been then strengthened by trillions of {dollars} in authorities help.

“This has meant that whereas credit score development has accelerated, debt servicing prices have risen and delinquency charges have elevated, the broad credit score image of the U.S. shouldn’t be alarming,” Gregory Daco, chief economist at EY, wrote. “What’s extra, with many householders locked in at low mortgage charges … the consequences of the Fed’s historic tightening cycle have been far more muted than anticipated.”

Bank card delinquencies

The New York Fed stated in a weblog posting accompanying the report that delinquency charges have been rising from very low ranges in 2021 amid a retreat in authorities help efforts. Within the case of auto loans, delinquency charges at the moment are above pre-pandemic ranges “and the worsening seems to be broad-based,” New York Fed researchers wrote.

“Loans opened throughout 2022 and 2023 are, to date, performing worse than loans opened in earlier years, maybe as a result of patrons throughout these years confronted greater automotive costs and should have been pressed to borrow extra, and at greater charges,” they wrote. Elevated delinquency charges “benefit monitoring within the months forward, notably with the amplified misery proven by debtors in lower-income areas.”

The report stated auto mortgage balances total have been up by $12 billion to $1.61 trillion within the fourth quarter.

Relating to housing, whole new mortgage borrowing rose by $112 billion to $12.25 trillion within the fourth quarter, the report added. In the meantime, bank card balances have been up $50 billion to $1.13 trillion, whereas scholar mortgage balances rose $2 billion to $1.6 trillion within the final three months of 2023.

The New York Fed famous “severe bank card delinquencies elevated throughout all age teams, notably with youthful debtors surpassing pre-pandemic ranges.” It added that the variety of mortgage loans transitioning into hassle remained traditionally low, whereas noting an increase in borrowing by house fairness traces for the seventh straight quarter.