By Sean Kevelighan, Triple-I CEO

Laws proposed by U.S. Rep. Adam Schiff (D-Calif.) to create a federal “disaster reinsurance program” raises a number of issues that warrant scrutiny and dialogue – beginning with the query: Does what’s being proposed even qualify as insurance coverage?

If enacted into regulation, the invoice would set up a “catastrophic property loss reinsurance program…to offer reinsurance for qualifying major insurance coverage corporations.” To qualify, insurers must supply:

- An all-perils property insurance coverage coverage for residential and business property, and

- A loss-prevention partnership with the policyholder to encourage investments and actions that scale back insured and financial losses from a disaster peril.

The proposed program would part in protection necessities peril by peril over a number of years and discontinue FEMA’s Nationwide Flood Insurance coverage Program (NFIP). It could set protection thresholds and dictate score elements primarily based on enter from a board wherein the insurance coverage trade is simply nominally represented.

And nowhere within the 22-page proposal do any of the next phrases or phrases seem:

- “Actuarial soundness”;

- “Danger-based pricing”;

- “Reserves”; or

- “Policyholder surplus”.

Actuarially sound risk-based pricing and the necessity to keep enough reserves and policyholder surplus to make sure monetary energy and claims-paying potential are the bedrock of any insurance coverage program worthy of the identify – not technical wonderful print to be labored out down the street whereas present mechanisms are being dismantled and market forces distorted by means of authorities involvement.

Insurance coverage is an advanced self-discipline, and prior federal makes an attempt at offering protection have struggled to steadiness their purpose of accelerating availability and decreasing premiums towards the necessity to base underwriting and pricing on actuarially sound ideas to make sure enough reserves for paying claims.

Actuarially sound risk-based pricing and the necessity to keep enough reserves and policyholder surplus…are the bedrock of any insurance coverage program worthy of the identify – not technical wonderful print to be labored out down the street…

Sean Kevelighan, CEO, Triple-I

Study from historical past

NFIP is a powerful living proof. Created in 1968 to guard property house owners for a peril that almost all non-public insurers have been reluctant to cowl, NFIP’s “one-size-fits-all” strategy to underwriting and pricing has led to this system now owing greater than $20 billion to the U.S. Treasury as a result of it lacked the reserves to completely pay claims after main occasions like Hurricane Katrina and Superstorm Sandy. It additionally typically led to lower-risk property house owners unfairly subsidizing protection for higher-risk properties.

Having thus realized the significance of risk-based pricing, NFIP has modified its underwriting and pricing methodology. The brand new strategy – Danger Score 2.0, introduced in 2019 and totally applied as of April 1, 2023 – extra equitably distributes premiums primarily based on dwelling worth and particular person properties’ flood danger. Consequently, premiums of beforehand sponsored policyholders – significantly in coastal areas with larger values – have risen, resulting in outcries from many higher-risk house owners who’ve seen their subsidies diminished.

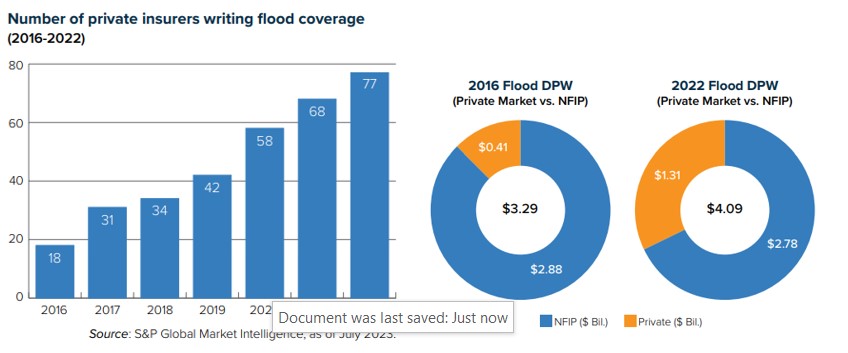

Along with resulting in fairer pricing, Danger Score 2.0 – by decreasing market distortions – will increase incentives for personal insurers to get entangled. For a very long time, non-public insurers thought of flood an untouchable peril, however improved information modeling and analytical instruments have elevated their consolation penning this enterprise. Because the charts beneath present, non-public insurers have been enjoying a steadily rising function in recent times, overlaying a bigger proportion of a rising danger pool.

Over time, this pattern ought to result in better availability and affordability of flood insurance coverage protection.

Quite than incorporating the teachings generated by NFIP’s expertise with a single peril, Rep. Schiff’s proposal would discontinue the reformed flood insurance coverage program whereas including a brand new layer of complexity to protection throughout all perils and casting into query the way forward for varied state insurance coverage applications and residual market mechanisms at present in place.

Time-tested ideas

Any try by the federal authorities to handle insurance coverage availability and affordability issues have to be made with an understanding of how insurance coverage works – from pricing and underwriting to reserving and declare settlement. For instance, the Schiff invoice proposes piloting an all-perils coverage with a time period of 5 years. There are good causes for property/casualty insurance policies to be written with a one-year time period. Particularly, the circumstances that have an effect on claims prices can change rapidly, and insurers – as referenced above – should put aside enough reserves to have the ability to pay all legit claims. If they can not revisit pricing yearly, the monetary outcomes might be disastrous.

“Who would have thought in 2019 that alternative prices would enhance 55 p.c inside three years?” requested Dale Porfilio, Triple-I’s chief insurance coverage officer. Provide-chain disruptions associated to the COVID-19 pandemic and Russia’s invasion of Ukraine contributed to only such a replacement-cost spike. “Requiring five-year phrases for insurance policies would have led to an enormous drain on policyholder surplus.”

Policyholder surplus is the monetary cushion representing the distinction between an insurer’s belongings and its liabilities.

In asserting his proposed laws, Rep. Schiff stated it’s supposed to “insulate customers from unrestrained value will increase by providing insurers a clear, pretty priced public reinsurance various for the worst climate-driven catastrophes.”

This language ignores the truth that, beneath state-by-state regulation, premium fee will increase are something however “unrestrained” and ratemaking is predicated on actuarially sound ideas which can be clear and truthful. Property/casualty insurance coverage already is likely one of the most closely regulated industries in the US.

Customers deserve actual options

Policyholders have legit issues about affordability and, in some instances, availability of insurance coverage. These issues can create strain for political leaders at each the state and federal ranges to advance measures which can be perceived as promising to assist. Sadly, many current proposals start by mischaracterizing present tendencies as an “insurance coverage disaster,” versus what they actually characterize: A danger disaster.

Insurance coverage premium charges have a tendency to maneuver in step with the frequency and severity of the perils they cowl. Additionally they are affected by elements like fraud and litigation abuse; local weather, inhabitants, and improvement tendencies; and international economics and geopolitics. That’s the reason insurers rent actuaries and information scientists and make use of cutting-edge modeling expertise to make sure that insurance coverage pricing is actuarially sound, truthful, and compliant with regulatory necessities in all states wherein they do enterprise.

That’s how insurers maintain lower-risk policyholders from unfairly subsidizing higher-risk ones.

To its credit score, the federal authorities is working to scale back climate-related dangers and investing in resilience by means of applications like Neighborhood Catastrophe Resilience Zones (CDRZ) and FEMA’s Constructing Resilient Infrastructure and Communities (BRIC) program. The Bipartisan Infrastructure Regulation accommodates substantial funding to advertise local weather resilience. These are worthy endeavors geared toward addressing dangers that drive up insurance coverage prices.

However historical past has proven that direct authorities involvement within the underwriting and pricing of insurance coverage merchandise tends to not finish effectively. Any plan that might try and micromanage insurers’ protection of all perils by means of a lens that ignores time-tested, actuarially sound risk-based pricing ideas raises a bunch of pink flags that have to be mentioned and addressed earlier than such a plan is allowed to change into regulation.

Study Extra:

It’s Not an “Insurance coverage Disaster” — It’s a Danger Disaster

Miami-Dade, Fla., Sees Flood Insurance coverage Price Cuts, Because of Resilience Funding

Illinois Invoice Highlights Want for Schooling on Danger-Primarily based Pricing of Insurance coverage

Schooling Can Overcome Doubts on Credit score-Primarily based Insurance coverage Scores, IRC Survey Suggests

Matching Value to Peril Helps Preserve Insurance coverage Accessible and Reasonably priced

Policyholder Surplus Issues: Right here’s Why

Triple-I Points Transient: Flood

Triple-I Points Transient: Proposition 103 and California’s Danger Disaster

Triple-I Points Transient: Danger-based Pricing of Insurance coverage

Triple-I Points Transient: How Inflation Impacts P/C Insurance coverage Pricing – and How It Doesn’t

Triple-I Points Transient: Race and Insurance coverage Pricing