One other California insurer will cease issuing protection within the state in a transfer affecting roughly 58,000 auto insurance policies.

Farmers Direct Property and Casualty Insurance coverage, a division of Farmers Insurance coverage, stopped writing new insurance policies in September.

Luis Sahagun, director of media relations at Farmers’ firms, didn’t reply by deadline to a Repairer Pushed Information question asking for particulars on what prompted its exit and whether or not it deliberate to assist clients transition to new insurance policies.

Nonetheless, in an e-mail to Patch, he mentioned the measure was a part of “an ongoing initiative to extend operational effectivity and mitigate threat publicity” and that insurance policies will start expiring Dec. 17. Affected clients will obtain non-renewal notices within the mail.

“For the overwhelming majority of affected clients, we’ll present a suggestion to transition them to a special Farmers-related insurer,” Sahagun wrote. He added that clients lined by Farmers’ different umbrella firms like Bristol West, twenty first Century, and Foremost gained’t be affected.

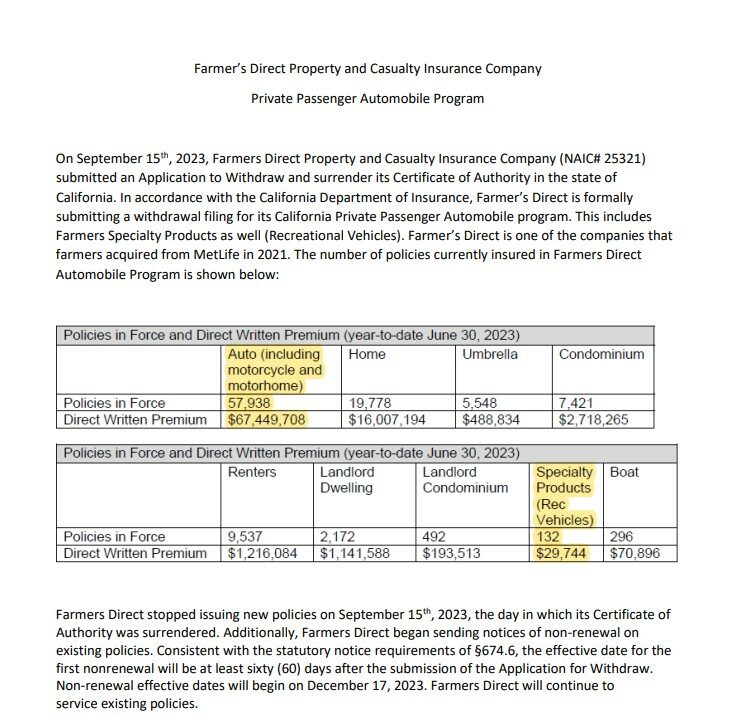

A submitting with California’s Division of Insurance coverage to withdraw and give up its Certificates of Authority within the state indicated the corporate’s withdrawal will largely have an effect on auto insurance policies.

Of the almost 100,000 insurance policies in pressure, greater than half had been for automobiles, together with motorhomes and bikes, representing greater than $67 million in written premiums.

A variety of insurers have already scaled again protection, notably in states they deemed unprofitable, in latest months. Kemper Corp. introduced in August that it’s exiting the popular house and auto market to reinforce its returns and “help worthwhile progress” in core companies. Its specialty enterprise Kemper Auto was not affected by the shakeup.

In July, Farmer’s Insurance coverage mentioned it will cease writing auto, residential and umbrella insurance policies in Florida, it confirmed this week in a transfer anticipated to have an effect on 100,000 insurance policies.

Liberty Mutual and Farmers Insurance coverage have initiated layoffs to enhance profitability.

The California Division of Insurance coverage didn’t reply to an RDN question by deadline to point whether or not it deliberate to work with insurers in figuring out if measures ought to be taken to assist their companies turn into extra sustainable within the state.

Earlier this month, Allstate executives mentioned when saying Q3 earnings that it was persevering with to limit progress in “profit-challenged states,” together with California.

“Whereas the advance was encouraging, loss value traits stay elevated and require continued execution of auto insurance coverage revenue enchancment plan, notably in California, New York, and New Jersey,” mentioned Tom Wilson, Allstate’s president and CEO, throughout an earnings name. “We are going to proceed to pursue charge will increase to revive auto insurance coverage margins again to focus on ranges.”

Mario Rizzo, Allstate’s president of property legal responsibility, advised buyers that the corporate could be compelled to reduce its exercise in these states if its pending charge enhance requests will not be authorised.

He mentioned Allstate has “important” charge will increase pending, together with a 35% hike in California, a 29% enhance in New Jersey, and an 18.3% bump in New York.

“The place we’re at now’s we have to motion these filings within the fourth quarter,” Rizzo mentioned. “And if we will’t, then we imagine the fitting factor to do for the purchasers within the different 47 states, in addition to for our shareholders, is to take further motion to get smaller throughout all three of these states. That’s what we’d do starting subsequent 12 months if we will’t get decision on the speed filings which can be at the moment pending.”

Earlier this 12 months, a Swiss Re research discovered that though a tough market is prone to proceed, 2023 is anticipated to be a “transition 12 months” globally for property and casualty (P&C) insurance coverage.

“Our evaluation reveals that non-life insurers’ profitability is about to enhance strongly within the coming years as greater rates of interest and charge hardening greater than offset greater claims prices from persistent inflation,” mentioned Jérôme Jean Haegeli, Swiss Re’s chief economist. “This will likely be very important to allow trade sources to develop at a charge that may match world demand for insurance coverage safety.”

Swiss Re added that regardless of the constructive outlook, profitability inside the P&C insurance coverage sector is prone to stay decrease than the rising value of capital this 12 months.

Turning the nook would require insurers to turn into extra disciplined with their capital and use it extra effectively, the research discovered.

Pictures

Featured picture courtesy of gguy44/iStock

Share This: