What Is Medical Funds Protection (MedPay)?

Medical funds protection is a sort of automobile insurance coverage that pays for medical bills when a automobile accident leads to accidents to the policyholder, their passengers, or different drivers listed on the coverage. This protection can be utilized after any accident, no matter fault, and it’s also known as “MedPay.”

Key Issues to Know About Medical Funds Protection

- MedPay typically prices lower than $10 monthly.

- Protection applies after any automobile accident, no matter fault, together with when the policyholder is hit by a automobile whereas strolling, biking or using public transit.

- MedPay doesn’t require the policyholder to pay any deductibles or copays.

- MedPay insurance coverage is just like private damage safety however doesn’t supply as a lot protection.

- It is best to contemplate buying MedPay even when you have already got medical insurance or private damage safety.

How Medical Funds Protection Works

Medical funds protection works by filling protection gaps between auto and medical insurance to verify medical payments receives a commission shortly. MedPay pays for accident-related medical bills for the policyholder and their passengers no matter fault, so there isn’t any want to attend for fault to be decided or for the opposite driver’s insurance coverage to pay on your declare. Moreover, MedPay protection by no means requires any copays or deductibles, and it could even be used to pay deductibles and copays for medical insurance or PIP.

With out MedPay, you’ll have to depend on the at-fault driver’s legal responsibility coverage (or your individual protection for uninsured drivers) to have your medical payments paid for. Sadly, bodily damage legal responsibility protection has limitations of its personal, particularly that it could take months to find out fault. Within the meantime, you’d be paying on your personal medical bills hoping that you just’ll be reimbursed.

What MedPay Does and Does Not Cowl

| What MedPay Covers | What MedPay Doesn’t Cowl |

|---|---|

| Medical payments usually coated by medical insurance | Misplaced wages |

| Skilled nursing providers | Childcare and different non-medical associated bills |

| Funeral bills | Property injury |

| Deductibles, copays, and coinsurance for different varieties of insurance coverage | Different drivers’ accidents |

Value of MedPay

Medical funds protection typically prices lower than $10 monthly, making it an especially inexpensive insurance coverage possibility. The precise value of medical funds insurance coverage is dependent upon a number of elements, together with your driving historical past, the kind of automobile that you just drive, and the quantity of protection that you just buy. The upper your protection limits, the upper your premium will likely be.

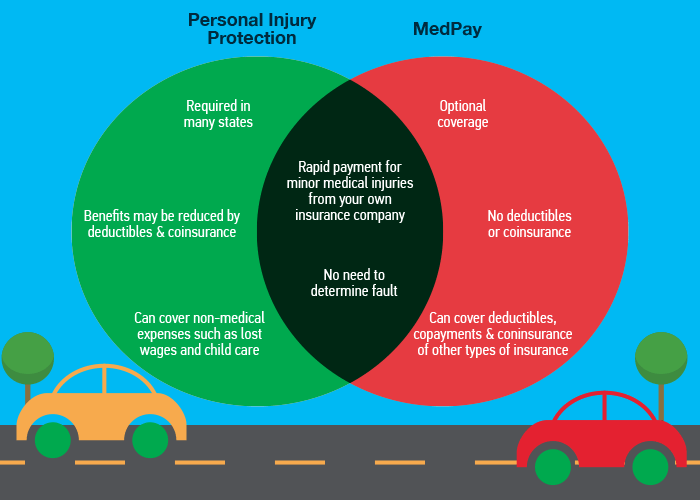

Medical Funds Protection vs. PIP Protection

In some states, you might be required or have the choice to purchase private damage safety (PIP) insurance coverage. Like MedPay, PIP will cowl well being care prices for you, your loved ones and your passengers. In contrast to MedPay, PIP insurance coverage can cowl extra than simply medical bills. It could additionally compensate you for issues like misplaced revenue and baby care bills. Take into account that PIP typically has a deductible and should require the buyer to pay a proportion of medical payments.

MedPay and PIP insurance coverage can complement one another. You should utilize MedPay to pay the deductibles and coinsurance that buyers are answerable for below PIP. And if medical payments exceed the boundaries of your PIP insurance coverage, MedPay can cowl the remaining quantity.

Study extra about medical funds protection vs. PIP protection.

Do You Want Medical Funds Protection?

Maine and New Hampshire are the one states that require drivers to hold medical funds protection. Even when MedPay will not be required, it’s virtually at all times an excellent funding since it’s an inexpensive method to verify medical payments for you and your passengers will receives a commission after a automobile accident.

Even when you have already got medical insurance or PIP, MedPay can fill in any protection gaps and reimburse you for out-of-pocket bills. Contemplating that the common bodily damage declare after an accident in 2021 was $22,734, in response to the Insurance coverage Info Institute, a medical insurance plan won’t be capable of cowl your entire bills. Plus, MedPay protection extends to passengers who will not be a part of your family – and who might or might not have medical insurance themselves.

Study extra about how a lot medical funds protection you want.

Finest Medical Funds Insurance coverage Firms

Study extra about greatest medical funds insurance coverage corporations.

Ask the Consultants

To achieve extra perception about Medical Funds Protection (MedPay), WalletHub posed the next inquiries to a panel of consultants. Click on on the consultants beneath to view their bios and solutions.

1. Is Medical Funds Insurance coverage or Private Harm Safety higher?

2. What varieties of drivers can purchase MedPay?

3. When ought to drivers get each MedPay and PIP?

4. What’s the greatest benefit of MedPay over Legal responsibility Insurance coverage?

Sheying Chen

Ph.D., Professor of Public Administration/Social & Well being Coverage, Dyson School of Arts and Sciences, Tempo College

Learn Extra

Jeff Helton

Scientific Affiliate Professor, Tutorial Director of Well being Applications, CU Denver Enterprise College, College of Colorado Denver

Learn Extra

Ellen M. Kraft

Ph.D., Affiliate Professor of Enterprise Research, College of Enterprise, Stockton College

Learn Extra

Patrick Bernet

Ph.D., Affiliate Professor, School of Enterprise, Florida Atlantic College

Learn Extra

Steven A. Lopez

Working towards College, College of Legislation, St. Mary’s College

Learn Extra

Mark Evers

Ph.D., CFP, CRPC, Lecturer and Monetary Planning Program Advisor, G. Brint Ryan School of Enterprise, College of North Texas

Learn Extra

Extra Consultants

Was this text useful?

Disclaimer: Editorial and user-generated content material will not be offered or commissioned by monetary establishments. Opinions expressed listed below are the creator’s alone and haven’t been accredited or in any other case endorsed by any monetary establishment, together with these which can be WalletHub promoting companions. Our content material is meant for informational functions solely, and we encourage everybody to respect our content material tips. Please understand that it’s not a monetary establishment’s duty to make sure all posts and questions are answered.

Advert Disclosure Sure gives that seem on this web site originate from paying advertisers, and this will likely be famous on a proposal’s particulars web page utilizing the designation “Sponsored”, the place relevant. Promoting might impression how and the place merchandise seem on this web site (together with, for instance, the order by which they seem). At WalletHub we attempt to current a big selection of gives, however our gives don’t characterize all monetary providers corporations or merchandise.