After a short respite from hovering auto debt, People are as soon as once more falling deeply underwater on their automotive loans.

Used-car values have tumbled about 16% from the pandemic-driven peaks of early final 12 months, in accordance with the Manheim Used Automobile Worth Index, and detrimental fairness — the quantity that debt exceeds a car’s worth — has been climbing quick.

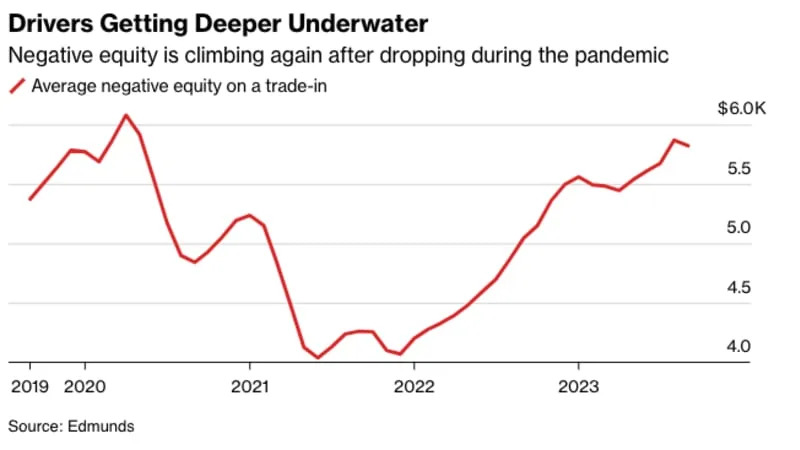

Amongst new automotive patrons, these carrying detrimental fairness on their trade-ins have been underwater by a mean of $5,820 in September. That’s in comparison with a low of lower than $4,100 in late 2021, in accordance with automotive data agency Edmunds.

Whereas it’s commonplace for motorists to accrue detrimental fairness, the long-term pattern has been exacerbated by low down funds and the emergence of six- and seven-year mortgage phrases. Drivers bought a measure of aid when a topsy-turvy auto market despatched used-car values hovering in the course of the pandemic, and a few motorists found their automobiles have been price greater than they’d paid for them.

Traditionally, round half of new-vehicle patrons commerce in a automotive, and simply shy of a fifth of these trade-ins really carry detrimental fairness, Edmunds knowledge present.

Despite the fact that solely a sliver of US automotive patrons arrive at dealerships with trade-ins which can be underwater, the rise is creating complications for sellers and would-be automotive patrons alike — rolling detrimental fairness into a brand new mortgage may be troublesome if the quantity owed is just too excessive.

Within the Columbus, Ohio, space, seller Rick Ricart was accustomed to seeing solely a few customers on any given weekend day with $10,000 or extra in detrimental fairness. On one Saturday in late August, although, he counted 10 prospects dealing with that situation.

Getting somebody like that right into a automotive “isn’t not possible,” Ricart stated. “However is the shopper snug with a fee that would go up a whole lot of {dollars} resulting from rates of interest, and the detrimental fairness that must be rolled into it?”