Personal credit score platform Modulus Options Funding Managers Ltd on Wednesday stated it has infused INR 105 crore in transmission gear and shafts maker Shivam Autotech as a part of its dedication to take a position INR 150 crore within the firm. The proceeds of the funding can be utilised for each development and dealing capital, Modulus Options stated in an announcement.

That is the maiden funding of the platform’s second non-public credit score fund, India Credit score Alternatives Fund II (ICOF II), which was launched earlier this 12 months, the assertion stated.

Modulus Options at the moment manages two Class II Personal Credit score AIFs, Centrum Credit score Alternatives Fund and India Credit score Alternatives Fund II.

Shivam Autotech, a Hero Group firm, is Modulus Options’ sixteenth funding, thus taking the whole invested capital to INR 1,895 crore within the non-public credit score platform, it stated.

Until date, the agency has exited 10 investments and returned greater than INR 825 crore of capital to traders, it added.

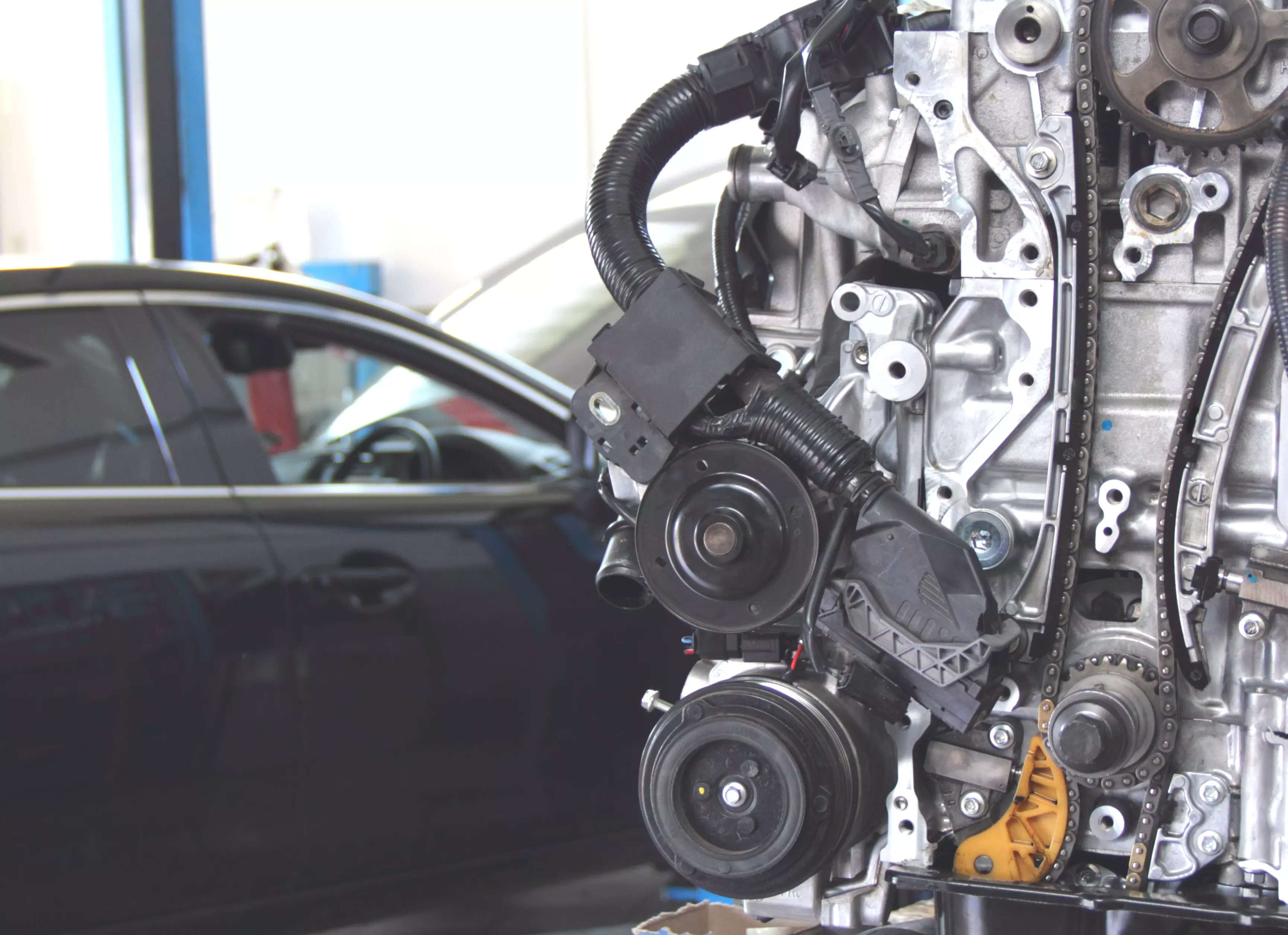

“We…have entered into this partnership (INR 150 crore dedicated funding) with Shivam Autotech. We strongly consider that the corporate has advanced right into a mature auto-component producer,” Rakshat Kapoor, Chief Funding Officer at Modulus Options Funding Managers Restricted, stated.

With the growth of its product line to incorporate four-wheelers and partnerships with main automakers, the auto element maker is uniquely positioned to capitalise on the numerous development alternatives, going ahead, he acknowledged.

Led by Yogesh Munjal and Neeraj Munjal of Munjal Group, Shivam Autotech has grown into one of many largest producers of transmission gears and steering parts throughout two- and four-wheeler segments.

ICOF II is a class II AIF with a focused corpus of INR 1,250 crore, together with INR 500 crore as a inexperienced shoe possibility, the platform stated within the assertion, including that the fund has acquired outstanding curiosity from traders and raised commitments in extra of INR 200 crore inside a brief span.

The AUM of the fund continues to develop as skilled traders discover new avenues for greater debt yields. With an identical technique as the primary fund, ICOF II will spend money on mid-sized corporations within the performing credit score house, it stated.