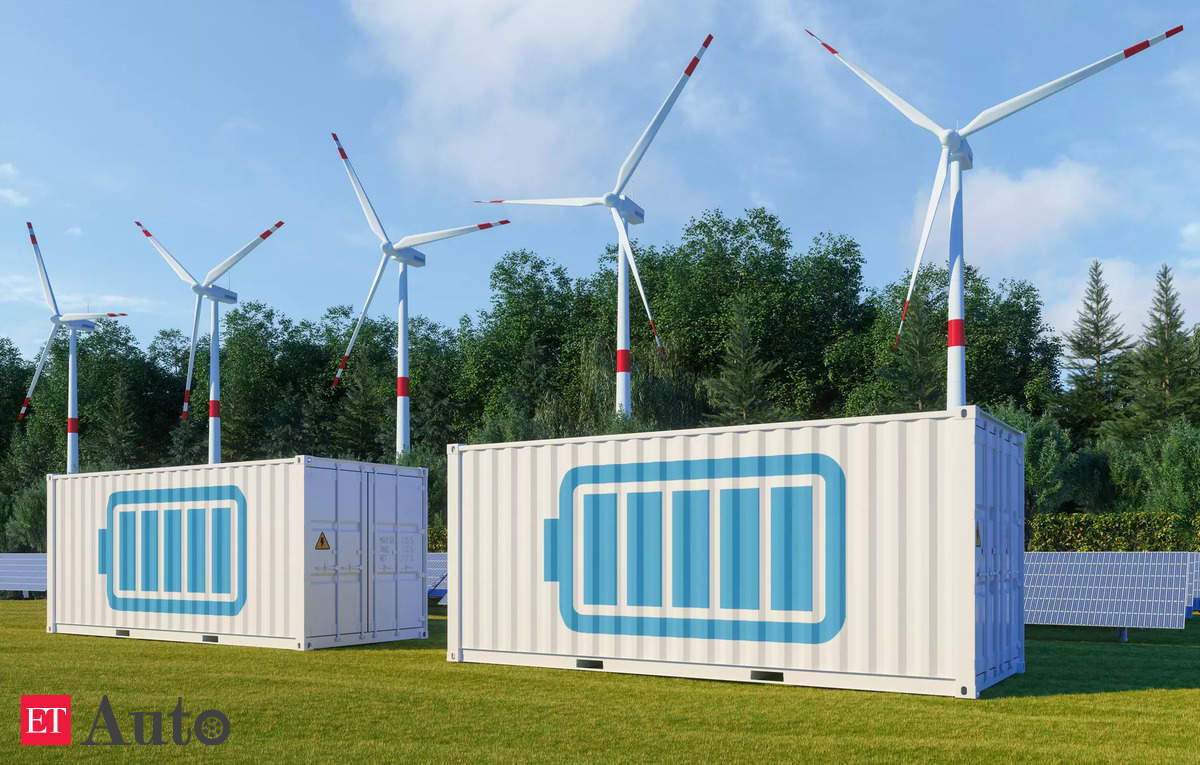

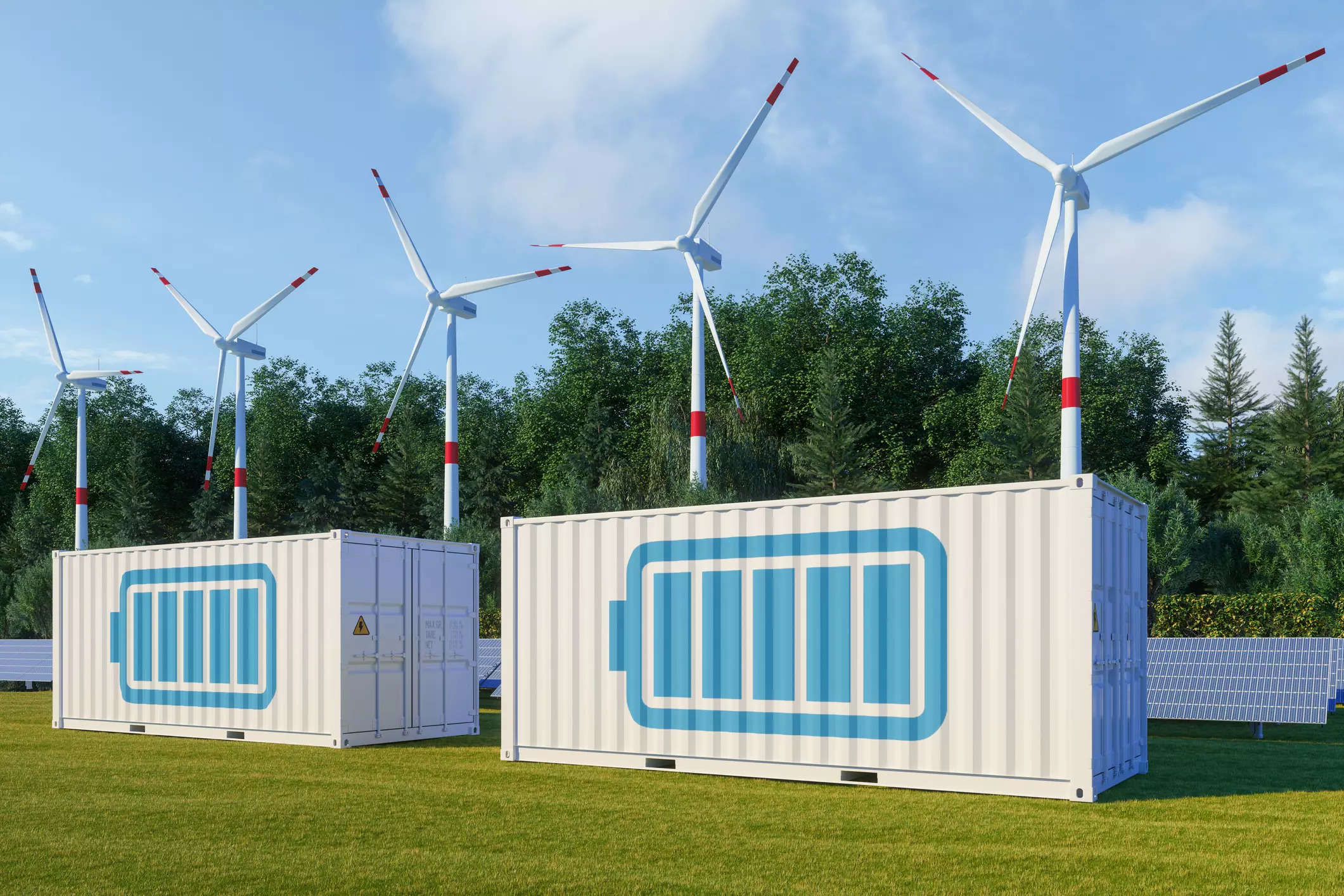

Battery vitality storage methods (BESS) have emerged as a linchpin in enabling the widespread integration of renewable vitality sources. The intermittent nature of wind and solar energy might be smoothed out and made dependable via BESS, an important element within the renewable vitality ecosystem.

The worldwide BESS market is anticipated to surge to a staggering USD 120 billion to USD 150 billion by 2030, greater than doubling its present measurement. Whereas these figures are certainly promising, the BESS panorama stays fragmented, necessitating a strategic method by business gamers to harness its full potential, says a latest evaluation carried out by McKinsey & Firm.

In a world that’s more and more centered on combating local weather change and reaching the objectives set forth within the Paris Settlement, the position of renewable vitality sources is pivotal. Governments and organizations across the globe are intensifying their efforts to embrace cleaner vitality alternate options. This motion is especially pronounced in areas grappling with vitality challenges. In Europe, the place an vitality disaster looms, and in america, spurred by the Inflation Discount Act of 2022 channeling USD 370 billion into clean-energy investments, the impetus for renewable vitality adoption has by no means been stronger.On the coronary heart of this transition is BESS. The McKinsey research signifies that the BESS market is witnessing spectacular progress. Investments in BESS reached an astonishing USD 5 billion in 2022, practically tripling from the earlier 12 months. Such exponential progress is attributed to the intrinsic worth BESS brings to the renewable vitality sector. Its flexibility and adaptableness permit for numerous purposes, together with peak shaving, self-consumption optimization, and serving as a backup throughout grid outages. As the price of battery know-how steadily declines, these purposes turn out to be extra financially viable, creating a good setting for market growth. The trajectory of this progress is nothing wanting outstanding.Strategic segmentation

In an effort to navigate this dynamic market, strategic segmentation is essential. The BESS purposes are categorized into three essential segments: Entrance-of-the-meter (FTM) utility-scale installations, behind-the-meter (BTM) industrial and industrial setups, and BTM residential installations. Of those, the FTM sector, comprising utility-scale installations, is poised for probably the most fast growth. The anticipated progress price of roughly 29% per 12 months throughout this decade positions FTM as probably the most swiftly evolving BESS section.

The utility-scale BESS sector serves as a linchpin in addressing the intermittency of renewable vitality sources and making certain grid stability. Income fashions on this section fluctuate relying on regional dynamics, encompassing ancillary companies and capability auctions. Trade leaders on this area are vertically built-in battery producers and enormous system integrators, distinguishing themselves based mostly on cost-efficiency, scalability, reliability, and the event of refined vitality administration methods.

Moreover, the industrial and industrial (C&I) section is a fertile floor for BESS integration. This section consists of electrical automobile charging infrastructure, crucial infrastructure like information centres, public infrastructure, industrial buildings, factories, and harsh environments comparable to mining and oil exploration. Notably, the anticipated surge in electrical automobile adoption is anticipated to gas the demand for BESS in EV charging stations, which is able to play a pivotal position in assuaging strain on grid infrastructure.

Residential installations symbolize a smaller however promising BESS section. These installations, usually accompanied by photovoltaic panels or built-in into good house methods, current ample alternatives for innovation and differentiation. Buyer curiosity in residential BESS options hinges on components comparable to affordability, security, and ease of set up.

Because the BESS panorama evolves, strategic positioning is paramount. Firms should determine underserved wants within the worth chain and discover software program improvement to boost the management and performance of storage methods. Resilient provide chains, strategic partnerships, and an understanding of rising battery applied sciences, comparable to sodium-ion batteries, can be essential for fulfillment.

As renewable vitality and battery know-how intertwine to forge a sustainable future, BESS suppliers have a novel alternative to form the course of the vitality transition and contribute considerably to world environmental efforts.