Considering of shifting to Florida or different Solar Belt states liable to flooding, wildfires or excessive warmth? You’re not alone. In line with a examine printed on Monday by the tech-based actual property brokerage, Redfin, Individuals are flocking to the counties hardest hit by local weather change. For a lot of of those migrants, pocketbook points like inexpensive housing and decrease earnings taxes are prime motivations. However the excessive value to owners of maximum climate could cancel out such financial savings.

Shifting to Florida, Arizona or Texas?

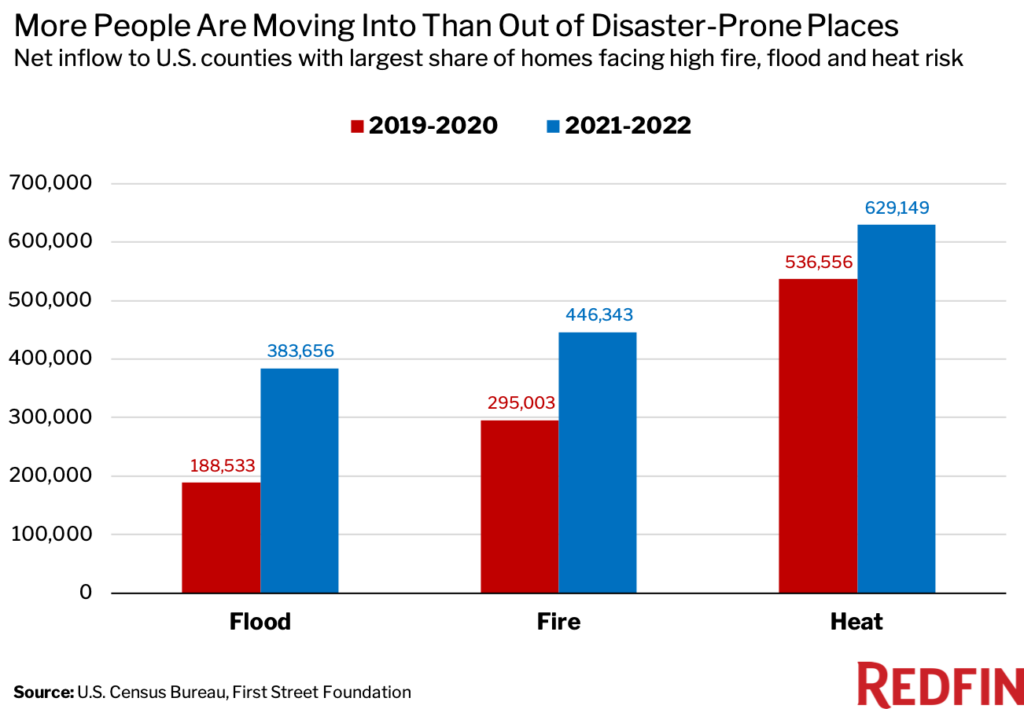

Redfin discovered that nearly 400,000 extra individuals moved into than out of counties with excessive flood threat in 2021 and 2022, representing a 103% improve over the earlier two years.

The identical development held true for different disaster-prone areas. Counties with the very best threat from excessive warmth noticed a internet 17% development in individuals shifting in over the previous two years in comparison with the prior two years, and counties with the very best wildfire threat noticed 51% extra individuals transfer in than out.

Subscribe to Kiplinger’s Private Finance

Be a wiser, higher knowledgeable investor.

Save as much as 74%

Join Kiplinger’s Free E-Newsletters

Revenue and prosper with the most effective of skilled recommendation on investing, taxes, retirement, private finance and extra – straight to your e-mail.

Revenue and prosper with the most effective of skilled recommendation – straight to your e-mail.

Redfin relied on information from the U.S. Census Bureau and from First Road Basis, which publishes climate-risk scores by location.

(Picture credit score: Redfin evaluation of U.S. Census Bureau and First Road Basis information.)

A part of the draw of those states is the low tax fee; each Florida and Texas don’t have any private earnings taxes. And Arizona’s tax fee can be on the low aspect in comparison with different states. Add within the development of distant work and the draw of sunshine and seashores, and it’s comprehensible why so many Individuals have moved to those areas, regardless of the dangers from excessive climate.

“It’s human nature to deal with present advantages, like waterfront views or a low value of residing, over prices that might rack up in the long term, like property harm or a lower in property worth,” stated Redfin Chief Economist Daryl Fairweather when commenting on the examine. “It’s additionally human nature to low cost dangers which are robust to measure, like local weather change.”

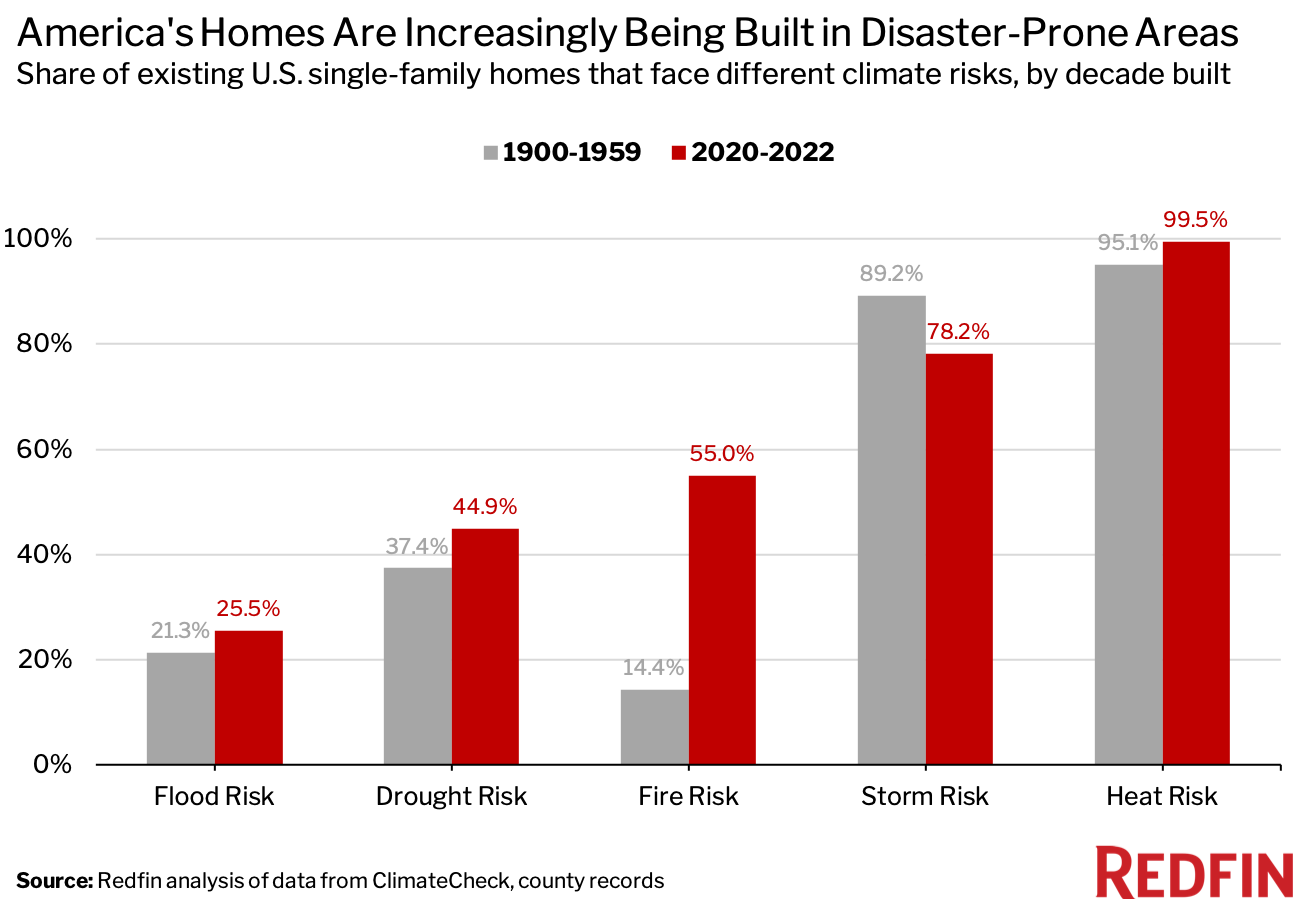

Many of those areas additionally present extra new and inexpensive housing than the locations that misplaced inhabitants, like San Francisco or New York Metropolis. In reality, a separate Redfin examine discovered that areas of excessive threat — particularly from fires — have a tendency to construct extra housing than safer areas do. The evaluation discovered that greater than half of houses constructed since 2020 face threat from fires, up from solely 14% of houses constructed from 1900 to 1995.

(Picture credit score: Redfin evaluation of knowledge from ClimateCheck and county data)

The Florida actual property draw

Coastal Florida, a lot of which is floor zero for dangers like sturdy winds and flooding, attracts huge ranges of in-migration within the Redfin evaluation.

Florida’s Lee County obtained extra internet individuals than any of the opposite 306 high-flood threat counties Redfin studied, and a 65% improve over the prior two years. This development continues in sizzling markets inside Lee County, like Cape Coral and Fort Myers, regardless of tons of of thousands and thousands of {dollars} in harm to the realm from the 2022 landfall of Hurricane Ian.

“Builders in Cape Coral haven’t stopped — they’re simply constructing like nothing occurred,” stated native Redfin actual property agent Isabel Arias-Squires. “That’s largely as a result of there’s loads of demand for brand spanking new houses.”

Local weather threat in Florida is multi-faceted. In Miami-Dade, for instance, porous limestone bedrock complicates efforts to protect towards sea degree rise when salt water can seep beneath sea partitions. And on the identical day that Redfin launched its report, the temperature off the south coast of Florida hit what could also be a world report for the hottest recorded seawater temperature, of 101.1 levels Fahrenheit. Sizzling oceans are unhealthy for corals and sea life, however may intensify hurricanes, that are recognized to extend in severity as ocean floor temperatures rise.

All of those local weather dangers translate into larger residence insurance coverage premiums, the necessity for flood insurance coverage in a lot of Florida, and complete auto insurance coverage. Years of insurance coverage fraud and litigation, and insurance coverage firms leaving the Florida market have additionally elevated charges. The common Florida residence insurance coverage premium is estimated to be $6,000 yearly, in comparison with a nationwide common of $1,700.

Arizona faces excessive warmth and drought

On Wednesday, Phoenix, Arizona broke its report for excessive warmth, with 26 straight days of temperatures of a minimum of 110 levels. Town has additionally skilled its fourth-longest interval with out rainfall, extending 125 consecutive days with no precipitation.

Regardless of scorching temperatures, Maricopa County, Arizona, which incorporates Phoenix, noticed a internet inflow of 76,000 individuals in the course of the previous two years. That’s the biggest development among the many 1,019 counties at excessive threat for warmth that Redfin analyzed. And in keeping with the U.S. Census, Maricopa County had the very best inflow of recent residents in comparison with some other U.S. county in 2022, not simply these going through warmth threat.

Along with warmth threat, Arizona struggles with diminishing groundwater provide, and relies upon closely on the harassed Colorado River for residential water. To its credit score, the state has labored arduous to extend water effectivity and conservation regardless of a rising inhabitants, nevertheless it additionally acknowledges limits to development. In June, the Arizona Division of Water Assets introduced that it might restrict new residence development in some areas of Phoenix the place it couldn’t assure ample water.

Texas counties additionally develop

The subsequent-biggest internet influx to counties with excessive warmth threat was in Collin County, TX, with 61,000 residents coming to the county. Like Florida, Texas additionally faces hurricanes that pose flooding and wind threat.

Louisiana shrinks

In contrast to Texas or Florida, Louisiana counties going through flood threat are dropping inhabitants, in keeping with the Redfin examine. Out-migration ticked up notably in counties pounded by hurricane Ida in 2021. Over twenty residence insurers within the state have both gone bankrupt or determined to depart Louisiana after 5 giant storms hit the state in 2020. That has raised insurance coverage premium costs and left some owners within the state to wonder if they’ll be capable to afford their houses sooner or later.

What’s a homebuyer to do?

A home is a lot greater than an funding, cementing bonds to group, tradition and typically household ties and traditions. So, the considered having to depart a group, as so many residents did in components of New Orleans and southern Louisiana after Hurricane Katrina, might be devastating. However getting caught in a home that turns into uninsurable, or that loses vital worth as a result of harm or threat, can be painful.

There are just a few methods you may shield your self when shifting to those areas of the nation.

- Know your threat. Analysis a selected residence for hearth, flood, wind and excessive warmth threat by getting into the tackle at Threat Issue. Search as nicely on town or county the place the house is positioned to get a way of total group threat. If your own home is without doubt one of the few on dry land however the remainder of the realm is flooded, you might lose entry to roads, utilities and key companies. For flood threat, verify if you’re in a FEMA-designated flood zone the place flood insurance coverage is necessary.

- Plan your exit technique. Except you propose to by no means promote your private home, or to bequeath it to your loved ones, take into consideration what number of years you’ll dwell within the residence. Then analysis how environmental situations could change in that point. For instance, if you happen to plan to remain for 15 years, you should utilize the Threat Issue software to see projections for the way threat could improve 15 years out. Making an exit technique can assist you keep away from getting caught with an uninsurable residence, or one that’s depreciating in worth.

- Scale back your private home’s threat. “Harden” your private home by following steerage on learn how to enhance possibilities of weathering a catastrophe. For instance, by decreasing vegetation close to the house that might gasoline hearth, putting in a roof licensed to face up to excessive winds or insulating your private home towards excessive warmth. Some states or counties have grants, loans or tax breaks for residents to finish these sorts of initiatives.

- Know the insurance coverage market in your space. Earlier than you buy a house, perceive your choices for insuring your private home with basic insurance coverage and, if want be, with flood insurance coverage. Speak to neighbors and observe native information to grasp if insurance coverage could also be an issue locally.

- Renters want insurance coverage too. In case you’re planning to lease in a high-risk space, contemplate renters insurance coverage and flood insurance coverage to guard the contents of your private home.