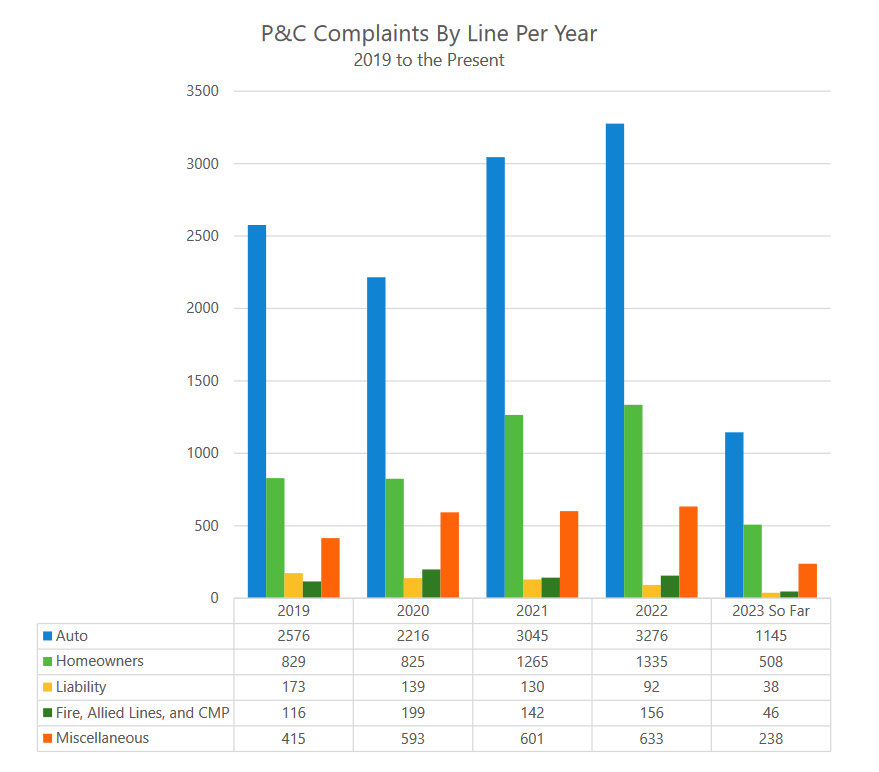

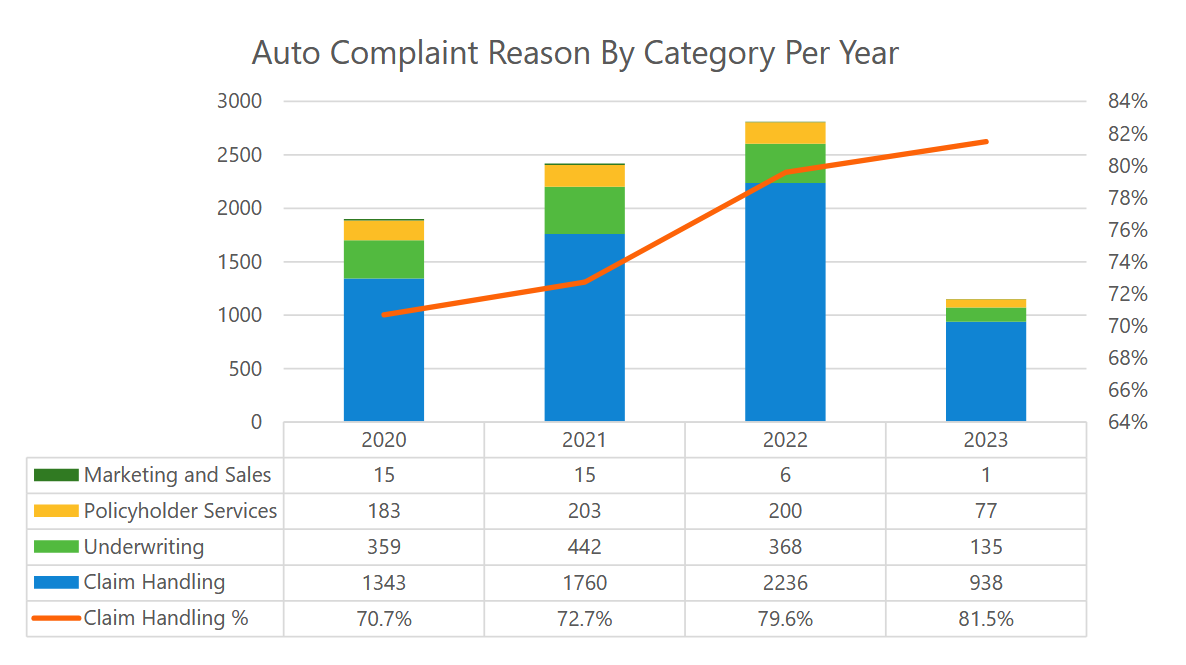

A workshop held Monday by the Washington State Workplace of the Insurance coverage Commissioner (OIC) shed some gentle on the state of the P&C trade in auto and residential insurance coverage declare experiences and complaints, which have seen a rise, largely in auto.

The OIC has reported a historic quantity of complaints since 2021 in line with its newest historic developments report.

The OIC’s Shopper Advocacy Program acquired 467 complaints in April 2023, up from the historic common of 287 a month, which was a 63% improve.

Collision restore commerce teams, insurer-member associations, appraisers, shopper advocates, and customers testified throughout the workshop.

OIC mentioned the paperwork filed as a part of the workshop file and testimonies throughout the workshop will “assist the OIC decide how you can transfer ahead in addressing the rising variety of auto and householders insurance coverage declare points.”

No questions have been answered by OIC or questions requested of people who testified. The OIC additionally made no feedback in response to the testimonies and shopper points that have been introduced up.

Kreidler began off the workshop by saying that he believes the insurance coverage trade is at all times appropriately in search of methods to enhance claims course of effectivity and accuracy.

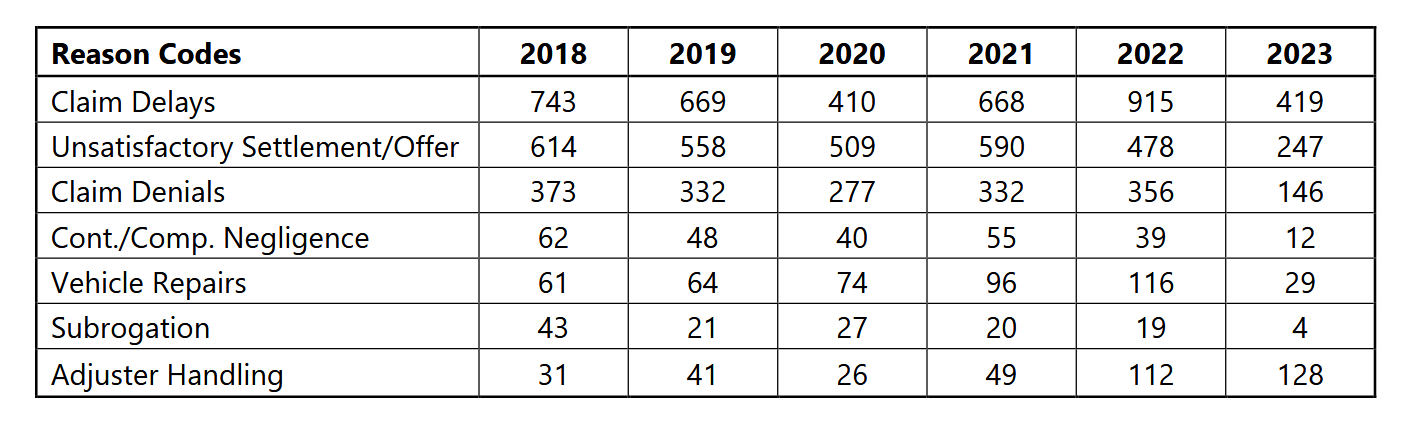

“When the method works, most customers are made entire,” he mentioned. “I consider now we have some severe points proper now. We’ve seen a 63% leap in complaints about claims points, on common… I do know provide chain points have brought on some restore delays however I’m particularly involved with the rise in customers with complaints in regards to the claims expertise that don’t contain provide chain issues.

“A few of the most regarding points we’re listening to contain the problem of using photograph that may produce little or no restore estimates. Precise human adjusters are usually not inspecting the injury and insurers are usually not totally explaining why they disagree with a shopper’s restore estimates.”

OIC mentioned it requested a number of insurance coverage firm distributors that develop and use photograph software program and synthetic intelligence (AI) to create restore estimates to take part within the workshop. None of them responded to the request.

Society of Collision Restore Specialists (SCRS) Government Director Aaron Schulenburg testified that the problems mentioned by the Washington OIC not solely affect collision restore outlets within the state however nationwide.

“Shoppers’ peace of thoughts via the promise of indemnification profit when customers select to not have a car repaired, when the patron in any other case turns into answerable for prices that ought to have been coated underneath a loss, and when shopper safety mechanisms are both weak or absent offering little or no recourse for people who the insurance policies have been supposed to guard.”

With the SCRS board seated round him, which incorporates collision restore store house owners and managers, Schulenburg added, “There’s not a enterprise right here who isn’t routinely requested to carry out repairs in a fashion that battle with their skilled experience and dedication to the car proprietor. There additionally isn’t a enterprise sitting round me as we speak who hasn’t had customers tackle these shortcomings via coverage protections, such because the appraisal clause.”

An appraisal clause might be included in insurance coverage insurance policies so policyholders can search out an unbiased appraisal after they don’t agree with what the provider provides, whether or not on complete loss or repairable autos. Each events rent an unbiased appraiser and if the appraisers can’t agree, an umpire is chosen to make the ultimate, binding resolution.

Appraisal clauses aren’t required in Washington insurance policies.

John Walker Jr., COO of MAS Options, an unbiased adjuster firm, mentioned the underlying difficulty of claims disputes comes right down to customers, public adjusters, carriers, and provider adjusters not being educated about insurance coverage insurance policies and claims processes. They know little or no about appraisal price that’s constructed into insurance policies, he mentioned.

“I’d be curious to see if the complaints got here earlier than or after they use this appraisal process that’s constructed into their coverage,” Walker mentioned, referring to the appraisal clause. “They knew this coverage, they knew that there can be disputes and there, there must be a easy solution to resolve it. That’s the place I’d advocate for training to assist the customers but in addition the appraisers and umpires which can be collaborating within the course of.”

That training must be provided via coaching by the state’s OIC, he added, “in order that we will all communicate the identical language” and “play by the identical guidelines.”

Testimonies given confirmed that taking part in truthful additionally comes right down to truthful cost, together with carriers paying outlets ample labor charges.

Erica Eversman, Nationwide Affiliation of Insurance coverage Commissioners (NAIC) shopper liaison and Automotive Training & Coverage Institute founder, testified that the labor charge surveys carriers use to find out how a lot they’ll pay for labor by geographic space aren’t correct.

First, she mentioned, survey respondents aren’t restricted to unbiased restore outlets. Direct restore program (DRP) outlets additionally conform to take the surveys. DRPs conform to abide by particular actions and limitations that carriers set.

“The surveys are routinely cited or talked about however perceive that there are only a few insurers who really have interaction in a survey of physique outlets to find out what the true market charges are for restore companies,” Eversman mentioned. “Insurers are inherently unreliable. Insurers don’t essentially at all times enable the entire physique outlets to take part [in the surveys].

“There’s additionally exercise that insurers have engaged in to cover the true quantity that they pay for labor charges and for procedures. This has occurred by offering lump sum quantities in a line merchandise moderately than really rising the labor charge subject when there was some concession by the insurer to actually improve that charge, or by together with a specific restore process on their very own estimates.”

Eversman added that she recommends outlets doc the entire restore procedures they do on every car whether or not they cost for it or not simply in case legal responsibility is ever questioned in any future collisions or issues with the vehicles.

“There’s an general failure by auto insurers to supply ample explanations to insureds and to 3rd events about what it’s that they’re paying for, what they’re not paying for, and the way they justify refusing to pay for any specific process or rising the labor charge,” she mentioned.

When talking on the inaccuracy of the surveys, she quoted Choose James G. Bertoli who dominated on two Sonoma Metropolis, California companion instances concerning labor charges (Wilkins v. Delross and Mason v. Ellis) in 2009.

“I strongly query the mental honesty of the labor market survey that’s completed by the insurance coverage corporations and their methodology,” Bertoli mentioned.

Since State Farm was a celebration to the case a part of what he mentioned was aimed straight at that exact provider: “If State Farm selected to find out their worth by studying hen entrails and – consulting with the three witches from McBeth (sic), that’s wonderful. I feel that’s nearly as correct because the survey itself is. I feel that survey from a statistical standpoint would get a first-year school scholar a flunking grade.”

Three insurance coverage provider associations — the Northwest Insurance coverage Council (NWIC), American Property Casualty Insurance coverage Affiliation (APCIA), and Nationwide Affiliation of Mutual Insurance coverage Firms (NAMIC) — mentioned they disagree with OIC’s developments report from the methodology to the outcomes and the workplace’s response.

NAMIC Regional Vice President Christian Rataj mentioned that whereas the affiliation agrees with the OIC that an rising variety of complaints is a crucial difficulty, he referred to as the conclusions made within the workplace’s report “misplaced, methodologically unfounded, and unsubstantiated by the information units,” noting that it was based mostly on a restricted knowledge set comparability.

“The variety of insurance coverage claims filed ought to naturally result in a rise in shopper complaints,” he mentioned. “Why hasn’t the OIC evaluated the historic proportion of shopper complaints submitted as in comparison with insurance coverage claims filed? We’re speaking a couple of very small historic pattern change; a fractional proportion level change for shopper complaints.”

Inhabitants development of 1 million throughout the knowledge set timeframe additionally contributed to a rise in complaints and a scarcity of sources, he added.

“One would naturally and fairly anticipate that because the inhabitants will increase and sources, particularly auto physique restore outlets, are actually challenged that this quantity would improve,” Rataj mentioned.

NWIC President Kenton Brine mentioned “practically the entire time” the council’s insurance coverage firm members in Washington are performing responsibly within the claims course of. The variety of complaints filed in Washington is often lower than 1% per yr, he mentioned.

“No matter having a low proportion of claims that end in complaints to the OIC and having an general declare satisfaction rating of 871 out of 1,000 from auto insurance coverage customers as measured by J.D. Energy & Associates in 2022, insurers are keenly conscious that these numbers imply nothing to an insured claimant whose auto restore is taking longer than they anticipated or who has not had a well timed response to their e-mail or a name from their claims adjuster as such,” Brine mentioned. “The OIC’s report is regarding to corporations that attempt to supply good service to their policyholders.”

The variety of claims is rising dramatically for a lot of insurers, notably auto insurance coverage claims, with one firm reporting a 44% improve in claims involving severe accidents between 2020 and 2022, he added. And, throughout the identical timeframe, the typical variety of labor hours in auto restore elevated by practically 4%, in line with Brine.

APCIA Vice President Mark Sektnan famous in his testimony that provide chain points and employee shortages brought on by the COVID-19 pandemic have led to longer auto restore instances.

“Insurers don’t profit from delays in getting their clients’ vehicles repaired,” he mentioned. “It’s in the perfect curiosity of the insurance coverage firm to make sure that their clients obtain a high quality restore as promptly as potential. The actual fact is a shopper could solely use that restore facility or house restore contractor as soon as however they’ll be reminded of that have each time they pay their insurance coverage premium.”

In Washington, APCIA member insurers are “seeing claims in opposition to restore outlets for negligence with provide chain points typically current stopping case decision,” Sektnan mentioned.

Mike Harber, a former store proprietor and present Harber Appraisal president, mentioned insurance coverage trade representatives deny there are issues in claims processing is nothing new — he’s been listening to the identical feedback from the trade for the final 10-15 years.

“I can inform you that the variety of those who we’re working with, it simply appears to be rising on a regular basis so there’s a downside and I feel we should always simply attempt to maintain it easy,” he mentioned. “If an insurance coverage firm decides that they don’t wish to deal with the declare or settle with a physique store, they’re abandoning autos. The investigation of claims is simply actually taken a again seat to essentially making an attempt to care for the insured or the claimants.

“Once we’re speaking in regards to the sophistication in these autos these days it’s a matter of life and dying, not just for the individual driving that car, that’s been improperly repaired however for the opposite folks which can be driving which have to look at that car coming in the direction of it.”

Photograph estimating

As a part of a survey by the Washington Impartial Collision Repairer’s Affiliation, 30 unbiased restore store respondents mentioned they see practically 1,300 photograph estimates each month and so they’re solely correct 2% of the time. Eighty % of respondents mentioned the photograph estimates they obtain are by no means correct.

The affiliation introduced the outcomes of the survey throughout the Washington OIC workshop.

Small damages have the best proportion of accuracy at 28% adopted by reasonable damages at 18.5%, and main damages at 14%, in line with the survey. And each month, on common, 319 clients drive autos in for repairs that outlets deem unsafe to function. “Unsafe” on this context means injury to the car construction, body, wheels, suspension, and/or collision power administration system and/or air bag or seat belt pre-tensioner deployment.

Respondents mentioned 93.4% of claims on autos at their outlets are settled solely based mostly on provider assessment of pictures. Greater than 63% of outlets mentioned they’re routinely informed by insurers that they will’t see within the pictures the injury that’s listed on restore invoices. And across the similar proportion of outlets mentioned insurers often deny their restore plans.

NWIC didn’t deny the accuracy of photograph estimates.

“Many insurers have turned to using estimating apps that enable the claimant to take and submit pictures of auto injury and file their claims on-line however as famous within the OIC report, estimating apps are new and should have restricted capacity to precisely estimate wanted pairs as a result of the pictures submitted by claimants could not reveal the complete extent of injury,” Brine mentioned.

In distinction, APCIA’s Sektnan mentioned “an estimate is simply that — an estimate of the price of restore based mostly on what the estimator can see on the time of the inspection.”

“There appears to be heightened scrutiny of digital estimating instruments and different types of expertise which can be used to hurry up the inspection course of,” he mentioned. “Some blame the rise in use of those instruments for the rise in dietary supplements… No estimator, whether or not the inspection is finished utilizing video or pictures, or in individual, goes to have the ability to detect hidden injury that may solely be discovered when the car is disassembled or torn down previous to restore.

“One member firm mentioned that the proportion of partial loss claims cost captured on an unique estimate was about 75% three years in the past. However now, that quantity is nearer to 60. This isn’t as a consequence of elevated use of photograph estimates. Reasonably, it’s pushed by a rise within the complexity of auto repairs.”

Shoppers, together with store house owners, that spoke throughout public remark about their dealings with auto insurers informed OIC they assume particular person value determinations must be checked out to raised gauge how insurance coverage appraisers are undervaluing broken autos and restore prices; the workplace is ignoring unhealthy religion actions by insurers and never finishing up its enforcement rights underneath state legislation, and that carriers must be investigated for the “mind-boggling issues they’ve completed” in dealing with claims and transferring via litigated claims.

Written public feedback will probably be accepted by OIC on-line till Aug. 15.

Pictures

Featured picture credit score: rarrarorro/iStock

Share This: