In relation to remodeling enterprise operations, synthetic intelligence holds lots of promise throughout many industries. Immediately, a startup that has been an early mover within the space of making use of AI, and particularly pc imaginative and prescient, to the world of insurance coverage is saying a spherical of progress funding to proceed increasing its enterprise. Tractable — which has constructed pc imaginative and prescient and associated AI to hold out distant assessments of injury to property and automobiles — has picked up an additional $65 million in funding.

SoftBank Imaginative and prescient Fund 2 is main this spherical, a Collection E, with earlier backers Perception Companions and Georgian additionally collaborating.

Tractable presently processes some $7 billion in claims yearly by its platform, partnering with insurance coverage giants like Aviva, Geico and Admiral and others. It will likely be utilizing the funding each to proceed rising that current enterprise; but additionally to speculate deeper into one in all its greatest markets, Japan; and to include extra of the newest advances in AI to broaden its companies from insurance coverage assessments into repairs, upkeep and gross sales of the gadgets it scans.

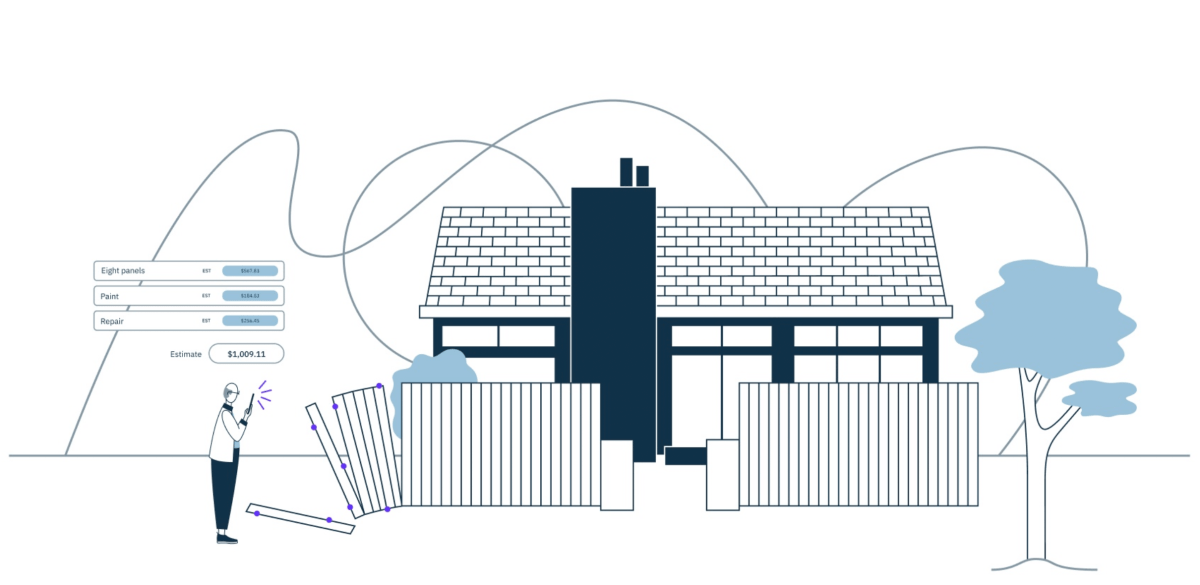

“Breakthroughs in generative visible AI will permit us to generate artificial visible information that may speed up the AI suggestions loop when customers level out enchancment areas for our AI,” CEO and founder Alex Dalyac stated in an interview over e-mail. “Breakthroughs in Massive Language Fashions, conversational AI and multi-modal AI open up the likelihood for an professional AI that may not solely assess your automotive and residential, but additionally converse and advise you on one of the simplest ways to restore, defend or promote your two most respected property.”

He additionally added that property value determinations for pure catastrophe restoration have “taken off in Japan,” with 10x year-on-year quantity progress anticipated this 12 months, together with 10x year-on-year quantity progress in its automotive aftermarket vertical — which is the place components distributors and repairers are utilizing Tractable to hurry up processes “as a result of pandemic recovery-induced labor and components shortages.”

All of that diversification couldn’t come sooner. Within the years because it’s launched, a variety of rivals and alternate options have emerged to offer customers and insurance coverage adjusters with instruments to facilitate distant assessments. Uveye, ProovStation, Ravin, Claims Genius, Innovation Group, and lots of others construct expertise to evaluate automobiles and extra.

When Tractable final raised cash — $60 million the heady days of mid-2021 — it did so at a valuation of $1 billion.

Immediately, nevertheless, Dalyac wouldn’t affirm what the corporate’s present valuation is, declaring that though there has certainly been a pull again from late-stage progress rounds (thereby giving extra bargaining energy to traders), “there has additionally been a significant acceleration of VC funding in AI,” (thereby making a extra aggressive course of which may assist preserve valuations sturdy).

SoftBank is value noting as a lead investor for a few causes. The corporate has been considerably much less energetic in VC within the final 18 months, following a very tumultuous interval through which lots of its earlier investments — made at excessive valuations and at a really speedy tempo — led to main write-downs for the agency. (Its most up-to-date annual outcomes, two months in the past in Might, confirmed an eye-watering lack of $32 billion on these valuation write-downs.) Unsurprisingly, its title has been arising a loss much less incessantly — making its look right here at the moment all of the extra fascinating.

“We’re excited to work with Alex, Razvan and group, who’ve been the forerunners of making use of AI pc imaginative and prescient to carry effectivity into the insurance coverage claims administration course of by way of making use of AI pc imaginative and prescient,” stated Nahoko Hoshino, Funding Director, for SoftBank Funding Advisers, in a press release. “As robust believers in AI expertise, we see enormous potential for the expertise to scale globally, embedding AI adoption into different verticals by exploring new use circumstances. Tractable already has robust traction in auto, whereas property is the thrilling new alternative that’s ripe for disruption.”

Trying forward, its curiosity in Tractable seems to be grounded in just a little extra practicality than maybe a few of these previous investments. Japan is a giant marketplace for insurance coverage — each automotive and property — with a really digital-first shopper base smitten by all issues AI and robotics. All that, coupled with the actual fact of what Dalyac described as “a urgent must automate within the face of a shrinking and growing old inhabitants,” made Japan into Tractable’s greatest market — a title that it now shares with the U.S., Dalyac stated.

This deal due to this fact “opens up strategic alternatives for collaboration with SoftBank,” he stated. “There isn’t any doubt that SoftBank’s relationships can assist Tractable additional its attain into the complexities of Japan’s enterprise ecosystem. Now that the funding has come collectively, we will begin exploring strategic business alternatives.”

As for what these alternatives is likely to be, the nation stays the world’s largest automotive producer, and it feels like Dalyac sees a chance to combine Tractable earlier into the material of automobiles and throughout extra of their lifecycle, not simply showing on an app when there’s been an accident to evaluate damages.

“Tractable’s expertise might be leveraged to restore, defend and recycle automobiles with higher pace and accuracy,” he stated. “Injury and restore analytics may also function manufacturing high quality suggestions insights from the street.”

The corporate stays unprofitable, Dalyac stated, however he’s additionally frank in describing why that’s the case for Tractable, and so many others:

“Resulting from 10 years of low rates of interest and an enormous provide of VC, VC-backed firm operators have been instructed for the final 10 years to give attention to progress regardless of losses. Maybe partially as a result of losses require extra VC injection? This has inspired a tradition of traders, operators and staff viewing profitability as nothing however a nuisance, ideally averted.

“Now that profitability is all of a sudden a should, the transition might be brutal. Price slicing is unpopular, might be very disruptive to these affected, and requires abdomen to bear,” he continued. “But it surely does really feel just like the tech sector has entered a ‘sink or swim’ interval. The rate of interest setting is absolutely testing the VC-backed sector’s skill to be worthwhile.” He stated that revenue is the “strategic aim in the direction of which we now have made substantial progress.” And given the SaaS margins of the enterprise remaining robust, he stated Tractable is “practically there on EBITDA breakeven.”