Years in the past, it could have been arduous to think about a time when robots may have nine-to-five jobs and deal with family chores, drivers may subscribe to luxurious car options like heated seats and massive infrastructure initiatives would change into widespread throughout the nation.

Remarkably, these aren’t future endeavors — they’re taking place right this moment. And so they symbolize three rising dangers insurers ought to maintain observe of as they proceed to develop.

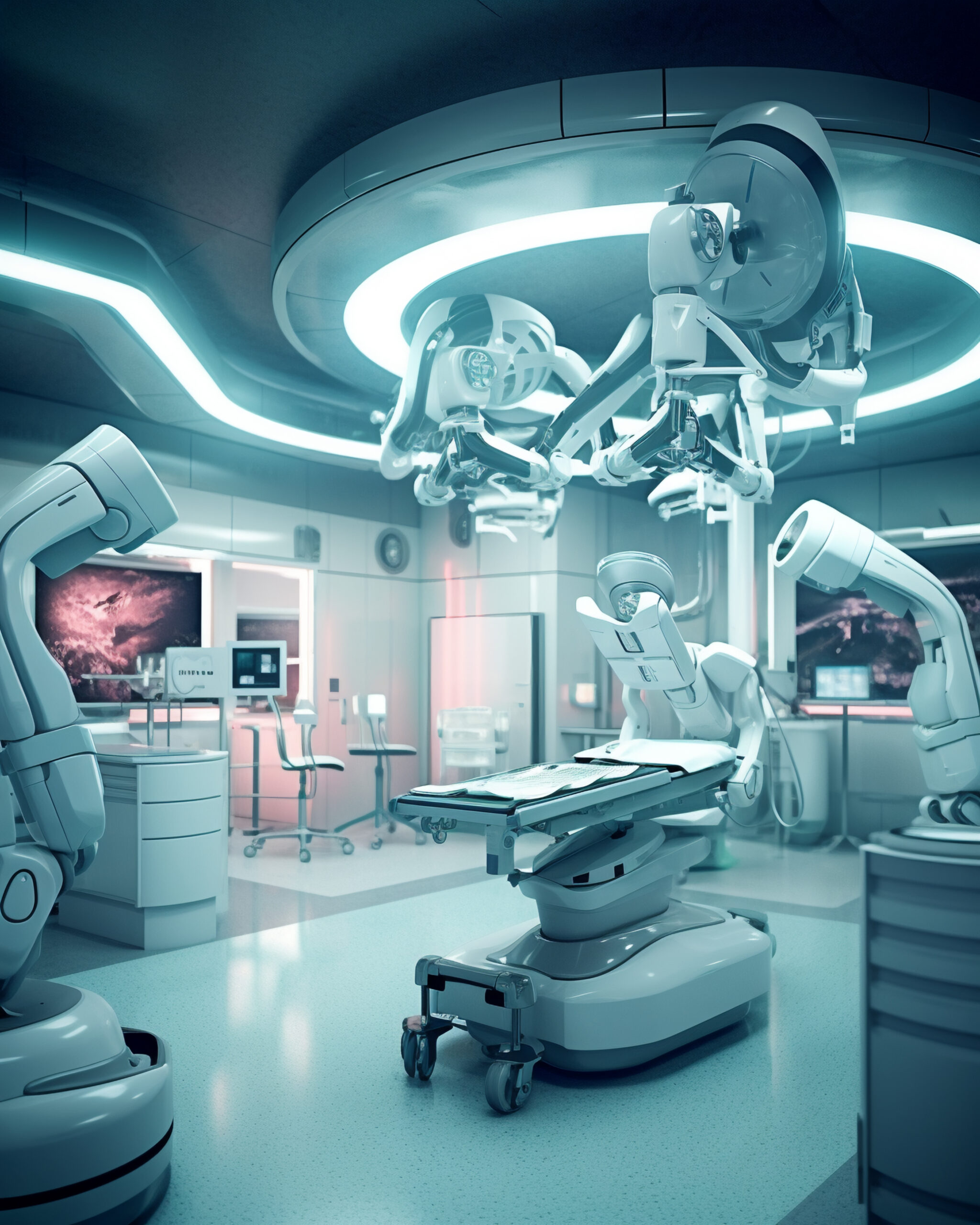

The Rise of Robots Raises Myriad Dangers

Robots have sparked the human creativeness for effectively over a century, however the very first robots may arguably be traced again to 1500 B.C.E., when Egyptians constructed water clocks with human collectible figurines to strike the hour bells. People have been devising ever-more bold and artistic methods to outsource their labor to machines ever since.

Industrial robots have been built-in into industries reminiscent of manufacturing, legislation enforcement, healthcare, warehouses, agriculture, automotive and extra. At the moment, an estimated 3.4 million industrial robots are working globally. By one account, gross sales of commercial robots reached an all-time excessive in 2021, with total market penetration doubling up to now six years.

Whereas robotic staff could assist improve security and productiveness, they don’t seem to be fully with out dangers. Potential points embrace distraction to human staff, surgical errors, cyber information breaches and property injury from a robotic in movement.

As the usage of robots grows, the potential for robotic-related claims involving bodily harm, property injury and monetary loss could rise as effectively, presenting insurers with the doubtless thorny complexity of figuring out the reason for a robot-related accident.

Robotic considerations might also lengthen to householders insurers, as effectively. At the moment, customers can purchase a robotic to hoover or mop their ground, mow the garden, clear a pool or wash out gutters. As dwelling robots develop in sophistication and recognition, the proliferation of those units could increase some considerations amongst householders insurers.

Researchers have demonstrated that some smaller family robots will be remotely commandeered and piloted round a house, snap photographs or be loaded with malware. And if lithium-ion batteries energy the robots, they might probably pose a hearth threat.

Will Infrastructure Spend Result in Extra Shortages and Inflation?

The latest manufacturing and re-shoring increase within the U.S., the place firms want to deliver provide chains nearer to dwelling, is creating potential alternatives for brand spanking new enterprise but additionally is elevating considerations amongst some insurers about provide chain strains and inflationary pressures.

As a part of the 2021 Bipartisan Infrastructure Act, the U.S. plans to speculate $550 billion in a variety of infrastructure initiatives — from decreasing PFAS contamination within the nation’s consuming water to fortifying growing older bridges, dams, ports and different buildings in opposition to the ravages of age and the weather.

The advantages of those initiatives for insurers embrace potential new enterprise alternatives in sectors reminiscent of transportation, manufacturing, vitality, electrical car charging and building. In the meantime, infrastructure investments that improve the nation’s skill to mitigate, reply, and rebuild following catastrophes (be they pure or cyber-related) could assist scale back the severity of those occasions and decrease the downtime companies and people expertise consequently.

On the draw back, as we discovered in the course of the pandemic, a increase in building (on this case, residential) strained provide chains for supplies reminiscent of lumber and drove reconstruction prices skyward.Excessive demand might also typically result in elevated inflation within the impacted industries. Demand for building staff, who’re reportedly already briefly provide, could additional exceed provide, resulting in potential delays in initiatives and property reconstruction after loss occasions.

Automobile Subscription Options

As of late it could really feel to some those that all the things is a subscription-based service, so it’s maybe no shock to study that even some automakers have begun placing a number of car options, reminiscent of heated seats, behind a subscription paywall.

Whereas the transfer could yield extra income for automakers, car subscriptions may complicate issues for insurers. Think about: Even when an proprietor doesn’t decide to pay for a given function, the {hardware} will possible should be included within the car, which can improve the general price of recent automobiles. This, in flip, may probably result in increased premiums and probably elevated prices for repairs (and thus insurance coverage claims) for options that the proprietor could not use and even have had entry to on the time of the accident.

Whereas this may increasingly sound comparatively innocuous for one thing like heated seats, it may trigger potential points for a subscription-based car security function. Insurance coverage firms could supply reductions for sure security options which can be both included or will be added on to automobiles at buy. However what occurs if a few of these security options are paywalled behind a subscription bundle that the insured both doesn’t buy or just chooses to not renew in the course of the coverage interval? Might this result in an insured’s premium reflecting a security function of their car that won’t truly be lively ought to there be a crash?

Subscription providers might also present a brand new outlet for hackers to use — the extra software-enabled options, the broader the potential assault floor for cybercriminals.

Whether or not it’s robots dealing with family chores, luxurious car options or an inflow of electrical car charging stations, our world is quickly altering. How insurers value and handle threat should shortly change with it to maintain tempo.

Subjects

Tendencies

Auto