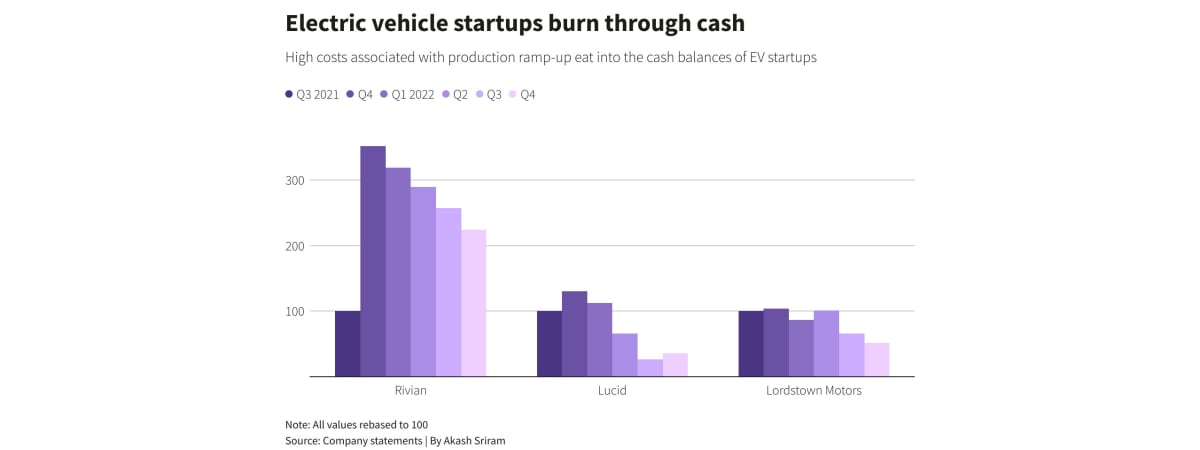

U.S. electric-vehicle startups are anticipated to report one other quarter of dwindling money reserves subsequent week, piling strain on a gaggle of firms which might be struggling to ramp up manufacturing and have few choices for funding in a turbulent economic system.

Having gone public with hopes of shaking up the auto business, these firms have seen their market valuations evaporate prior to now few months as EV demand slows and market chief Tesla Inc cuts costs to stoke orders.

Lucid Group kicks off first-quarter earnings for the group on Monday, with the corporate anticipated to report a 36% sequential slide in money reserves, in line with Seen Alpha.

Rivian Automotive, in the meantime, will probably report on Tuesday that its money steadiness fell by 6.8% to $10.78 billion from the previous quarter, per a Seen Alpha estimate.

The Amazon.com Inc-backed agency, whose shares have declined by almost 1 / 4 this yr, can be anticipated to report a bigger lack of $1.75 billion as each deliveries and manufacturing fell within the interval. It posted a $1.59 billion loss a yr in the past.

Fisker Inc and Nikola, each of which report earnings on Tuesday, are anticipated to see their money reserves decline by 5% and 15%, respectively, in line with Seen Alpha.

“Any firm that is shedding cash with a low valuation is toast and EVs are not any exception. I feel it’s only a sluggish bleed. Perhaps they will get fortunate and a few of their applied sciences possibly purchased by larger gamers,” mentioned Thomas Hayes, chairman of hedge fund Nice Hill Capital.

A drop in valuations of firms has rendered promoting fairness for treasured money extra ineffective and buyers have gotten more and more sad with their stake being diluted as a number of startups are but to acknowledge income from operations.

British EV startup Arrival SA and Nikola have issued going-concern warnings prior to now few months, with the previous set to merge with blank-check agency Kensington Capital Acquisition Corp in a bid to boost money.

Lordstown Motors mentioned this week it may very well be compelled to file for chapter on account of uncertainty over a funding cope with main shareholder Foxconn. Its earnings in an unscheduled launch on Thursday confirmed Lordstown’s money steadiness fell 11% sequentially.

A number of the firms together with Lucid and Rivian have additionally mentioned they might not present knowledge on reservation numbers going ahead, sparking some concern amongst buyers.

It’s a “disturbing growth,” CFRA Analysis analyst Garrett Nelson mentioned. “What we have seen is a development of much less transparency within the reservation depend, however general competitors is a giant drawback,” he added.