Ten years in the past, on April 15, 2013, two brothers positioned strain cooker bombs close to the end line of the Boston Marathon. The units detonated inside seconds of one another, killing three folks, injuring greater than 260 others, and inflicting property injury within the adjoining space.

Over the following few days police undertook a hunt for the bombing suspects in Boston and close by suburbs. Gov. Deval Patrick requested all residents within the space shelter in place and suspended public transportation.

Throughout the police chase, the bombers killed a police officer.

One of many suspects, the older brother, Tamerlan Tsarnaev, was shot and killed. A day later, police captured the second brother, Dzhokhar Tsarnaev, in Watertown. He was later convicted and stays in jail interesting his loss of life sentence.

The hunt for the suspects precipitated some extra property injury within the metro areas.

The ensuing property injury raised the chance that the federal Terrorism Danger Insurance coverage Act (TRIA) can be triggered for the primary time. Below this system, the federal government shares the prices of some property/casualty claims attributable to terrorist acts.

Below TRIA, an occasion just isn’t thought-about a terrorist act until the U.S. Treasury, the Secretary of State and U.S. Legal professional Normal all certify it as an act of terrorism. The act should endanger life and property and have been taken to affect the general public or authorities coverage. Additionally, TRIA is barely activated if there’s at the least $5 million of mixture property and casualty losses.

TRIA applies to business property/casualty claims solely; private traces, medical insurance and life insurance coverage are usually not a part of TRIA.

TRIA was not triggered as a result of the Treasury by no means licensed the Marathon bombing as a terrorist occasion. The business and public by no means realized why the Marathon bombing was not instantly licensed as a terrorist occasion. Because it turned out, at the least one of many standards required by TRIA — that P/C losses complete greater than $5 million— was by no means reached.

Insureds and personal P/C insurers had been on their very own to settle claims.

Certification might have triggered terrorism exclusions which are discovered in lots of business insurance coverage insurance policies. Companies with these insurance policies would have wanted separate terrorism protection to fill the hole, which not many had. Whereas TRIA requires insurers to make terrorism protection on sure traces of property/casualty insurance coverage (corresponding to fireplace, staff’ compensation, and legal responsibility) out there to companies, TRIA doesn’t require them to purchase it.

9 months after the assault, the Massachusetts Division of Insurance coverage (DOI), headed then by Insurance coverage Commissioner Joseph Murphy, collected information from chosen property/casualty insurance coverage firms (prime 25 insurers and the residual market insurer Massachusetts FAIR Plan) and offered some perception into how insureds and their insurers made out.

In an Insurance coverage Journal interview in April 2014, Murphy stated his division was not conscious of any terrorism exclusions impacting coverages, “however hopefully one of many takeaways shall be that companies will understand that the specter of terrorism can happen.”

The information name confirmed that among the many 160 business property and enterprise interruption claims, simply 13.5% had separate terrorism protection. No residential property claims had separate terrorism protection. Not one of the business property, enterprise interruption and residential property claims had been impacted by a terrorism exclusion.

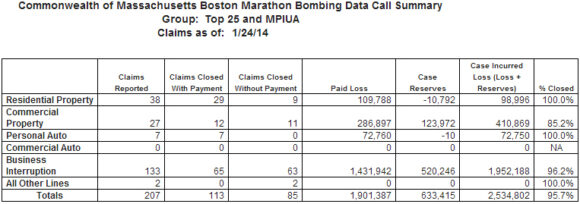

The DOI information name as of January 24, 2014 revealed that:

- Well being, property/casualty and staff’ compensation firms mixed had been projected to pay $24.9 million for medical claims and property injury claims related to the bombings.

- The insurance coverage firms had dealt with 207 bombing-related claims.

- Whole property/casualty losses (plus case reserves) totaled roughly $2.5 million. The common property/casualty declare measurement was $9,185.

- 100% of 45 residential property and private auto claims had been resolved; 36 with funds and 9 with out funds. Insurance coverage firms paid greater than $182,000 for injury to non-public cars, properties, and related private property. The common declare measurement for residential property and private cars was $2,889 and $10,394 respectively.

- Virtually 94% of the 160 business property and enterprise interruption claims had been resolved; with 12 of 27 property claims ending in funds and solely 65 of 133 enterprise interruption claims closed with funds. Insurance coverage firms paid about $2 million for injury to business property and enterprise interruption.

- 5 individuals had staff’ compensation prices projected to be lower than $200,000.

- There have been 1,702 individuals with projected well being care prices of roughly $22.8 million. The health-related claims had been anticipated stay open.

- The DOI didn’t take into account life insurance coverage claims which could have been made on behalf of the 4 people who had been killed.

Partially due to their expertise after the Boston Marathon, some within the insurance coverage business have expressed concern concerning the Treasury’s course of for certifying a terrorist act below TRIA.

Some business stakeholders maintained that the Boston Marathon bombing raised questions concerning the certification course of as a result of they considered the occasion as a transparent terrorist assault. It was unclear whether or not the occasion was not licensed as a result of it didn’t attain the financial loss threshold for certification, which was unknown on the time, or as a result of it didn’t meet TRIA’s non-monetary requirement for establishing intent.

Danger managers urged the federal authorities to set a deadline for certifying if an occasion is an act of terrorism and likewise urged Treasury to make use of insurers’ figures for estimating losses to hurry up the decision-making.

The chance managers’ group RIMS maintained that the uncertainty surrounding whether or not the assault can be licensed left many policyholders in limbo. “People who had chosen to buy terrorism protection had been unable to have claims paid below that protection as insurance policies usually required the act to be licensed,” RIMS wrote to policymakers in 2015. “Likewise, these enterprise house owners who had chosen to forego terrorism insurance coverage had been susceptible to having claims denied if the act was licensed as acts of terrorism are usually excluded from commonplace property and casualty insurance policies.”

Boston Bombing Lesson: Danger Managers Urge Higher ‘Terror Act’ Certification

Treasury carried out inner critiques after the Boston Marathon bombing in 2013, however didn’t publicly talk that it was wanting into the occasion or that it had determined to not formally evaluate the occasion for certification. In its final public assertion in September 2014, a U.S. Treasury spokesperson stated, “The Secretary has not decided that there was an ‘act of terrorism’ below the Terrorism Danger Insurance coverage Act.”

Treasury finally didn’t certify the occasion as a result of insured losses totaled below the $5 million certification threshold.

Treasury’s procedures for certifying an occasion don’t embody public communication of its inner evaluate part, a 2020 Normal Accountability Workplace (GAO) report confirmed.

Companies, Insurers Tangle Over Boston Marathon Loss Payouts

Business stakeholders instructed GAO that they had been unsure concerning the size of time Treasury would take after future occasions to speak that it was contemplating certification. They want improved communication from Treasury after an occasion to assist present certainty in paying policyholder claims and receiving reinsurance funds.

Treasury officers have acknowledged their procedures and the considerations, however, in line with the 2022 annual report on TRIA by the Federal Insurance coverage Workplace inside Treasury, they like to take care of flexibility in how they reply to such occasions provided that circumstances can fluctuate extensively.

Photograph: This picture offered by the Maine Forest Service reveals a number of locomotives and rail vehicles burning after a freight prepare derailed, Saturday, April 15, 2023, in Sandwich Academy Grant Township, close to Rockwood, Maine. Three staff had been handled and launched from a hospital, and Canadian Pacific Railway shall be main the cleanup and observe restore, in line with officers. (Maine Forest Service through AP)

Subjects

Claims