New Delhi: Vitesco Applied sciences, a number one worldwide provider of contemporary drive techniques for sustainable mobility, elevated its gross sales in 2022 to EUR 9.07 billion (2021: EUR 8.35 billion; market consensus: EUR 9.08 billion). The corporate revealed its steering, starting from EUR 9.0 billion to EUR 9.2 billion. Adjusted for modifications within the scope of consolidation and alternate charge results, gross sales rose by 4%. Its core enterprise achieved an natural development charge of 9.2%, in contrast with an total market development charge of 6.2%, the corporate stated in its preliminary outcomes for 2022.

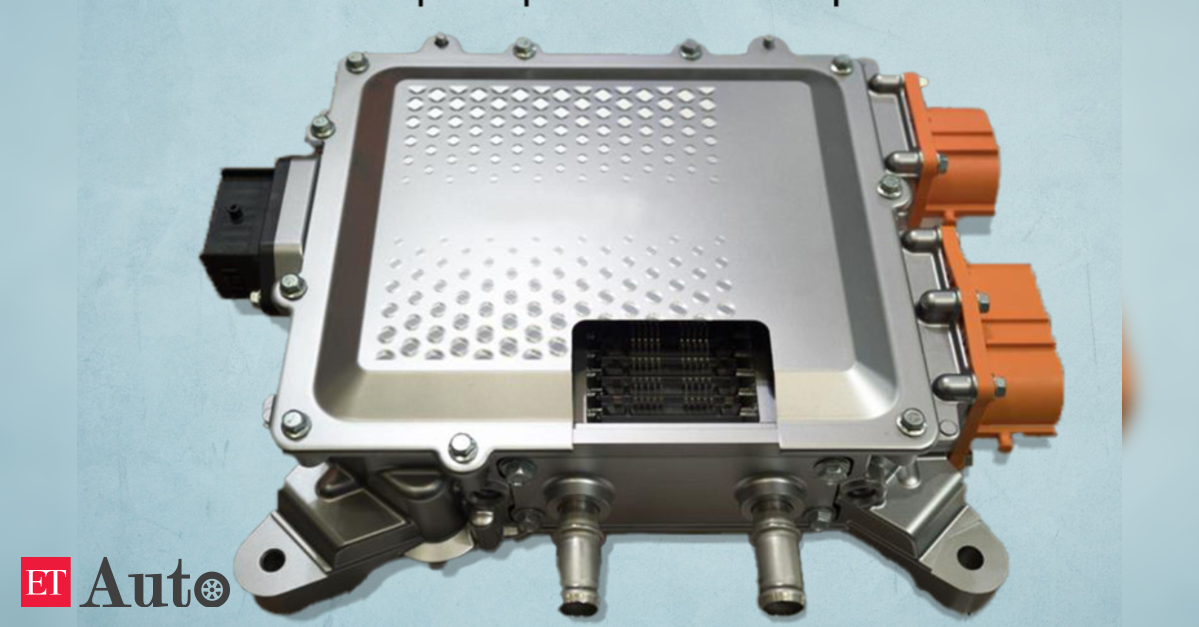

Vitesco Applied sciences generated gross sales of round EUR 1.1 billion from electrification parts in 2022. The core companies of all three enterprise models contributed to this outcome, with the Electrification Know-how enterprise unit registering the strongest proportion development in gross sales of 17.9% from EUR 587.1 million in 2021 to EUR 691.9 million in fiscal yr 2022.

Adjusted EBIT rose to EUR 222.9 million revealed its preliminary outcomes for 2022.

“We glance again on a profitable yr, regardless of the historic challenges akin to Russia’s struggle of aggression in Ukraine and ongoing disruption to produce chains,” Chief Govt Officer Andreas Wolf stated.

(2021: EUR 148.5 million; market consensus: EUR 213 million). The corporate’s adjusted EBIT margin of two.5% (2021: 1.8%) was on the higher finish of its forecast vary of two.3% to 2.5% and exceeded expectations (market consensus: 2.3percentt).

On account of reporting date associated results, the free money circulation for the fiscal yr 2022 got here to EUR 123.2 million (2021: EUR 113.3 million). This exceeded Vitesco Applied sciences’ personal forecast of greater than EUR million in addition to the market consensus of €68 million.

Free money circulation included a money outflow of EUR 446.6 million (2021: EUR 441.3 million) for capital expenditure on property, plant, and gear and software program (with out consideration for right-of-use property in accordance with IFRS 16). As a proportion of gross sales, the capital expenditures ratio is at 4.9% (2021: 5.3%).

In 2022, Vitesco Applied sciences obtained new orders totaling round EUR 14 billion (2021: EUR 11.2 billion). Roughly EUR 10.4 billion of the order consumption was attributable to parts for electrified automobiles (2021: EUR 5.1 billion). “This implies round 75% of our orders have been associated to e-mobility. That may be a file for the corporate. The amount of recent orders we obtained all over the world reveals as soon as once more that the OEMs have now absolutely embraced the electrification pattern,” Wolf stated.

With an fairness ratio of 40.3% as of December 31, 2022 (December 31, 2021: 36.3 %), Vitesco Applied sciences’ stability sheet stays exceptionally strong. The corporate reported web liquidity of EUR 333.4 million as of December 31, 2022 (December 31, 2021: EUR 345.1 million).

Chief Monetary Officer Werner Volz expressed his satisfaction with this efficiency in view of the troublesome market situations. He stated, “Regardless of the headwinds, we have been in a position to absolutely meet our forecast for 2022 in all key monetary indicators, and even exceed it in some areas. This provides us an extra enhance in our transformation towards e-mobility.”

Additionally Learn: