New Delhi: Sona BLW Precision Forgings Ltd. (Sona Comstar), a number one automotive know-how firm offering mission-critical techniques and parts for electrified and non-electrified powertrain segments, immediately introduced its monetary outcomes for the quarter and nine-months ended December 31, 2022.

In Q3 FY23, Sona Comstar posted a income of INR 685 crore with 39% YoY progress. Battery Electrical Autos (BEV) accounted for 26% of income, with a 29% year-on-year improve in income. EBITDA of Rs. 186 crores with a margin of 27.2% and 43% YoY progress. PAT of Rs. 107 crores with a internet revenue margin of 15.6% and 45% YoY progress. The online order ebook elevated to INR 23,800 crores from Rs. 20,500 crores as of September 30, 2022.

Within the first 9 month of FY23, Sona Comstar posted a income of INR 1,932 crores, up 22% 12 months on 12 months. 25% income share is from battery electrical autos (BEV), with BEV income progress of 31% YoY. EBITDA of INR 494 crores with an EBITDA margin of 25.6% and 17% YoY progress. PAT of INR 276 crores with a internet revenue margin of 14.3% and 18% YoY progress. The online order ebook elevated to INR 23,800 crores from INR 18,600 crores as of March thirty first, 2022.

Commenting on the efficiency, Vivek Vikram Singh, MD and Group CEO, mentioned, “We delivered our highest quarterly income, EBITDA, and internet revenue in Q3 FY23. Our income grew 39% 12 months over 12 months within the final quarter, pushed by the scale-up of income from new packages. Our BEV income was increased by 29% y-o-y, representing 26% of total revenues.”

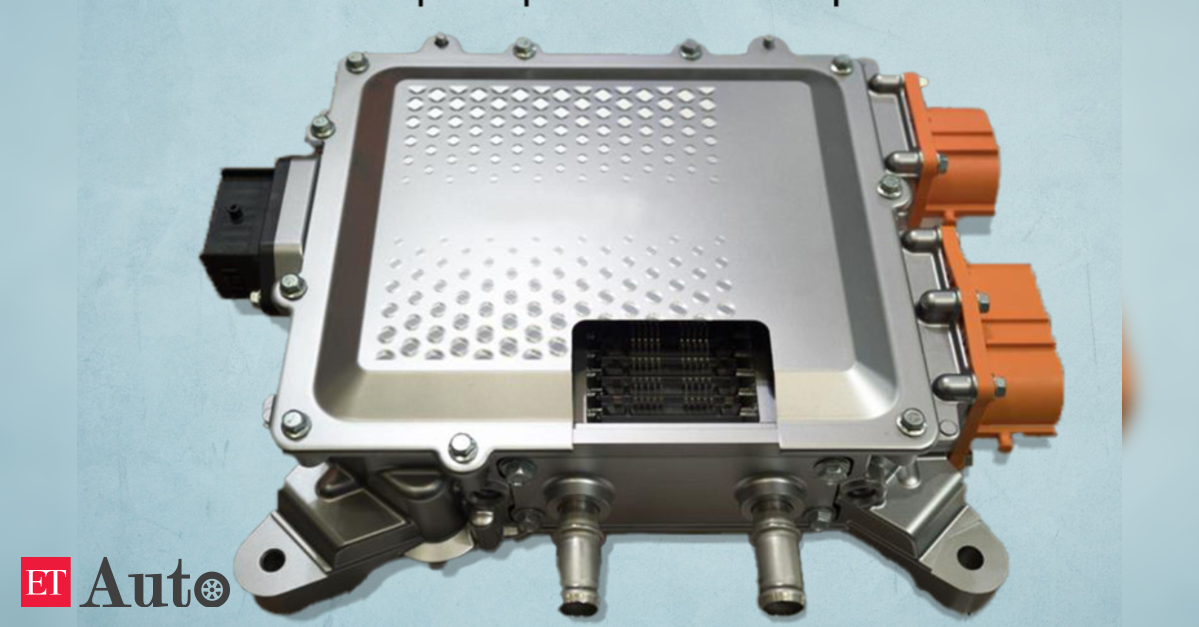

He added, “Regardless of the continued excessive metal costs, the EBITDA margin improved by 80 foundation factors 12 months over 12 months to 27.2%, driving EBITDA progress of 43% and PAT progress of 45%. We proceed to make progress on all our key strategic priorities. We received the most important single new order in our historical past, an EV driveline program, which is an enormous step ahead for us in each enterprise improvement and know-how, as it is a new product referred to as an Digital Differential Lock (EDL). This win demonstrates our potential to maintain including new, higher-value merchandise for our clients. We additionally made our first acquisition since 2019, and with NOVELIC, we have now added a 3rd pillar of sensors and software program to our enterprise.”

Operational Highlights: Q3 FY23 and 9M FY23

A world EV OEM has awarded the corporate a brand new program to provide digital differential lock (EDL) for his or her upcoming BEV mannequin. This program has added INR 3,350 crores to our order ebook and is the only largest new order win in our firm’s historical past. This system’s begin of manufacturing is in H2 FY24.

The corporate has been awarded a brand new program for a US-European OEM of PVs and EVs to provide differential assemblies for his or her upcoming BEV mannequin. This program has added INR 360 crore to our order ebook. This system’s begin of manufacturing is in H2 FY24.

Additionally Learn: