As cooling inflation provides shoppers much-needed reduction, many automotive house owners are in for a impolite awakening when insurance coverage renewal arrives this yr, a brand new report discovered.

Automobile insurance coverage charges are anticipated to extend by 8.4% throughout the U.S. in 2023, the most important price enhance in six years, in line with the report from analysis agency ValuePenguin.

The typical price of full protection automotive insurance coverage is predicted to be $1,780 per yr, however charges will differ dramatically between states, the report discovered.

In Michigan, the state with the very best common value, automotive insurance coverage will price $4,788 a yr. In Vermont, the state with the bottom common value, automotive insurance coverage will price $1,104, the report mentioned.

Automobile house owners in 45 states will see their charges enhance by no less than 1%, with charges leaping essentially the most in Illinois, Arizona and New Hampshire, the report mentioned. The states that may expertise a price enhance under 1% embrace California, Hawaii, Vermont and Wyoming.

Automobile insurance coverage firms Geico, Progressive and State Farm didn’t instantly reply to a request for remark.

The numerous nationwide value leap owes to a return to driving patterns resembling pre-pandemic life, as many employees come again to workplaces and households resume journey, mentioned Divya Sangam, an insurance coverage spokesperson at LendingTree, the mother or father firm of Worth Penguin.

“When extra individuals are driving, you may have extra accidents and a better quantity of claims and that raises insurance coverage charges,” Sangam advised ABC Information.

The impact of an elevated quantity of claims has been exacerbated by the heightened price of automotive repairs since a provide chain bottleneck continues to boost the price of auto elements. A employee scarcity provides labor prices too, Cate Deventer, an insurance coverage author and editor at Bankrate, advised ABC Information.

In the meantime, an uptick in medical prices has heightened the quantity that insurance coverage firms pay to cowl accident-related accidents, she added.

“Inflation is hitting the whole lot throughout the board,” Deventer mentioned. “It drives up the price of claims.”

New vans are seen at a dealership, Sept. 23, 2022 in Lengthy Seashore, Calif.

Eric Thayer/Getty Pictures, FILE

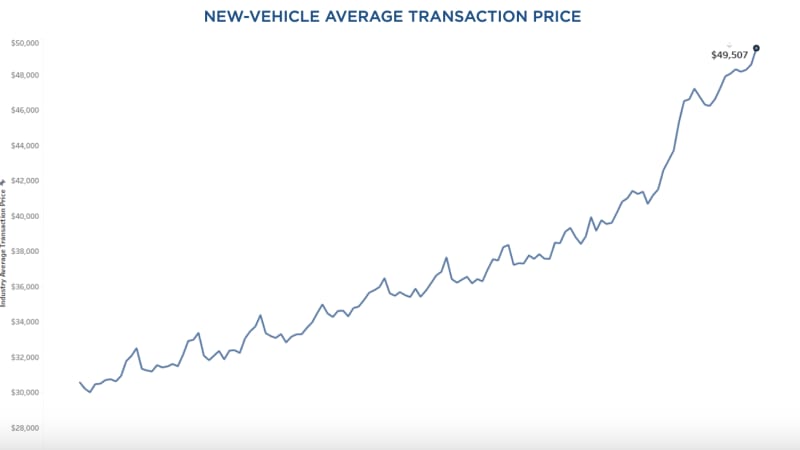

The value of a brand new automotive has surged almost 8% over the previous yr, whereas the price of tires and auto elements have jumped greater than 10%, authorities information reveals.

The pandemic-related value pressures tied to pent up demand and provide shortages arrive roughly three years after the outbreak of the coronavirus. The typical automotive insurance coverage price jumped only one.3% final yr, the report discovered.

“We have been shocked that it took so lengthy for premiums to extend,” Sangam mentioned. “This has been a bit of overdue.”

The prevalence of maximum climate occasions makes up one other key driver of the insurance coverage value enhance, Sangam mentioned.

“With local weather change, the largest story tends to be round houses getting destroyed,” she mentioned. “However in actuality, when there’s an enormous flood, like in California proper now, automobiles get destroyed. And with climate harm, we’re speaking about automobiles getting totaled.”

The rise of electrical autos has additionally contributed to the worth spike, since insurance coverage prices complete about 28% extra for electrical autos than gas-powered ones, the report mentioned.

The monetary ache for automotive house owners will possible show non permanent, Sangam mentioned, predicting that the worth will increase would gradual within the coming years as inflation softens additional and the price of automotive elements declines.

“It’s not going to rise on the identical clip because it has this yr,” she mentioned.

Deventer cautioned {that a} slowdown in price will increase subsequent yr will depend upon the easing of provide chain bottlenecks and an extra cooling of inflation.

“It’s onerous to say as a result of we don’t know what’s going to occur with the financial system,” she mentioned.