Aditya Birla Capital Ltd., managed by billionaire Kumar Mangalam Birla, is contemplating promoting its insurance coverage brokerage unit because the group seeks to restructure its monetary companies enterprise, individuals conversant in the matter mentioned.

The publicly traded firm has held talks with potential patrons a few sale of Aditya Birla Insurance coverage Brokers Ltd. because it did not scale up the 19-year-old enterprise, the individuals mentioned, asking to not be recognized as the knowledge just isn’t public. It’s considered one of India’s largest composite insurers, which means it affords each life and non-life insurance policies, but the unit reported income of solely 6 billion rupees ($73 million) within the 12 months to March 31, 2021, its web site reveals.

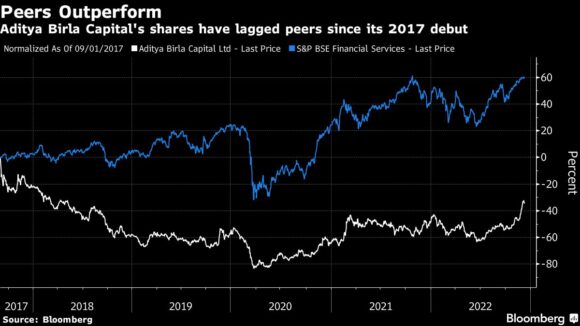

The sale is a part of Aditya Birla Capital Chief Government Officer Vishakha Mulye’s efforts to restructure the corporate’s companies, which vary from asset administration to mortgage financing, with the intention to increase shareholder returns, the individuals mentioned. Although the corporate’s shares have by no means traded above their 2017 debut worth, they’ve surged greater than 50% since Mulye took the helm in June.

The corporate plans to shut the transaction by March 31, nonetheless no last determination has been reached concerning the valuation, and the sale might nonetheless be shelved, the individuals mentioned. A spokesman for Aditya Birla group declined to remark.

The unit being thought of on the market affords broking and advisory companies to corporations and people together with re-insurance options to insurers, the web site reveals. It has greater than 350 individuals working throughout 11 places in India.

{Photograph}: Kumar Mangalam Birla, chairman of Aditya Birla Group, in Mumbai, India, on Tuesday, Sept. 18, 2018. Picture credit score: Dhiraj Singh/Bloomberg

Copyright 2022 Bloomberg.

Subjects

Businesses

Excited about Businesses?

Get automated alerts for this matter.