HDFC Financial institution is aiming to treble its lending to electrical car (EV) purchases in three years after an early check lending is popping out to be worthwhile and asset high quality stays robust regardless of some hiccups on the car trade stage.

After initially testing the waters with lending for 589 EV purchases and a e book dimension of ₹5,100 crore, the financial institution goals to triple the e book dimension by 2025.

“According to our purpose to turn out to be carbon impartial by 2031-32 we’re aggressively pushing EV financing,” stated Vikas Pandey, enterprise head-auto loans at HDFC Financial institution. “We’re market leaders in passenger car financing. Out of 100 EVs bought, we’re financing 15-17. So, we now have a market share of greater than 15%.”

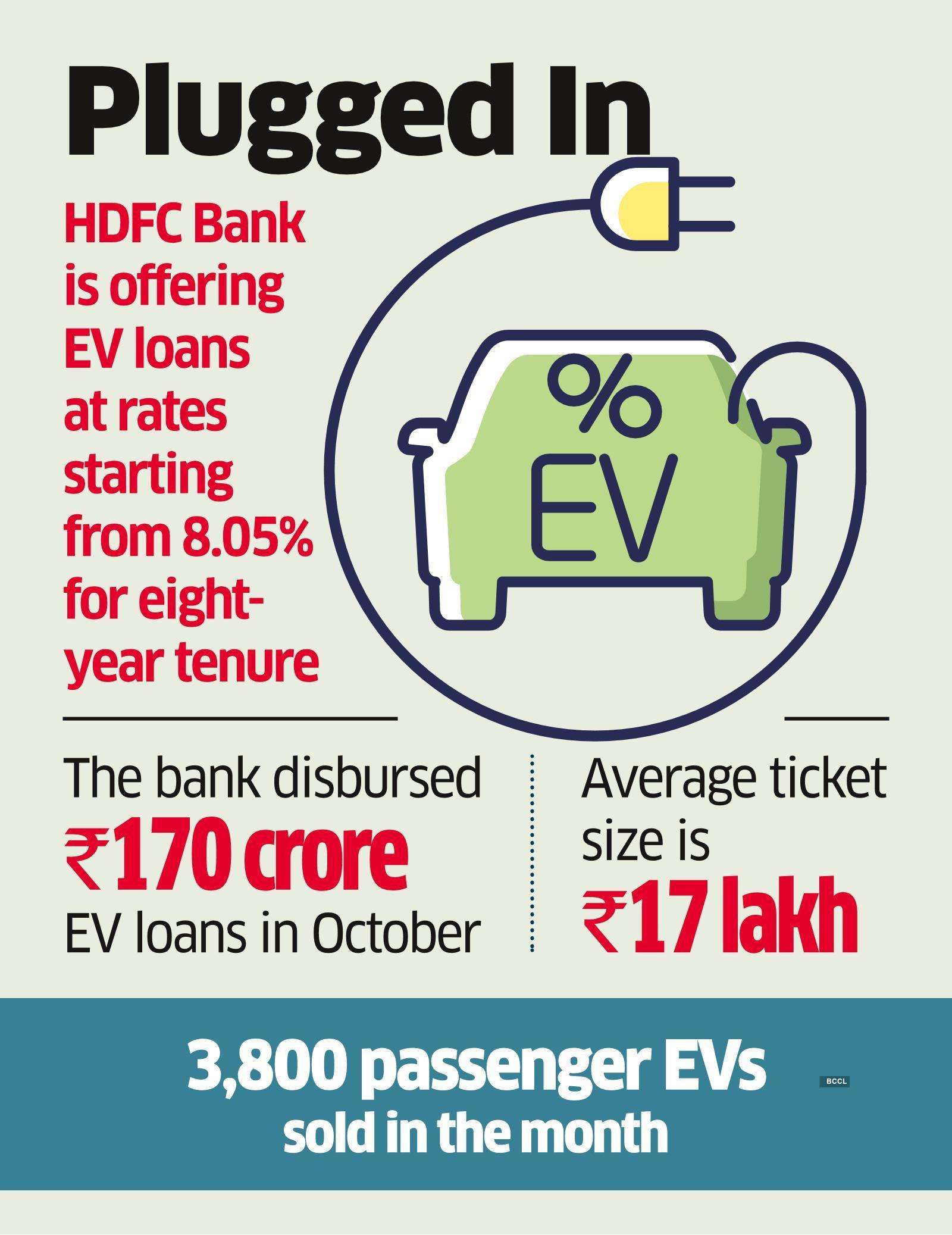

Information present 3,800 passenger EVs had been bought in October, out of which HDFC Financial institution financed 589 autos. The financial institution disbursed such loans price ₹170 crore in October.

“We’re seeing minimal 2.5x development this yr by way of volumes of autos financed,” Pandey stated. “From right here onwards, numbers ought to multiply and within the subsequent three years, we’re seeing 3x development. By 2025, we’re aiming for a market share of greater than 20%.”

The financial institution is providing a mortgage tenure of eight years with rates of interest ranging from 8.05%. The common mortgage ticket dimension is ₹17 lakh. Metros and concrete places account for 80% of the demand as entry to charging infrastructure stays a roadblock for widespread EV adoption within the nation.

“Our recharging infrastructure is tilted in direction of city areas, which we do not see in semi-urban and rural areas,” Pandey stated.

There are 2,500 EV chargers throughout 270 cities in India. Virtually 500 of those are in Maharashtra.

In response to Pandey, nearly 80% of the autos financed by HDFC Financial institution are manufactured by Tata Motors whereas the remaining is with MG Motors and Hyundai. With Chinese language participant BYD coming into India and M&M anticipated to launch its EV, the market is about to widen.

Final yr, 19,500 electrical passenger autos had been bought within the nation. This yr, 20,500 autos have been bought until October.

Immediately, the penetration of EV passenger autos is under 1% within the car area.

India’s EV financing market will doubtless be price $50 billion (₹4.1 lakh crore) by 2030 when 30% of personal automobiles, 70% of economic autos, and 80% of two- and three-wheelers within the nation are anticipated to make use of the electrical powertrain.