Funds centered on sustainability, corresponding to Northern Arc Capital, Delta Corp Holdings and Incofin Funding Administration, are shopping for into Indian fintech companies that specialize in electrical car (EV) financing to fast-track adoption of two- and three-wheelers utilizing the electrical powertrain.

Rev Fin, OTO, Mufin Finance, and Three Wheels United are among the many fintech companies which have secured both fairness or debt financing from the likes of Northern Arc Capital, Shell Basis, Delta Corp Holdings, Incofin Funding Administration, Matrix Companions India, Prime Enterprise Companions, 9Unicorns and Higher Capital – world and native funds that assist inexperienced initiatives. These partnerships search to route loans for EV purchases to the un-banked and the under-banked, consultants stated.

Some months in the past, digital e-mobility lending platform Revfin raised ₹100 crore funding in debt, led by Northern Arc, Liquiloans and Shell Basis, a UK-registered charity. This can assist Revfin develop the e-rickshaw financing companies in new states corresponding to Assam, Madhya Pradesh, Rajasthan and Punjab, stated Sameer Aggarwal, Founder and CEO, RevFin.

“The most recent influx of funds will assist us overcome a number of obstacles within the EV financing house in a structured method,” stated Aggarwal. “Having skilled over 5X progress in month-to-month disbursements, we’ve constructed partnerships with all main e-rickshaw OEMs and are additionally planning to convey ahead our subsequent fairness elevate.”

For world funds, these partnerships are additionally key to reaching sustainability targets.

“We’re partnering with RevFin for financing electrical mobility, a quickly evolving section that may assist scale back carbon emission and result in sustainable growth,” stated Bama Balakrishnan, Chief Working Officer, Northern Arc Capital.

Equally, Mufin Inexperienced Finance this month raised ₹45 crore in Collection A funding from Incofin India Progress Fund.

Value Influences EV Buy Choices

The corporate has helped finance the acquisition of ₹160 crore value of EVs in 9 States. Mufin Inexperienced Finance additionally funds EV charging stations and battery top-up loans moreover bankrolling car purchases.

Two-wheeler financier OTO raised ₹6 crore final month from enterprise debt agency Stride Ventures. That spherical of financing comes nearly a 12 months after OTO raised $6 million in Collection A funding, led by Matrix Companions India. Three Wheels United (TWU) has additionally raised $10 million in Collection A funding led by Delta Corp Holdings. The shortage of inexpensive financing choices for low-income customers stands in the best way of quicker EV adoption regardless of some decline in car prices.

“India’s EV adoption price is shifting slowly, primarily as a result of they don’t seem to be priced on a par with standard automobiles and are available at a premium,” stated Rohit Mehta, Managing Director, Akasa Finance. “It influences buy choices.” Established non-bank lenders, in the meantime, are nonetheless cautious about lending to this section of the automotive trade. That is a niche the fintech companies are looking for to fill.

“We’re capable of fulfil financing necessities with versatile EMI choices, making the acquisition a lot simpler,” stated Sumit Chhazed, CEO and cofounder, OTO.

OTO has tie-ups with a few of India’s largest two- and three-wheeler firms, corresponding to Hero MotoCorp, TVS Motor, Bajaj Auto and Suzuki. The platform affords 35% decrease EMIs in contrast with different banks.

India’s EV financing market will seemingly be value $50 billion (₹4.1 lakh crore) by 2030, when 30% of personal automobiles, 70% of business automobiles and 80% of two- and three-wheelers are anticipated to make use of the electrical powertrain.

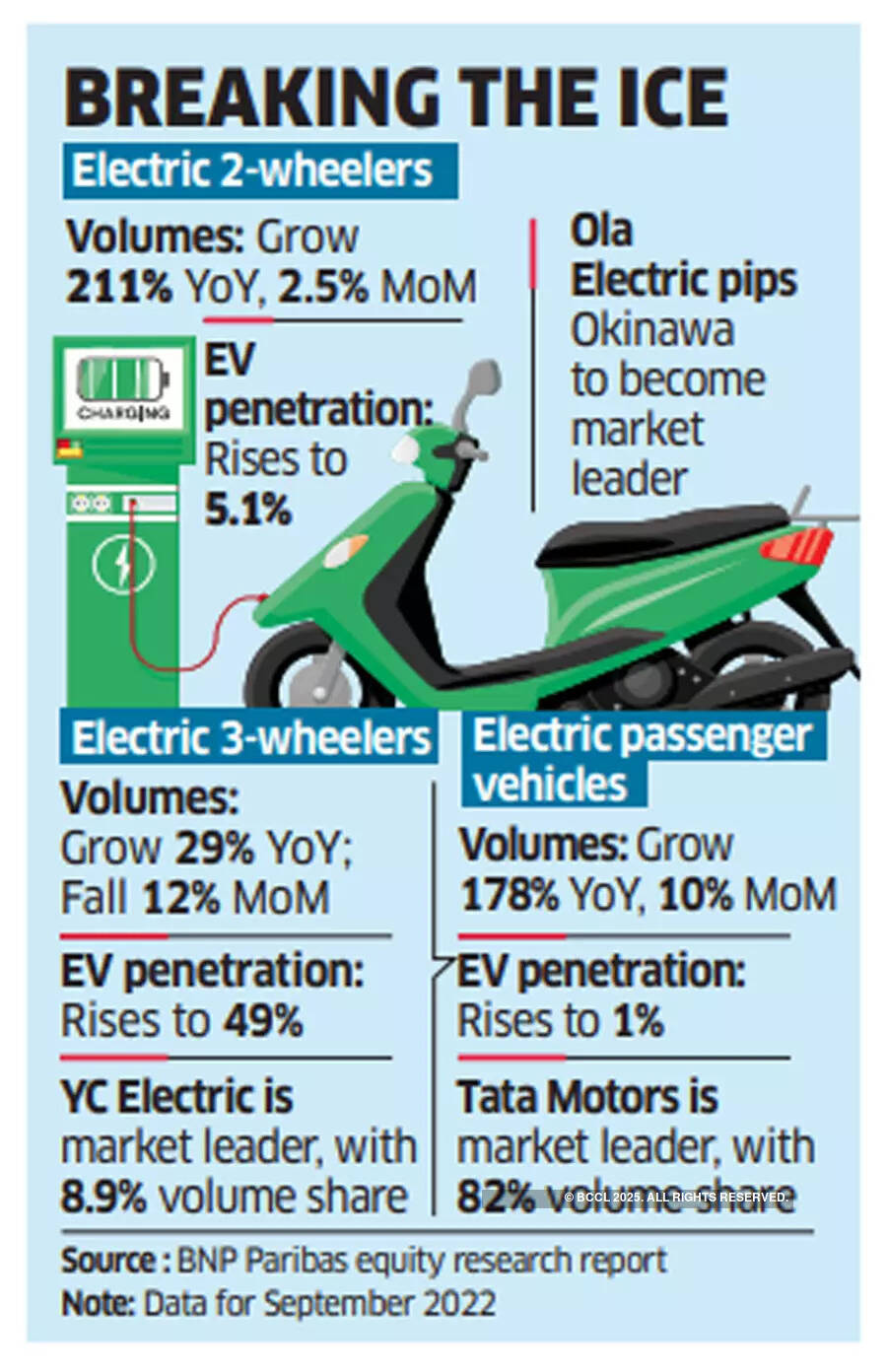

Enterprise capital fund Blume stated that gross sales of electrical two-wheelers are anticipated to develop 24 occasions their present volumes in India by 2030 to the touch 17.69 million items, up from a projected quantity of 0.75 million this 12 months.