Most cost-effective Automotive Insurance coverage in New York for Good Drivers

Geico has the most cost effective automotive insurance coverage for many good drivers in New York. Drivers who’ve by no means had an accident or obtained a quotation are thought of good drivers by insurers and pay much less for insurance coverage than drivers with dangerous data. Along with low charges, good drivers can usually qualify for extra reductions from their insurance coverage firm.

Most cost-effective Automotive Insurance coverage in New York for Full Protection

Full protection refers to a coverage that goes past the minimal state necessities. As a result of full protection protects you in additional conditions, it prices greater than the minimal necessities.

Most cost-effective Automotive Insurance coverage in New York After a Ticket

After a dashing ticket, most drivers will see their insurance coverage charges go up for 3-5 years. It’s essential to understand that every insurance coverage firm calculates charges in a different way, so you must all the time get a number of quotes with a view to just be sure you get the very best deal.

Most cost-effective Automotive Insurance coverage in New York for Drivers with One At-Fault Accident

One at-fault accident will often have an effect on your insurance coverage negatively for 3-5 years as insurers will think about you high-risk. Due to your increased charges, it’s much more essential to comparability store.

Most cost-effective Automotive Insurance coverage in New York for Drivers with Poor Credit score

A low credit score rating usually flags drivers as increased threat, so insurers will often cost them extra for protection. Nevertheless, since insurers use completely different formulation to calculate premiums, poor credit score would possibly have an effect on your charges extra with one firm than one other. As a result of every insurance coverage firm treats credit score in a different way, it pays to check quotes.

Most cost-effective Automotive Insurance coverage in New York for Younger Drivers

Since younger drivers have much less expertise behind the wheel, insurers are inclined to cost them increased charges than extra mature drivers. On common, most drivers will see their charges drop as they become older with a substantial lower as soon as they flip 25 years outdated.

Most cost-effective Automotive Insurance coverage in New York for Older Drivers

Though mature drivers pay much less for automotive insurance coverage than teenagers, older drivers begin to see their charges go up as they enter their senior years. Evaluating automotive insurance coverage charges can save older drivers tons of of {dollars} a yr.

Finest Cities for Low-cost Automotive Insurance coverage in New York

| Metropolis | Premium | P.c Enhance |

| Ithaca | $1,295 | 0.00% |

| Rochester | $1,497 | 15.60% |

| Troy | $1,564 | 20.80% |

| Schenectady | $1,577 | 21.80% |

| Binghamton | $1,604 | 23.90% |

| Albany | $1,787 | 38.00% |

| Utica | $1,832 | 41.50% |

| Rotterdam | $1,840 | 42.10% |

| Poughkeepsie | $1,871 | 44.50% |

| West Seneca | $1,928 | 48.90% |

| Syracuse | $1,932 | 49.20% |

| Buffalo | $2,307 | 78.10% |

| White Plains | $2,523 | 94.80% |

| New Rochelle | $2,845 | 119.70% |

| Huntington Station | $3,276 | 153.00% |

| Yonkers | $3,364 | 159.80% |

| Mount Vernon | $3,509 | 171.00% |

| Astoria | $4,379 | 238.10% |

| Forest Hills | $4,471 | 245.30% |

| Ridgewood | $4,511 | 248.30% |

| Woodside | $4,518 | 248.90% |

| East Elmhurst | $4,548 | 251.20% |

| Flushing | $4,620 | 256.80% |

| Jamaica | $4,645 | 258.70% |

| Elmhurst | $4,645 | 258.70% |

| Corona | $4,744 | 266.30% |

| Far Rockaway | $4,900 | 278.40% |

| Queens Village | $5,132 | 296.30% |

| New York | $5,202 | 301.70% |

The desk above displays the common annual price of automotive insurance coverage in New York’s largest cities and cities.

Components That Have an effect on Automotive Insurance coverage Premiums in New York

Recap: Most cost-effective Auto Insurance coverage Firms in New York

The most cost effective automotive insurance coverage firm in New York is NYCM Insurance coverage, which costs a median of $125 per 30 days for state-minimum protection. Along with being the most cost effective auto insurer for New Yorkers total, it’s the least expensive possibility for quite a lot of particular classes, similar to full protection and insurance coverage for good drivers.

In your comfort, we’ve summarized the most cost effective firms total under.

Most cost-effective Automotive Insurance coverage in New York

7 Suggestions for The right way to Get Low-cost Automotive Insurance coverage in New York

1. Evaluate quotes from each nationwide and regional insurers

Don’t neglect to incorporate native insurance coverage firms in your seek for low cost automotive insurance coverage. In New York, regional insurers like New York Central Mutual and Essential Road America may need decrease charges than nationwide firms like State Farm, Vacationers, and Allstate and have comparable buyer satisfaction rankings.

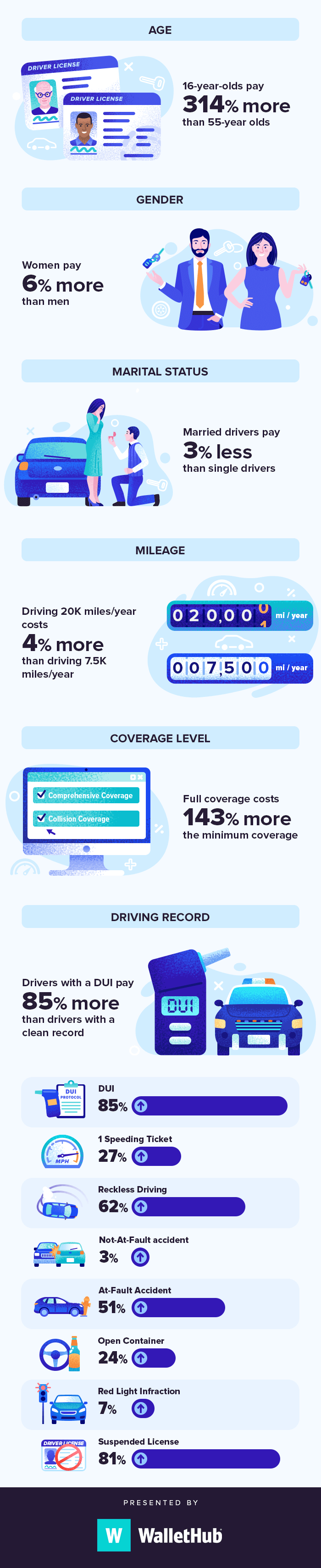

2. Know the components affecting insurance coverage in New York

Everybody is aware of that your driving habits and claims historical past have an effect on how a lot you pay for automotive insurance coverage. However in New York, firms can even think about your age, gender, credit score historical past, marital standing, and extra when setting premiums. The automotive you drive, your annual mileage, and even some components past your management all affect the value of insurance coverage.

3. Select protection that’s best for you

You want legal responsibility insurance coverage to pay for the opposite driver’s bills in case you’re at fault in an accident in New York. Collision and complete protection, then again, are elective and could also be pointless in case you personal an older automotive. Going with the next deductible or decrease protection limits prices much less, too. Don’t skimp on the protection you want. However make knowledgeable decisions so that you don’t pay greater than you must.

4. Seek for reductions

High automotive insurance coverage firms in New York have a wide range of reductions, so nearly anybody can discover methods to avoid wasting. You could possibly get a reduction in case you’re a scholar, veteran, good driver, home-owner, prepared to go paperless, and extra.

5. Keep in cheaper zip codes

Automotive insurance coverage costs can differ quite a bit based mostly on zip code in New York. On common, drivers in the most costly elements of New York spend over $4,000 extra per yr on automotive insurance coverage than these dwelling within the least costly areas.

6. Strive usage-based insurance coverage

New Yorkers take public transportation greater than 3.8 billion instances per yr, which implies many residents drive a lot lower than the common American. Drivers with a low annual mileage who are usually fairly protected behind the wheel can probably save quite a bit with usage-based insurance coverage—as much as 50% with some firms. If you happen to’re comfy letting the insurance coverage firm monitor your precise driving habits, you could possibly discover cheaper charges with a usage-based coverage.

7. Preserve protection

You’ll see increased charges in case you let your insurance coverage lapse, even in case you don’t personal a automotive. New York drivers who don’t keep steady protection pay a median of 6% greater than these with 5 or extra years of insurance coverage historical past.

Video: Low-cost Auto Insurance coverage in New York

Methodology for Deciding on the Most cost-effective Auto Insurance coverage in NY

Within the desk under, you’ll be able to see all the profile traits that had been utilized in WalletHub’s evaluation, along with the precise subset of traits that make up our Good Driver profile.

| Class | All Profile Traits | Good Driver Profile |

| Gender | Male, Feminine | Male |

| Age | 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 35, 45, 55, 65 | 45 |

| Marital Standing | Single, Married | Single |

| Teenage Driver Included on Coverage | No, Sure | No |

| Driving Report | Clear, One Dashing Ticket, One At-Fault Accident, One DUI, Suspended License, Open Container, Crimson Gentle Infraction, Reckless Driving, One Not At-Fault Accident | Clear |

| Miles Pushed Per Yr | 7,500 Miles, 15,000 Miles, 20,000 Miles | 15,000 Miles |

| Protection Degree | Minimal, Normal, Full | Minimal |

| Reductions | None, Multi-Coverage, House owner, Scholar | None |

| Credit score Degree | Poor, Good | Good |

| Filings | None, SR22, FR44 | None |

| Automotive | Sedan, Minivan, SUV, Coupe, Truck | Sedan |

Under are extra particulars relating to the terminology and particular traits of the variables within the above desk:

- Minimal Protection: Protection necessities of $25,000 in bodily harm legal responsibility per particular person, $50,000 in bodily harm legal responsibility per accident, $50,000 in legal responsibility for demise per particular person, $100,000 in legal responsibility for demise per accident, $10,000 in property injury legal responsibility per accident, in addition to $25,000 in uninsured motorist bodily harm per particular person, $50,000 in uninsured motorist bodily harm per accident and $50,000 private harm safety (PIP), as required by New York’s minimal protection necessities.

- Normal Protection: Protection ranges of 50k/100k/25k of legal responsibility protection, 50k/100k/25k of uninsured motorist protection, $50,000 of legal responsibility for demise per particular person, $100,000 of legal responsibility for demise per accident, and

$50,000 of non-public harm safety (PIP). - Full Protection: Protection ranges of 100k/300k/50k of legal responsibility protection, 100k/300k/50k of uninsured motorist protection, collision and complete protection with a $500 deductible, $50,000 of legal responsibility for demise per particular person, $100,000 of legal responsibility for demise per accident, and

$50,000 of non-public harm safety (PIP) .. - Sedan: 2018 Toyota Camry.

- Minivan: 2018 Dodge Grand Caravan.

- SUV: 2018 Toyota RAV4.

- Coupe: 2018 Ford Mustang.

- Truck: 2018 Ford F-150.

The place driver profiles should not specified, WalletHub averaged New York insurance coverage quotes throughout 40 completely different driver profiles, utilizing the above variables. Quote info is from Quadrant Data Providers and is consultant solely. Particular person charges will probably be completely different.