nito100

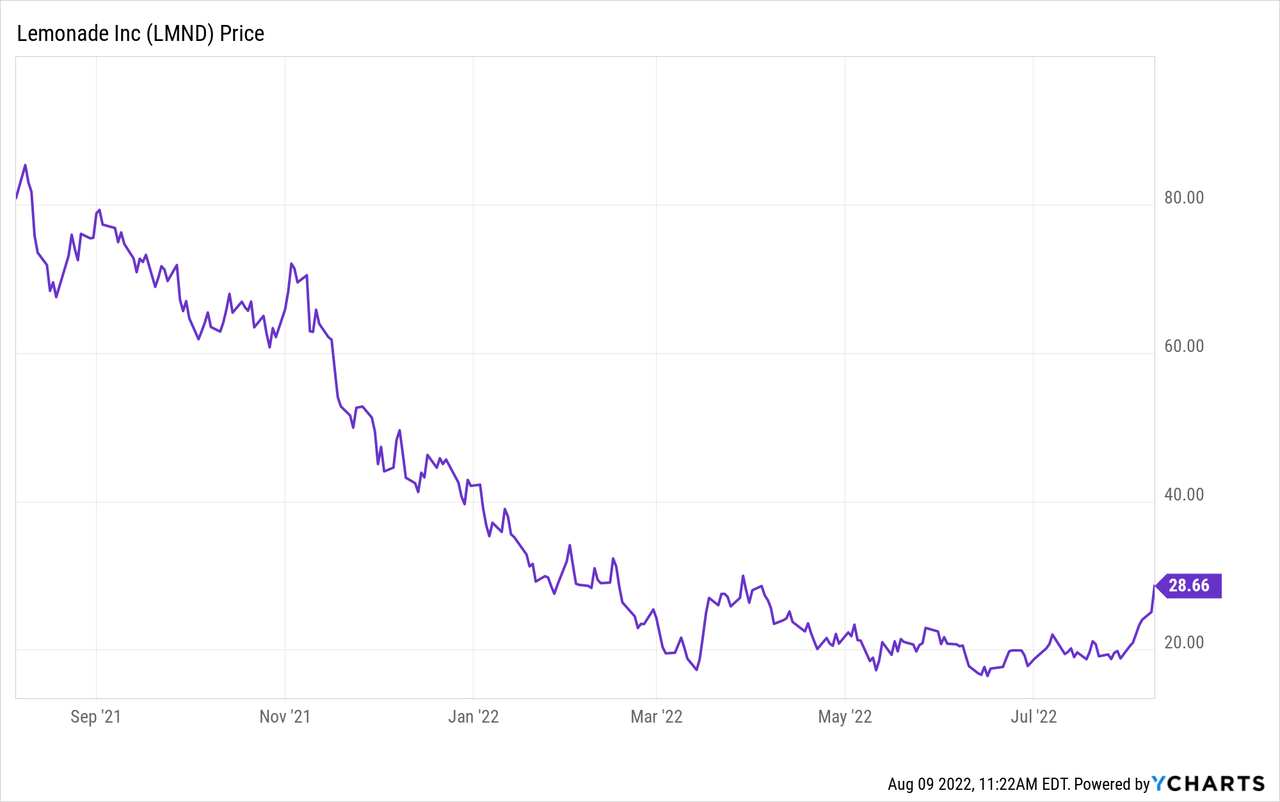

Lemonade (NYSE:LMND) is an organization I’ve adopted since its fanfare IPO in 2021. The corporate’s shares hit an all-time excessive of $108/share in July 2021 and since then have slid down by ~72%. This decline in share value was pushed by the rising rate of interest setting, along with slowing buyer progress and mounting losses. Nevertheless, within the midst of this darkness Lemonade inventory has popped by ~50% because the finish of July with 30% of that achieve coming inside the previous 5 days. The corporate has just lately produced incredible monetary outcomes for the second quarter of 2022, beating each income and revenue estimates. On this publish I will dive into the corporate’s enterprise mannequin and break down its newest monetary outcomes, let’s dive in.

Disruptive Enterprise Mannequin

Lemonade is an Insurtech firm which is on a mission to disrupt the standard insurance coverage business, that is price a staggering $5 trillion globally. Lemonade goals to do that by providing its user-friendly app and customer-centric method to promoting insurance coverage. Conventional insurance coverage corporations are recognized for having a poor consumer expertise and may be costly.

In accordance with one quote from an analyst at Gartner;

“Insurance coverage corporations are accustomed to getting cash off of friction, like making claims processes unnecessarily troublesome and protection that is lower than clear.”

Insurtech corporations corresponding to Lemonade purpose to unravel this downside by introducing a self-service, low-friction expertise for customers, optimized with Synthetic Intelligence. Lemonade’s expertise reportedly allows prospects to save lots of as much as 80% on their insurance coverage value in lower than 90 seconds. No advanced type filling or inquiries to try to catch you out, only a easy and simple consumer expertise.

Prospects are demanding this “Amazon Fashion” Product Advertising Expertise, Customized, Quick and Simple. The corporate additionally has a clear claims process, which is because of its mounted value mannequin. Lemonade takes a flat charge for an insurance coverage coverage and if there’s unclaimed cash on the finish of the 12 months, the corporate offers as much as 42% to a charity of the shoppers selecting. That is referred to as the “Give again” scheme and is a genius transfer to not solely align the pursuits of the corporate and prospects, but additionally to attraction to the socially aware millennial.

Lemonade began with renters insurance coverage however has since expanded to householders, automobile, pet and even life insurance coverage. Its mission is to “develop with the client” and be with them via each stage of their life. The corporate presently operates throughout america, Germany, the Netherlands, and France whereas persevering with to develop globally.

Lemonade has just lately expanded its new comparatively new Automotive insurance coverage providing with the just lately closed acquisition of Metromile in an all-stock deal for 7.3 million shares of Lemonade inventory. The corporate believes its automobile insurance coverage product is the “most pleasant product available on the market” and with Metromile they consider they’ve a knowledge benefit over different insurance coverage corporations. Metromile makes use of sensors embedded inside your vertical to supply cost-effective “pay by mile” insurance coverage by which the way in which you drive impacts the value you pay.

Nice Administration

Lemonade was based in 2015 by Daniel Schreiber and Shai Wininger. Schreiber is a former SanDisk Government who has various Patents underneath his identify. However extra importantly, he’s a incredible storyteller and nice marketer. I consider a part of Lemonade’s excessive valuation in the course of the IPO was pushed by the storytelling means of the model and Schreiber himself. Co-Founder Shai Wininger can be a category act, as the previous founding father of Fiverr (FVRR) he’s a veteran entrepreneur and a expertise genius. These are the kind of individuals you need to be operating an organization. In accordance with insider buying and selling knowledge, Wininger owns 4.93% of the corporate and thus has “Pores and skin within the Sport”.

Juicy Second Quarter

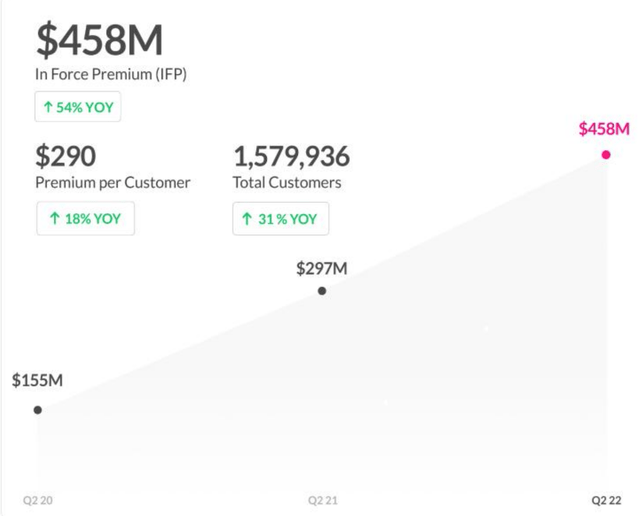

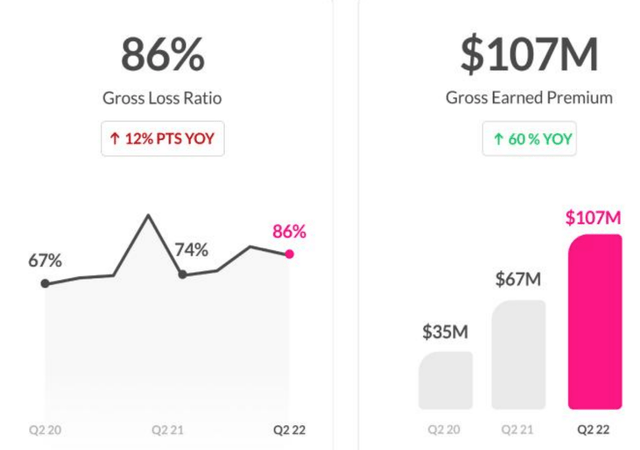

Lemonade produced sturdy financials for the second quarter of 2022. Income was $50 million, which beat consensus estimates of $47.6 million. This was additionally up a blistering 77% 12 months over 12 months and 12% sequentially. Inforce premium per buyer (lively insurance policies) additionally elevated by a considerable 54% 12 months over 12 months. Whereas premium per buyer jumped by 18% 12 months over 12 months to $290. As of Q2, Lemonade’s complete prospects stand at 1.58 million, rising at 31% 12 months over 12 months. Buyer progress numbers began to decelerate final 12 months and that’s when administration made the choice to deal with a number of product streams and develop the share of pockets.

Lemonade Insurance coverage (Q2 earnings)

Administration added some colour to their earnings report, with a daring assertion;

“We’re not altering course, however altering tempo”

They then went on to make use of the analogy of driving and optimizing for Miles per Gallon versus Miles per hour, given the present macroeconomic setting and the upper value of capital.

The corporate’s losses had been nonetheless a priority however Q2 adjusted EBITDA loss did slim to $50.3M in contrast with a lack of $57.4M within the prior quarter and a lack of $40.4M in Q2 2021. Q2 GAAP Earnings Per Share additionally got here in higher than consensus at -$1.10 vs -$1.32 estimates. Nevertheless, it must be famous this was nonetheless extra destructive than the -$0.90 produced in Q2 2021.

Financials (Q2 earnings report)

Gross sales and Advertising bills had been decreased within the Quarter by $1 million sequentially to $37 Million. This can be reflecting a part of the corporate’s miles per gallon optimization technique. Nevertheless, it must be famous that is nonetheless increased than the $33 million invested within the second quarter of 2021.

Shifting ahead, administration has guided for double-digit income progress for “so far as the attention can see”. It has estimated $63M-$65M in income for Q3 up from the $57.0M consensus.

Full 12 months adjusted EBITDA losses are additionally anticipated to slim to a lack of $240M-$245M vs. lack of $265M-$280M beforehand.

The corporate has a powerful stability sheet with $381 million in money, money equivalents and short-term investments. Along with roughly $24 million in complete debt.

Superior Valuation

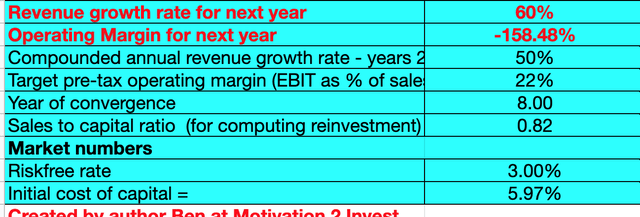

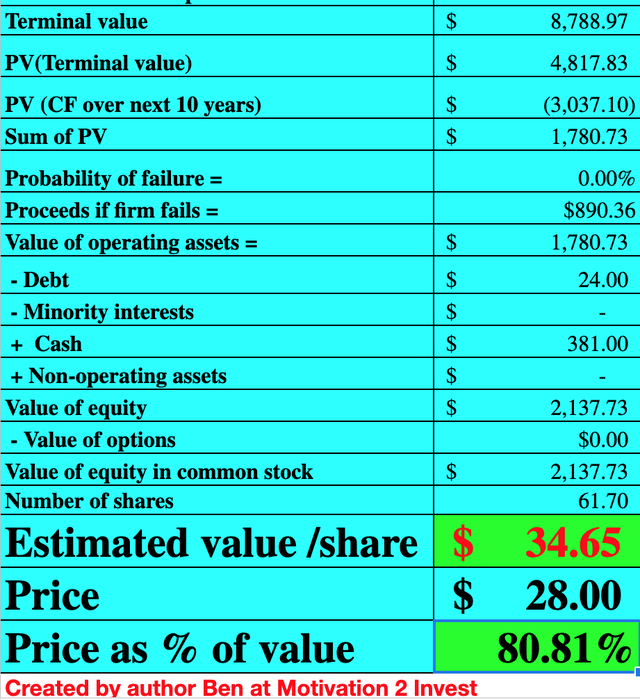

With a purpose to worth Lemonade, I’ve plugged the most recent financials into my superior valuation mannequin, which makes use of the discounted money circulate methodology of valuation. I forecasted 60% income progress for subsequent 12 months (which is decrease than the prior 77% progress reported). I’ve additionally forecasted 50% income progress for the subsequent two to 5 years.

Lemonade Inventory Valuation 1 (created by writer Ben at Motivation 2 Make investments)

By way of margins, I’ve forecasted the corporate’s working margin to extend to 22%, which is beneath the typical of the software program business. I’m estimating the corporate can do that in eight years as they scale operations.

Lemonade Inventory valuation (created by writer Ben at Motivation 2 Make investments)

Given these components I get a good worth of $34/share, the inventory is buying and selling at $28/share and thus is ~19% undervalued on the time of writing.

Dangers

Insider Holding/Shopping for

With a founder-led firm like this, I might search for a sign corresponding to insider shopping for to indicate administration has religion within the firm. As talked about prior, co-founder Shai Wininger has a considerable stake within the firm, however I couldn’t discover up-to-date particulars on Schreiber Holding. Ideally, I wish to see sturdy insider shopping for by each founders and broader administration.

Nonetheless Unprofitable

The corporate continues to be unprofitable, and the losses do not appear to have narrowed but. Inventory-based compensation is also a problem and Given the inventory trades at a ahead value to gross sales of 10, one may not deem it to be “low cost”. Given the macroeconomic setting of rising rates of interest and inflation, Wall Road is further delicate to “Development shares” and tends to vote with their ft on the first signal of hassle.

Ultimate Ideas

Lemonade is an amazing firm which actually is disrupting the legacy insurance coverage enterprise. They’ve generated sturdy progress and have continued to execute nicely. Its founders are skilled expertise veterans and nice storytellers, which helps to maintain the model participating and investor story present. The inventory is undervalued intrinsically, assuming they will sustain the stable progress charges forecasted and develop margins. Nevertheless, the highway is lengthy, so buyers ready for a “juicy” return might want to optimize for miles per gallon.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/26UVUYYXTJGYFCR7KKAQ4CA57Q.jpg)