blackdovfx

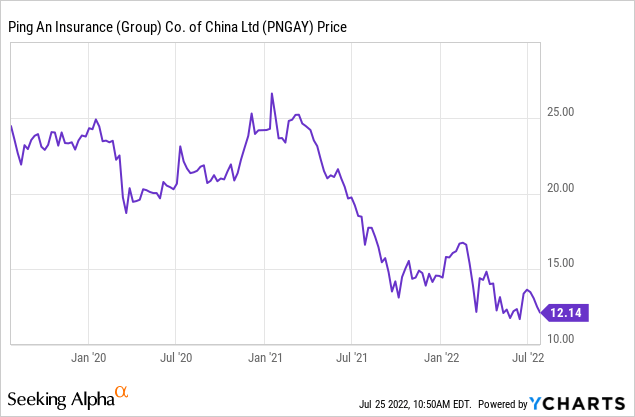

Since my preliminary bullish article on Ping An Insurance coverage in August 2020, the inventory (OTCPK:PNGAY) has come down greater than 40%. Right here I discover whether or not this has something to do with the enterprise, whereas any exterior elements are analyzed for severity and continuity.

Ping An’s story is decidedly China-centric. And so is that this replace. Nevertheless it doesn’t take away from the corporate’s specialties that make it stand out even in essentially the most inauspicious of circumstances. McKinsey calls built-in insurers like Ping An “ecosystem orchestrators” that derive extra worth from buyer relationships via associated companies past insurance coverage. Utilizing its giant measurement to its benefit, Ping An retains on including to its enterprise mannequin; on the identical time, the group has been decreasing complexity via unparalleled digitization. Though it has not been clean crusing for Ping An for the reason that second half of the final yr (which turned some headline indicators crimson), there are sufficient causes to anticipate higher long-run returns.

First, the exterior setting

COVID-19

It was initially thought that China can be the primary to depart the pandemic behind, when actually the federal government’s uncompromising zero-covid coverage means issues are nonetheless removed from regular.

Mass testing and lockdowns have turn out to be an nearly everlasting characteristic of life, more likely to stay so for the foreseeable future (if new subvariants preserve rising). And whereas manufacturing output has someway managed to persevere, shopper confidence has been badly shaken.

Insurance coverage merchandise have fallen out of favor with nervous Chinese language. Ping An’s income for 2021 dropped for the primary time in additional than a decade, by 2.7%. Many of the harm got here from Life & Well being Insurance coverage whose new enterprise worth (the current worth of future income from new premiums written throughout the yr) declined 24%, with long-term safety merchandise taking the largest hit.

Market woes

Ping An’s companies rely nearly fully on the home market, in order that they naturally mirror the state of the native financial system. Flagging shopper spending was not the one fear. Though GDP grew by a stable 8.1% in 2021, the yr was marked by monetary troubles in actual property and political meddling within the expertise house. The ensuing adverse investor sentiment had an influence on Ping An’s efficiency too.

The property sector disaster, which had been triggered by the regulation on debt ceiling for builders, was one through which Ping An was instantly concerned. As a part of a consortium, it grew to become a majority shareholder in struggling Founder Group. The share value in Hong Kong (HKEX:2318) plunged 20% on the information. Widespread hypothesis was that Ping An had been compelled into the deal and that this wouldn’t be the final time. A greater rationalization might be that the acquisition was strategic given an overlap in key traces of operation.

Nonetheless, a lot of Ping An’s investments in actual property soured. In 2021, the 29% decline in internet revenue attributable to shareholders to 101.6bn yuan was blamed primarily on one other troubled property developer China Fortune Land Growth through which Ping An holds a 25% stake: writedowns and impairments in its identify amounted to 24.3bn yuan.

Financial coverage

Ping An’s newest quarterly report for the interval ending 31 March stated there was a “mismatch of financial cycles between China and america”. Nothing makes this extra obvious than an entire divergence in rate of interest actions. Involved with slowing financial development, the Folks’s Financial institution of China has lower the important thing mortgage prime charge twice for the reason that early pandemic days, in December 2021 after which in Could 2022, whereas central banks in different main economies have began tightening rates of interest to curb inflation.

China’s GDP grew 4.8% within the first three months of 2022 however the second quarter might carry a contraction of 1.5%, based on the most recent polls. Lingering COVID restrictions, a unbroken hunch within the property sector and weak retail gross sales are a triad of things weighing down the financial system. Ping An, as the most important insurer within the nation whose pursuits unfold out far and vast, can not come out of this unscathed. In Q1, the variance between precise returns of Life & Well being funds and the assumed long-run funding returns diminished the group’s profitability by 19.7bn yuan; internet revenue attributable to shareholders declined 24% total year-on-year to twenty.7bn yuan.

Altering climate

Ping An, like different massive insurers across the globe, is uncovered to excessive climate occasions which can be turning into ever extra frequent and expensive. Local weather change is exacerbating this inherent threat. In China, 2021 was marked by the devastating Henan Floods that resulted in rapid financial losses of greater than 114bn yuan ($18bn). The price to insurers in claims reached 11bn yuan ($1.7b); Ping An Property & Casualty paid out greater than 3.1bn yuan. The inventory got here down nearly 10% within the week after the floods. Local weather losses will proceed to rise as catastrophes get tougher to foretell.

And the corporate?

Having been overtaken by Hong Kong’s AIA (OTCPK:AAGIY), Ping An is at the moment the second largest public life insurer on the earth with a market cap of about $115bn. It’s nonetheless the largest firm within the Chinese language insurance coverage market, adopted by China Life Insurance coverage (LFC). As a gaggle, it presents built-in companies in finance (insurance coverage, banking, asset administration) and healthcare. Know-how, in all of this, is a bonding agent that provides coherence to Ping An’s product portfolio unfold out via 22 subsidiaries to allow cross-selling and up-selling.

Because it stands right now, the group has fallen behind its personal historic averages on most monetary indicators. However as was proven, Ping An’s woes are usually not of its personal making, and the underlying enterprise mannequin stays robust.

PNGAY | Trailing 12 months | 5-year common |

Internet earnings margin | 7.6% | 10.1% |

Return on frequent fairness | 11.8% | 19.8% |

Return on whole belongings | 0.9% | 1.4% |

Dividend yield | 5.9% | 3.5% |

Supply: Searching for Alpha

In a difficult setting, the group has caught to what it does greatest — pursuing efficiencies via innovation. Greater than ever now, the group is targeted on constructing a cohesive ecosystem of services spanning a number of industries. And regardless of the group has achieved via synergistic results to date will solely be amplified going ahead.

Ping An’s excessive debt load (2.09tn yuan at Q1’22) is offset by plentiful money (2.04tn yuan) which retains internet gearing at low single digits, making certain the group stays protected throughout downturns. By extension, this additionally means the administration is ready to fulfill its dedication to pay dividends which have been on a rising pattern since mid-2016, reaching a compound development charge of 27% per share.

One vital change that’s being repeatedly highlighted is the continued restructuring of Ping An’s military of insurance coverage brokers: culling the numbers by half within the final couple of years (one more reason why income fell in 2021) however elevating the standard bar and the contribution of other, significantly AI powered, channels.

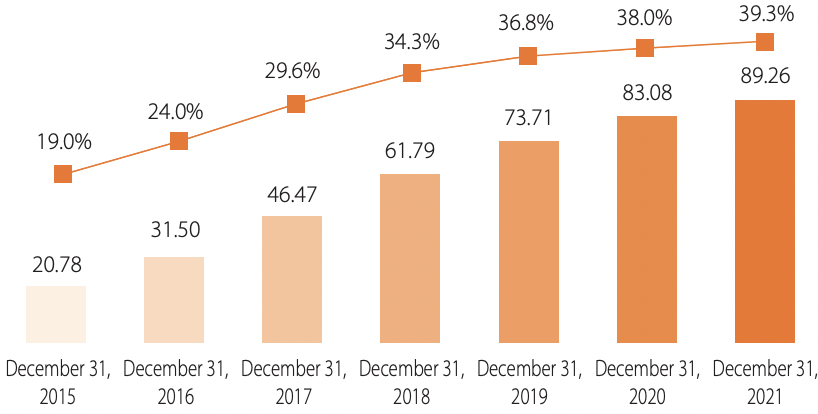

Some efficiency metrics have remained fixed all through. Ping An is regularly increasing its retail buyer base (+4.1% in 2021 and 0.7% in Q1’22) — an excellent portion of it sourced from the group’s personal web customers — in addition to contracts per buyer (+1.8% and +1.0% respectively).

The power to cross-sell at scale — propagated below the “one buyer, a number of merchandise and one-stop companies” technique — has been an enormous boon for Ping An’s subsidiaries. In 2021, near 33 million buyer migrations befell between the group’s monetary corporations promoting insurance coverage, healthcare and wealth administration. Company premiums generated via cross-selling grew 7.3% yr on yr and new company financing 26.9%. As much as a fifth of all new monetary prospects at Ping An come from its healthcare subsidiaries.

% of retail prospects (mn) with a number of contracts in several subsidiaries

Ping An

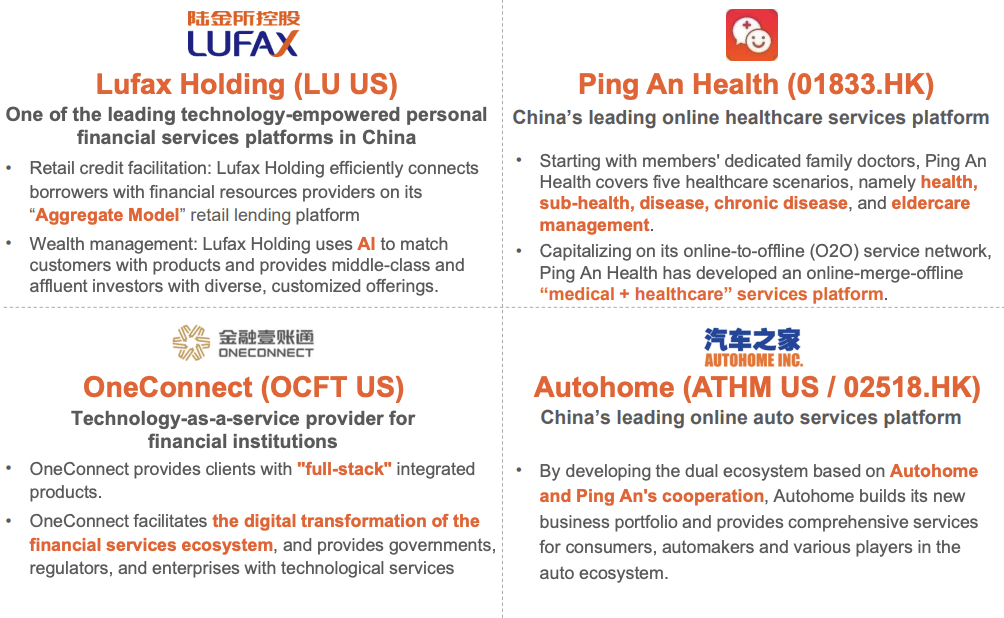

Know-how companies

Not like conventional monetary companies teams exterior of China, Ping An has stayed forward of change by internalizing insurtech and discovering a method to incubate its expertise improvements. It’s the expertise investments of Ping An that bear essentially the most potential to drive exponential development for the group. To make certain, it’s early days for publicly owned Lufax (LU), OneConnect (OCFT), Ping An Well being (HKEX: 01833) and Autohome (ATHM), however all 4 are already among the many main platforms in China of their respective niches. Know-how grew its working revenue by 91% (in comparison with the group’s total 5%) in 2020, 19.5% (versus 6%) in 2021 and 18% (10%) in Q1’22.

Ping An

Valuation

Ping An shares traded on the Shanghai Inventory Trade (601318.SS) closed at 42.91 yuan on July 24. The Road goal is 69.08 yuan based on Refinitiv Eikon. The inventory is at the moment buying and selling at a reduction to its comparable group: trailing Value/Ebook is 0.9 in comparison with the Insurance coverage business’s common of 1.3 and 1.0 of Financials. The group’s P/B ratio fell beneath 1 for the primary time up to now ten years and averaged 2.0 over the previous 5 years.

Conclusion

After adjusting for exterior elements which have affected the corporate, Ping An has not modified principally, as I see it. Development charges from mature non-technology companies will finally recuperate. In its steering, the administration units out to enhance revenues and lower prices whereas pushing additional structural and technological reforms. Extra importantly, although, the large wager on technological analysis and innovation ought to repay and raise the group’s worth as a complete. If and when that occurs will depend upon a mix of economics and politics.