Pay-as-you-drive insurance policies enable consumers to set a mileage restrict for his or her automobile and supply them reductions over the conventional premium. The decrease the restrict, the larger the low cost over the conventional premium. The insurance coverage is legitimate solely as much as the restrict chosen by the client. One insurance coverage firm provides three slabs of seven,500 km, 5,000 km and a pair of,500 km.

Insurance coverage firms also can supply reductions primarily based on the standard of driving. A telematics gadget is fitted within the automobile to watch the situation of the car and the driving habits of the consumer. This knowledge is then interpreted to offer reductions to cautious drivers. It could possibly additionally penalise rash and negligent drivers.

These developments appear excellent news for individuals who personal a number of autos or haven’t been driving an excessive amount of because of Covid restrictions. They received’t need to shell out the complete premium if their autos will not be getting used an excessive amount of. “The introduction of those choices will support in giving the much-needed fi llip to motor Personal Harm cowl within the nation and enhance its penetration,” Irdai stated in an announcement.

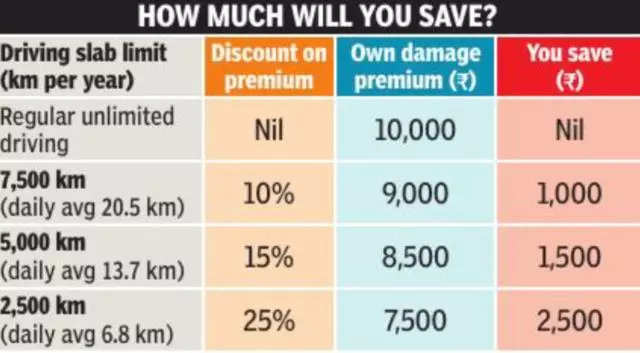

Nevertheless, the reductions supplied on the premium will not be too thrilling (see desk). For those who select the 7,500 km slab, you get solely a small 10% off on the common premium. Thoughts you, the low cost solely applies to the ‘personal injury’ premium, and the obligatory third-party premium and different add-on covers will not be affected.

The low cost is a bit more engaging for a decrease restrict of two,500 km, however that works out to a median drive of lower than 7 km in a day. Take into account that earlier than you go for a coverage with a low slab.

The excellent news is that consumers can swap to the next slab and even to a daily limitless coverage in the event that they find yourself driving greater than the slab restrict. However this improve must be executed properly earlier than time. It isn’t doable to improve after a mishap or declare incident.

The set up of telematics units additionally raises privateness issues for the automobile proprietor. Little doubt it’ll cut back the insurance coverage premium, however this low cost comes at a value. Go for it solely if you’re comfy with the thought that the insurer can have 24×7 knowledge in your automobile’s motion.