Allstate, GEICO prime record of carriers elevating auto insurance coverage premiums

By

on

Bulletins | Insurance coverage | Authorized

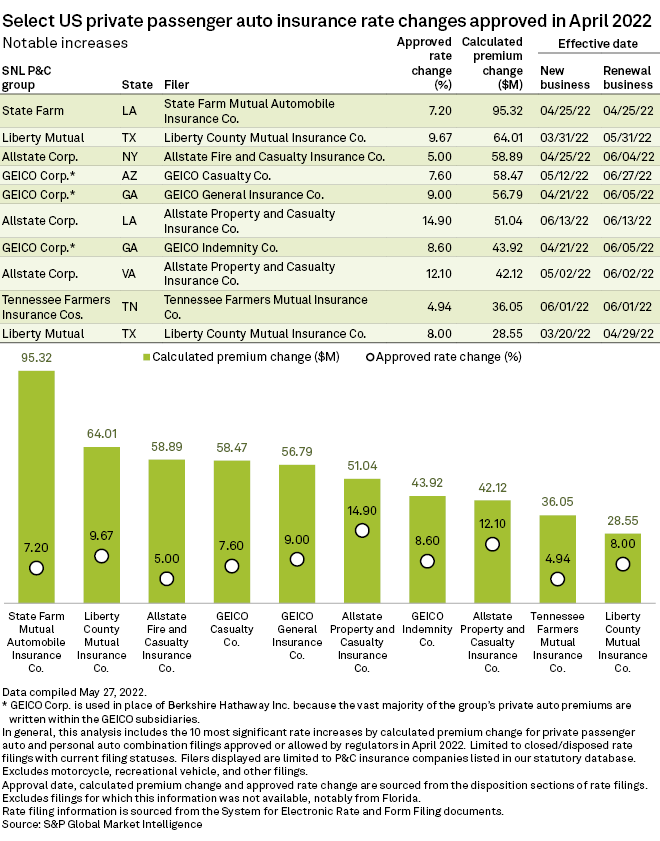

Allstate and GEICO will every soak up practically $200 million in extra premium nationwide because of auto insurance coverage price will increase applied in April, in accordance with an evaluation by S&P World Market Intelligence.

The evaluation, which relies on publicly obtainable price filings submitted to state insurance coverage regulators, discovered that Allstate had acquired approval for 22 price will increase throughout 13 states. When mixed, the will increase might doubtlessly improve the service’s calculated premiums by practically $195 million, S&P World stated.

GEICO was a detailed second, anticipated to comprehend a further $193.4 million in premiums via 10 will increase permitted within the month. Georgia and Arizona drivers will probably be paying the majority of the extra premium, calculated at $119.7 million and $58.5 million in these states, respectively.

The “most impactful” state premium improve will probably be felt in Louisiana, the place about 1 million State Farm policyholders pays a further $95.3 million, due to an permitted 7.2% improve, S&P World stated.

In Texas, State Farm was permitted to lift its charges 9.7%, amassing a further $64 million.

S&P World discovered two double-digit proportion will increase on the state degree, each awarded to Allstate. In Louisiana, drivers will see a 14.9% improve, for a $51 million rise in premiums collected. And in Virginia, a 12.1% improve will herald a further $42.1 million in premiums for the service.

Allstate, for one, has made no secret of its intention to lift auto insurance coverage charges all through 2022 because it reacts to a rise within the variety of bodily harm and bodily damage severity claims.

Allstate CFO Mario Rizzo instructed traders on April 29 that the service had elevated its charges in March, on common, by 9.8% in 15 places and “applied 53 price will increase averaging roughly 8.2% throughout 41 places because the starting of the fourth quarter 2021.”

“These places characterize roughly 62% of 2021 Allstate model auto written premiums,” Rizzo stated. “The rise to Allstate model complete auto insurance coverage written premiums of roughly 6.5% applied over this six-month interval will probably be earned all through this 12 months and into 2023.”

The most recent price will increase construct on hikes permitted within the second half of 2021. In response to S&P World, price will increase permitted for GEICO in the course of the interval had been anticipated to result in $1.06 billion in extra premium, whereas Progressive, Allstate, and State Farm had been anticipated to comprehend will increase of $363 million, $351.5 million, and $321.9 million, respectively.

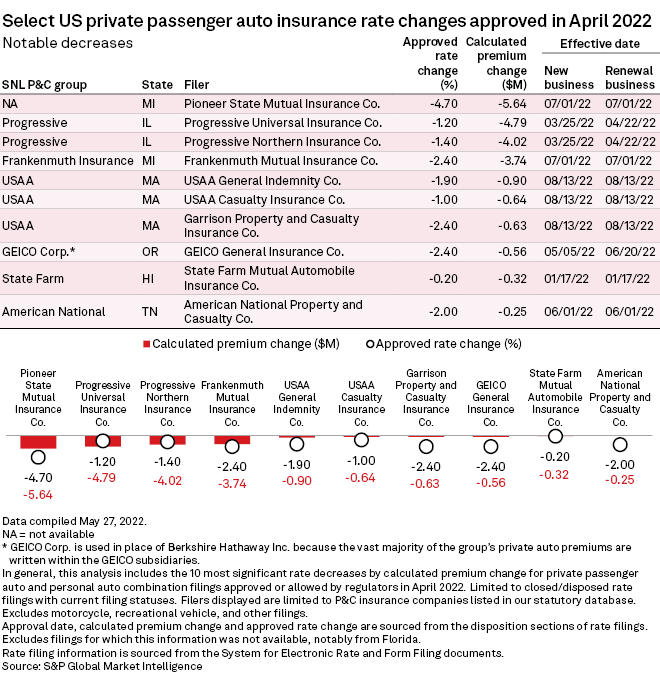

Not all carriers are elevating charges, S&P World discovered. In Michigan, Pioneer State Mutual Insurance coverage Co. has acquired approval for a 4.7% price lower, decreasing the anticipated premiums by $5.6 million. The brand new price will have an effect on about 61,000 policyholders starting July 1.

S&P World notes that states use a wide range of price regulation mechanisms equivalent to prior approval, modified prior approval, file and use, and use and file. The shape submitting legal guidelines govern the kind of coverage type regulation utilized by the state and should not require specific approval by state regulators previous to utilizing the brand new price, it stated.

Pictures

Featured picture by cnythzl/iStock

Chart by S&P World Market Intelligence. Used with permission.

Share This: