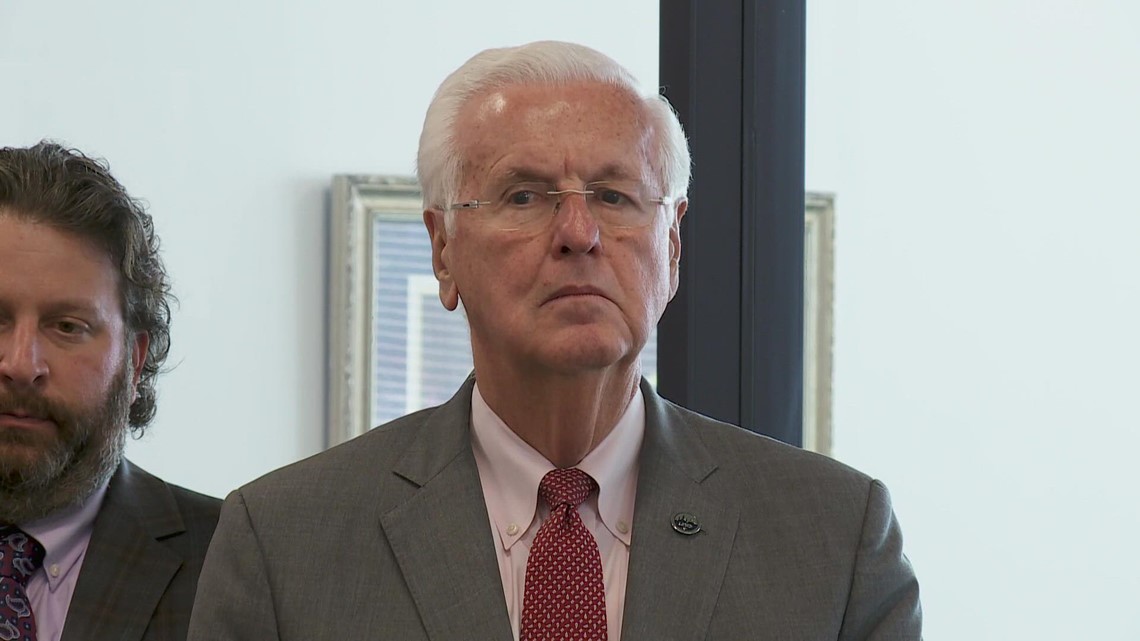

The invoice is getting robust pushback from legislators cautious of extra paperwork and from the state insurance coverage commissioner, Jim Donelon.

NEW ORLEANS — Tons of of hundreds of Louisiana residents filed insurance coverage claims after two disastrous hurricane seasons, and greater than 6,000 of them have lodged complaints towards their insurance coverage firms, in keeping with the state Division of Insurance coverage.

The American Policyholders Affiliation and different advocates say the state of Louisiana must do extra to guard householders from unfair remedy by insurers and their consultants. The APA and one other insurance coverage reform group, Actual Reform Louisiana, are actually backing a invoice within the state Legislature by Rep. Ed Larvadain, D-Alexandria, that will create a brand new company to deal with these claims.

“We’re not seeing the extent of enforcement that we have to both on the state or native degree,” stated the invoice’s writer, Actual Reform Louisiana’s government director Eric Holl.

Larvadain stated the brand new company, if created, can be even-handed in addressing fraud and unfair practices by each insurers and the insured, serving to stop inflated claims by policyholders whereas additionally defending property house owners from insurance coverage underpayments.

However the invoice is getting robust pushback from legislators cautious of extra paperwork and from the state insurance coverage commissioner, Jim Donelon, who says the trouble is redundant. The invoice was just lately referred to the Appropriations Committee as a result of it might price $300,000 to face up the brand new company.

Donelon stated his 12-person insurance coverage fraud unit has referred 10,000 circumstances to state police within the final six years and is greater than able to serving to legislation enforcement root out insurance coverage fraud in any respect ranges.

“Carry it on. Any fraud that you simply suspect, we’re all ears and we’re anxious to obtain it and to analyze it,” Donelon stated.

Donelon additionally argues an current company, the Louisiana Auto Theft and Insurance coverage Fraud Prevention Authority, or LATIFPA, has already been conducting outreach to guard shoppers towards fraud. However Holl says LATIFPA has been centered an excessive amount of on auto insurance coverage points and never on serving to policyholders after storms.

Donelon stated he would welcome increasing the LATIFPA board and the dimensions of its two-person employees to raised handle storm fraud points, however he’s towards creating an entire new entity.

“We do not want $300,000 price of extra staff,” Donelon stated. “I do not desire a rival board below my supervision doing the identical factor that we’re already doing in my workplace.”

Holl stated a significant problem that isn’t being addressed is the position of engineers employed by insurance coverage firms to evaluate a few of the 600,000 property injury claims filed over the past two hurricane seasons. Insurers rent engineering companies to find out if the injury pre-existed a storm.

Holl stated he was impressed to suggest the brand new laws when he noticed a WWL-TV investigation from 2017. It checked out U.S. Forensic, a Metairie-based engineering agency whose stories had been getting used to disclaim claims by householders after Hurricane Sandy in New York and New Jersey and after the widespread flooding in south-central Louisiana in 2016.

One WWL-TV report featured Bucky and Vivian Millet in Lake Arthur. Their insurer, Farm Bureau, employed U.S. Forensic to evaluate their declare. U.S. Forensic’s engineer wrote a report saying the Millets’ flooring injury pre-existed the 2016 flood, which pictures confirmed had stuffed the crawl area below their house with lake water.

The engineer’s report stated buckling of their wood flooring pre-existed the 2016 flood from a earlier supply of water intrusion.

“The way in which that engineer wrote that report, it was like he was calling us, I felt he was calling us a liar,” Vivian Millet stated.

Farm Bureau finally settled with the Millets and agreed to pay a further $29,000 for the ground injury, Bucky Millet stated final week.

However WWL-TV discovered earlier issues about U.S. Forensic’s practices. In 2015, The New York Occasions and CBS’ “60 Minutes” reported on U.S. Forensic’s position in denying a flood declare in New York after Hurricane Sandy. The home-owner in that case sued, alleging U.S. Forensic’s engineer had initially discovered Sandy had broken the house, then altered the report back to say the injury was pre-existing.

U.S. Justice of the Peace Decide Gary Brown, who’s now a federal district decide within the Japanese District of New York, accused U.S. Forensic of “extremely improper” practices and located the agency “secretly rewrote” its preliminary report back to make a “baseless reversal.”

However U.S. Forensic argued the modifications to the report had been part of its regular, peer-review course of and stands by the scientific technique it makes use of to find out when injury occurred.

U.S. Forensic has dealt with hundreds of claims since Sandy, however the feedback by one federal decide in a single case in New York proceed to canine the agency. U.S. Sen. John Kennedy referred to as out U.S. Forensic throughout a Senate listening to on FEMA’s Nationwide Flood Insurance coverage Program, citing Decide Brown’s findings. However regardless of the decide’s harsh feedback, U.S. Forensic was by no means charged with any type of fraud.

“U.S Forensic offers complete, unbiased, and engineering-based stories to its purchasers,” the agency stated in an emailed assertion. “Every report is produced by licensed skilled engineers, who adhere to the best commonplace of professionalism whereas guided by the ideas of science and engineering and adhering to the strict guidelines and legal guidelines set forth by the Louisiana Skilled Engineering and Land Surveying Board.”

RELATED: Danger Ranking 2.0 goes into impact, greater than 80% of coverage holders might see charge improve

RELATED: Sure, federal protection of COVID-19 testing and remedy for uninsured People has ended