For the second time this month, a private auto insurance coverage big devoted an investor convention to the subject of charge hikes, with Allstate executives additionally assuring listeners the service has numerous different instruments to return to profitability.

“Wanting again to comparable difficult environments, ….we now have a demonstrated observe file of addressing previous revenue challenges,” Mario Rizzo, chief monetary officer of Allstate, stated throughout a particular occasion final week, describing how the auto insurer put via charge jumps that translated into $2.5 billion again in 2015 and 2016 when rising auto frequency broken underwriting income.

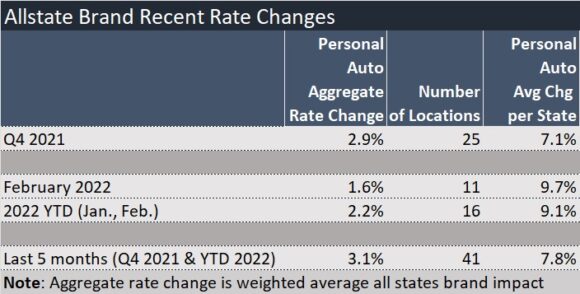

Now tackling an auto severity drawback tied to the rising restore and substitute prices and social inflation, Allstate has achieved 41 charge will increase averaging 7.8 p.c every throughout 34 places for the reason that starting of fourth-quarter 2022, which can convey $1.2 billion of extra estimated annual premium written onto Allstate’s books, based on Glen Shapiro, president of Allstate’s property-liability enterprise, and Julie Parsons, chief working officer. (The figures consult with the Allstate model alone. Allstate additionally disclosed charge adjustments for the Nationwide Common model to buyers however didn’t talk about them in the course of the occasion.)

“Growing charges is certainly core to restoring margins, however we are able to average the influence for patrons via claims excellence and lowering bills,” Shapiro stated, echoing commentary from executives of Progressive early in March who repeatedly referred to “different levers” past conventional charge filings out there to take care of profitability.

Associated article: Why You Could See Much less of Progressive’s Flo In Your State

At Progressive, the opposite levers included slowing down promoting, altering billing plans and extra restrictive underwriting. At Allstate, Parsons described pricing refinements made potential by telematics to supply fairer charges than conventional charge plans. “The latest model of Drivewise gives an incentive for secure driving by providing discounted charges primarily based on the way you drive and discourages larger danger driving,” she stated.

Extreme high-impact claims attributable to high-risk driving behaviors are a part of the issue that each one insurers are going through, Shapiro famous early within the convention. Whereas he confirmed slides with knowledge much like info offered by Progressive detailing hovering used automotive costs and rising components and labor costs, he stated that larger influence non-rush-hour accidents are one other driver of rising claims severity. These are “driving a shift of extra complicated and expensive remedies in casualty claims, in addition to better lawyer illustration.”

Extra Levers: Predictive Fashions and Information Science

Giving some finer element on declare severity will increase, Eric Brandt, government vice chairman and chief claims officer, stated that larger bodily harm severity has added roughly six factors to Allstate mixed ratio since 2019, with larger casualty severity contributing 4 extra factors.

Used automotive worth jumps have been answerable for 60 p.c of the six-point bounce on the bodily harm aspect, and components and labor value inflation contributed one other 20 p.c. The ultimate 20 p.c got here from higher-impact accidents, he stated, including that larger velocity accidents are placing extra broken vehicles within the whole loss class.

They’re additionally inflicting extra extreme accidents, driving up casualty severity. “Larger medical reimbursements mirror extra expensive remedies and elevated consumption of medical care,” he stated, additionally including that the authorized surroundings continues to issue into casualty prices. “Elevated lawyer promoting, lawyer illustration charges and backlogs within the courtroom system are all combining to result in elevated payouts for bodily damage.”

Past charge hikes, telematics-based refinements and state-by-state pricing concerns described by Parsons, Brandt flagged Allstate’s investments in know-how and strategic partnerships with suppliers and restore services as necessary instruments for combating claims severity. He additionally described the usage of predictive modeling to extend claims dealing with effectivity and investments in expertise—particularly in groups of information scientists, on-staff medical and authorized specialists in a position to assessment complicated claims and separate out the simpler to deal with “low-touch” claims.

“Allstate’s scale and experience assist mitigate value will increase for patrons,” he stated.

Predictive fashions used on the time of first report of a declare assist the service to determine rapidly which vehicles are repairable and which of them needs to be totaled or bought for salvage. “Our knowledge scientists have used our personal proprietary knowledge to enhance whole loss predictability at first discover of loss by 200 p.c over the previous 12 months,” he stated, later revealing that Allstate expects to spice up workers of the claims knowledge science group by 125 p.c over the two-year interval that began in 2020.

Utilizing predictive fashions, low complexity claims are decided upfront and routed for low contact and low value declare dealing with, Brandt stated. “On the casualty aspect, claims which have a better chance for bodily damage, authorized danger, and even potential fraud are decided early within the course of” so extra subtle sources could be engaged.

What About Social Inflation?

It was the authorized danger that bought the eye of 1 analyst listening the presentation, who requested Allstate executives to weigh in on social inflation developments, and the prospect of extra lawyer involvement in private auto claims.

“We don’t predict it but it surely additionally doesn’t imply we settle for it,” responded Allstate’s Chief Government Officer Tom Wilson. “We work aggressively to ensure that the variety of claimants [who] really feel that they want an lawyer is decrease” after being hit by one in all Allstate’s prospects, he stated, turning to Brandt to explain extra particularly what Allstate does to handle lawyer illustration charges.

“This all goes again to our investments in a collection of well-placed bets on what it’s we predict will assist us to have the ability to management rising inflationary developments,” Brandt stated, once more referring to the roles of information scientists, and in-house medical and authorized experience in combatting inflation. By controlling loss prices, Allstate can creates a “flywheel impact of higher worth out there for our prospects and hitting our profitability targets,” Brandt stated.

Contrasting the latest jumps in regular CPI with social inflation, Brandt stated the latter “has been rising at a tempo on a multiyear foundation,” with larger medical therapy prices and elevated lawyer involvement each contributing.

“We are able to’t forecast what’s going to occur from an lawyer illustration perspective. What we do is we leverage exceptionally granular knowledge to trace every little thing from promoting charges, spot TV buying, clusters or density of attorneys and involvement.” From that knowledge, Allstate can kind out what issues are in danger for elevated outcomes. By detecting that early, the service can “activate methods and strategies that greatest mitigate that danger,” he stated.

Throughout his presentation, Brandt additionally mentioned Allstate’s digital claims instruments, together with digital estimating via a course of that permits prospects can submit photographs via the Allstate app, and “Digital Help,” permitting physique outlets to video chat with adjusters in actual time. “We’ve seen better buyer adoption of our digital declare instruments whereas lowering loss adjustment bills by 1.2 factors since 2018,” he reported. This represents an approximate monetary influence of half a billion {dollars} to our revenue assertion in 2021 primarily based on earned premium ranges.”

Mid-90s Mixed Ratio Focused

Nonetheless, the inflationary developments in 2021 resulted in a damaging turnaround in underwriting outcomes because the yr progressed final yr, with Allstate reporting auto insurance coverage underwriting revenue of $1.7 billion in the course of the first-half of 2021, however an underwriting lack of $459 million within the second half of the yr, Shapiro reported in the beginning of the particular subject investor name—”Specializing in Present Auto Insurance coverage Working Setting.”

By way of mixed ratios, that meant {that a} quantity that regarded like 94.3 for second-quarter 2021—sitting comfortably inside the firm’s mid-90s goal vary—soared to 104.3 in fourth-quarter 2021. (Mixed ratios cited are for each the Allstate and Nationwide manufacturers collectively. For simply the Allstate model, the figures have been 94.0 for the second quarter and 103.9 for fourth-quarter 2021.)

Parsons gave one other tackle the powerful highway forward, noting that mixed ratios have been 96 or larger in about half the states for Allstate within the second half of 2021. In distinction, between 2017 and first-half 2021, nearly all states had underlying mixed ratios under 96.

Whereas the distribution of states above and under the mid-90s goal is much like the 2015-2016 timeframe when there was a spike in accident frequency, the breakdown of outcomes above 96 is totally different. In 2015-2016, hardly any states have been above 100; within the second-half of 2021, a excessive proportion of states got here in better than 100, representing roughly 55 p.c of Allstate’s written premium.

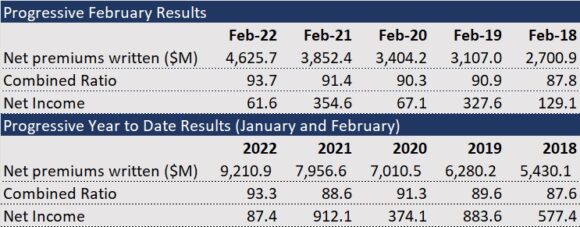

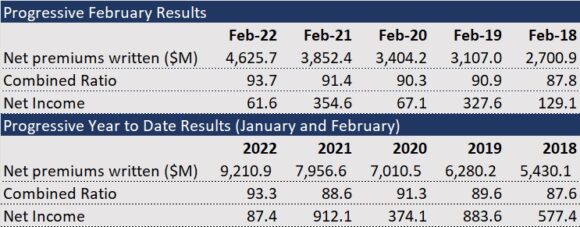

Whereas each Allstate and Progressive are offering sturdy disclosure of charge adjustments by month, Allstate has not but disclosed mixed ratio outcomes for 2022 to offer an early learn on how nicely the speed adjustments and different levers to maneuver the corporate towards profitability are working.

A couple of days earlier than the Allstate particular occasion, nonetheless, Progressive did report outcomes for the month of February and the yr so far. Service Administration has summarized the Progressive outcomes under, together with comparable outcomes for prior years. (Editor’s Notice: Web realized losses for 2022 contributed to the drop in revenue at Progressive this yr.)

Matters

Revenue Loss

Pricing Tendencies

Information Pushed