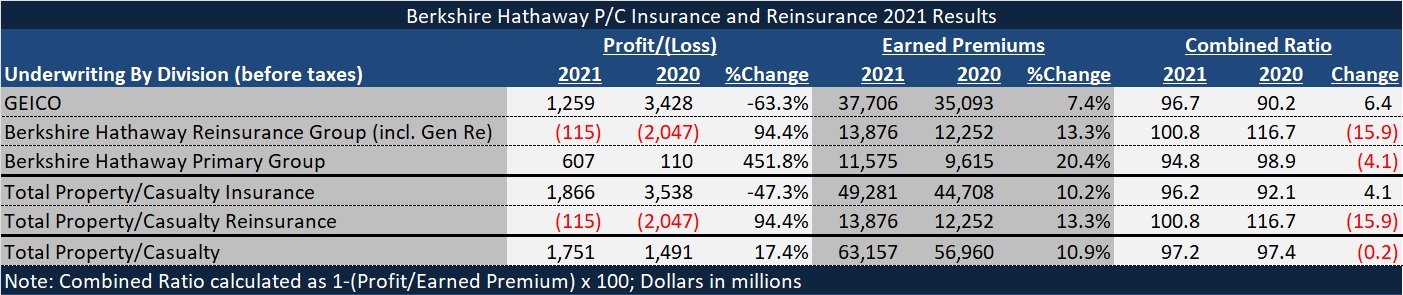

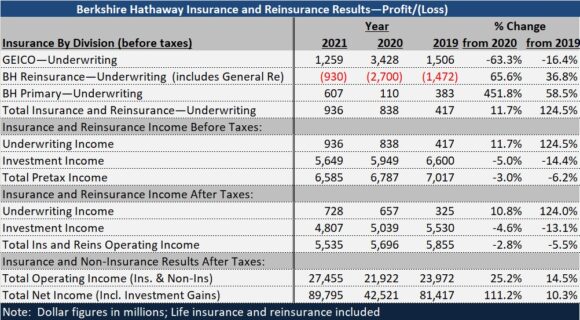

Though Berkshire Hathaway’s largest insurance coverage operation GEICO reported a 63 % drop in pretax underwriting earnings in 2021, general the conglomerate’s insurance coverage and reinsurance operations noticed pretax underwriting revenue bounce almost 12 %, the annual report reveals.

Underwriting revenue for Berkshire’s major industrial insurance coverage operations nearly returned to ranges recorded throughout 2014-2018, and underwriting losses got here in decrease for Berkshire’s reinsurance operations in 2021 than in current previous years, bringing the general mixed ratio for all of Berkshire’s property/casualty operations to 97.2, almost consistent with final yr’s mixed ratio. (Editor’s Notice: For the needs of this text, CM editors approximated the mixed ratio calculation utilizing underwriting earnings and earned premiums introduced within the annual report.)

On Saturday morning, Berkshire launched its fourth-quarter 2021 and full-year 2021, together with Chair Warren Buffett’s annual letter to shareholders.

Buffett didn’t say a lot about insurance coverage in his annual letter, though he did checklist the insurance coverage operations as the primary of “4 giants” that account for a “giant chunk” of Berkshire’s worth. (Different giants are BNSF Railroad, Berkshire Hathaway Vitality and Berkshire’s stake in Apple.)

“The product won’t ever be out of date, and gross sales quantity will typically improve together with each financial development and inflation. Additionally, integrity and capital will eternally be essential,” he mentioned, referring to insurance coverage.

“There are, in fact, different insurers with glorious enterprise fashions and prospects. Replication of Berkshire’s operation, nonetheless, can be nearly not possible,” he wrote.

Like different auto insurers, GEICO reported a file yr in 2020, and 2021 underwriting outcomes that have been worse than pre-COVID ranges of 2019. In 2020, in spite a six-month program of COVID-related premium givebacks totaling $2.9 billion from GEICO to its policyholders, the service reported $3.4 billion of pretax underwriting revenue. The 2020 revenue, ensuing from decrease auto declare frequencies, translated right into a 90.2 mixed ratio for all of 2020—decrease than it had been within the decade of outcomes that Provider Administration has tracked for Berkshire Hathaway.

In 2021, written premiums elevated $3.5 billion (to $38.4 billion), or 9.9 %, in comparison with 2020 however losses and loss adjustment bills elevated $5.0 billion, or 19.1 %, pushing the loss ratio up greater than 8 factors.

“Claims frequencies in 2021 have been increased for all [personal auto] coverages,” the Administration Dialogue and Evaluation part of the newest annual report mentioned, citing bodily harm and property injury frequency jumps within the 13-14 % vary, and collision frequency will increase of over 20 %. Reporting that declare severities have been up as nicely, the report additionally disclosed a $1.8 billion takedown in prior-year reserves impacting GEICO’s loss ratio within the different route (roughly 4.8 factors based mostly on $37.7 billion of earned premiums).

Including underwriting bills to the equation, GEICO’s mixed ratio for 2021 was 96.7—greater than 6 factors increased than the 2020 mixed ratio and about one level increased than 2019.

The underwriting revenue story was extra constructive a Berkshire’s different major insurance coverage operations—the industrial and specialty operations that embrace Berkshire-Hathaway Specialty, MedPro Group, and USLI, amongst others. General written premiums jumped 23.3 % for these corporations, with Berkshire Hathaway Specialty recording the most important bounce—36 %.

Though the Berkshire report doesn’t escape underwriting revenue figures by firm for this industrial strains group, collectively the mixed ratio for Berkshire Hathaway Main Group was 94.8 in 2021—about 4.0 factors decrease than 2020, and 1 level decrease than 2019—producing a pretax underwriting revenue of $607 million.

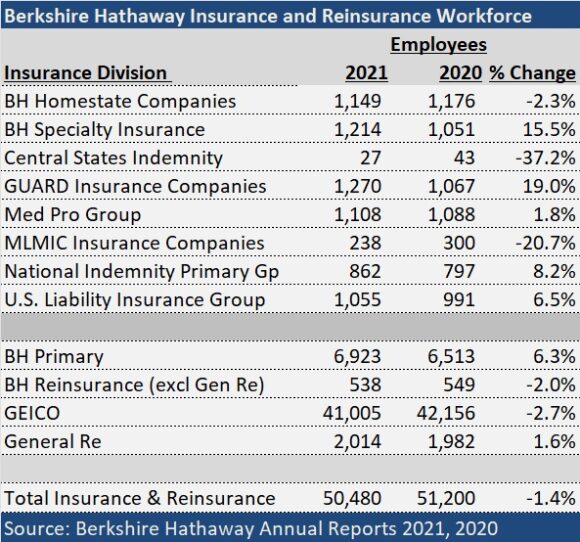

The report does embrace a breakdown of the workforces of all of the insurance coverage and reinsurance operations, which signifies that Berkshire Hathaway Main Group bucked an industrywide development, growing staffing by greater than 6 %. GEICO and the reinsurance operations reported declines in headcount in 2021.

The Backside Line

Pretax underwriting outcomes for the property/casualty companies are set forth within the first chart of this text, together with outcomes for P/C reinsurance and retroactive reinsurance operations. Whereas Berkshire posted $667 million in pretax underwriting earnings for P/C reinsurance, $782 million of underwriting losses for retroactive reinsurance operations introduced the full to $115 million written in crimson ink.

Life reinsurance operations suffered greater underwriting losses bringing complete pretax underwriting losses for all reinsurance operations to nearly $1 billion ($930 million to be actual).

Combining all of the P/C and life insurance coverage and reinsurance operation outcomes, after-tax underwriting revenue landed at $728 million in 2021, up 10.8 % from 2020.

Funding earnings for the insurance coverage operations, nonetheless, is the larger driver of general working outcomes, and with funding earnings falling 4.6 % to $4.8 billion, general working earnings for the insurance coverage and reinsurance operations fell 2.8 % to $5.5 billion.

Backside-line web earnings for insurance coverage and non-insurance operations greater than doubled, reaching $89.8 billion. Many of the bounce, nonetheless, was attributable to funding features, with after-tax working earnings for insurance coverage and non-insurance operations rising 25.2 % to $27.5 billion.

{Photograph}: (AP Photograph/Nati Harnik)

Subjects

Revenue Loss