skynesher/E+ through Getty Photos

This text is contributed by Douglas from our Superstocks Seekers staff.

The “Airbnb” of vehicles

Turo (TURO) has all the time been dubbed the “Airbnb” for vehicles, as a result of similarities of their companies’ working fashions. Each corporations are asset-light Peer-to-Peer (“P2P”) marketplaces that goal to assist homeowners monetize their under-utilized belongings. Income is then earned by taking a reduce of the transaction.

It’s fascinating as each Turo & Airbnb (ABNB) have been based across the identical time – Airbnb in Oct 2007, Turo in Nov 2008 – and but their worth now could not be far more totally different. Airbnb has scaled to a present valuation of about $100 billion, whereas Turo secured funding at a $1 billion valuation in its final spherical of financing in 2019.

We beforehand did a brief high quality examine on the corporate from customers’ views in an IAC/InterActiveCorp (IAC) article. IAC is Turo’s largest shareholder presently. The latest announcement of Turo’s public itemizing lastly gave a view inside their financials. As such, this text might be utilizing the outcomes of Airbnb to evaluate the prospects of Turo. For Airbnb’s overview, click on right here.

Companies’ Overview

Origins

The primary thought when evaluating the 2 corporations would be the distinction in scale. Though each corporations focus primarily on touring, Airbnb has operations in additional than 200 nations whereas Turo is simply in 3 (US, Canada, UK).

Turo’s S1

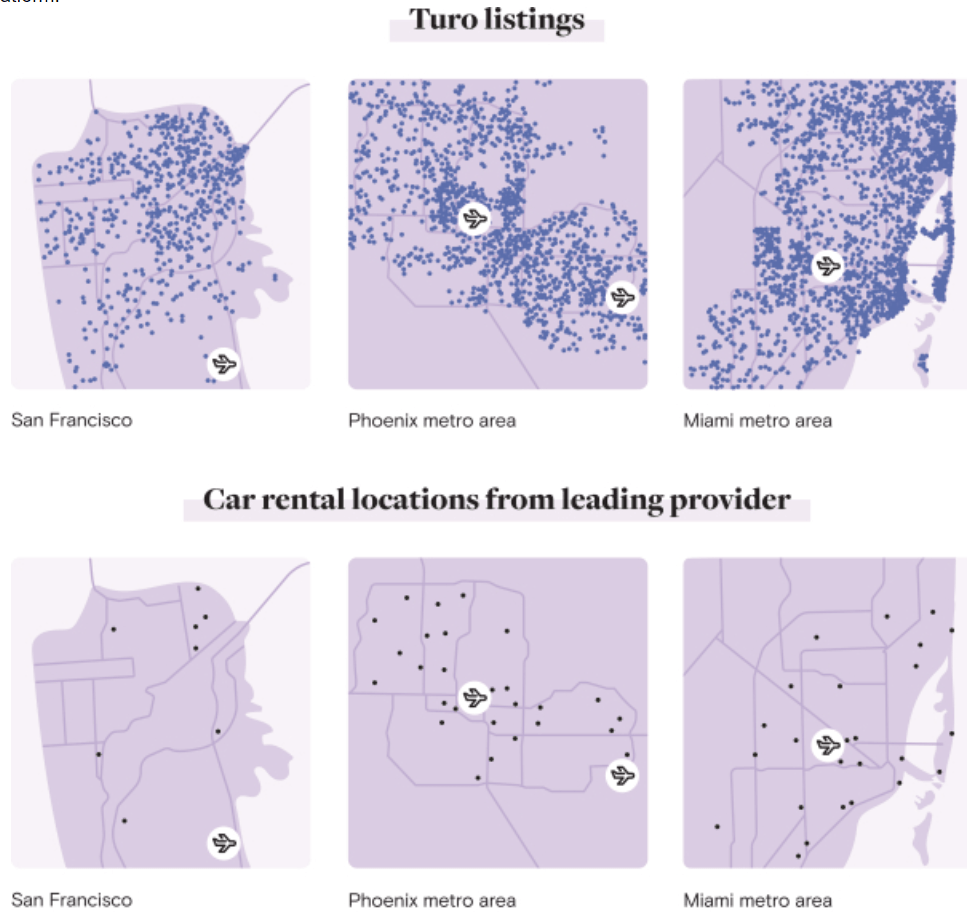

This boils right down to the character of touring conduct. Airbnb is disrupting the lodge trade whereas Turo is disrupting the normal B2C automobile rental trade comparable to Avis (CAR). B2C automobile rental corporations normally station their fleets within the airports, the arrival & departure level for worldwide vacationers. Thus, it’s far more handy for them to hire by way of these corporations than Turo, if they’re solely in search of a automobile to journey round and never in search of a particular mannequin (extra on this under). Then again, worldwide vacationers seldom keep close to airports. They may therefore be extra inclined to check out Airbnb for a special expertise moderately than all the time staying in inns.

The early adopters clearly confirmed the distinction. From the start, Airbnb had been attracting visitors from totally different states in areas the place it’s anticipated to expertise room shortages as a result of native occasions. For Turo, the primary customers have been automobile fans, in response to an interview with CEO Andre Haddad. These fans noticed Turo as a solution to check out different vehicles, whereas additionally as a solution to monetize their costly collections. The worth proposition of sharing vehicles wasn’t as apparent as sharing houses.

Heterogeneous Provide of Listings

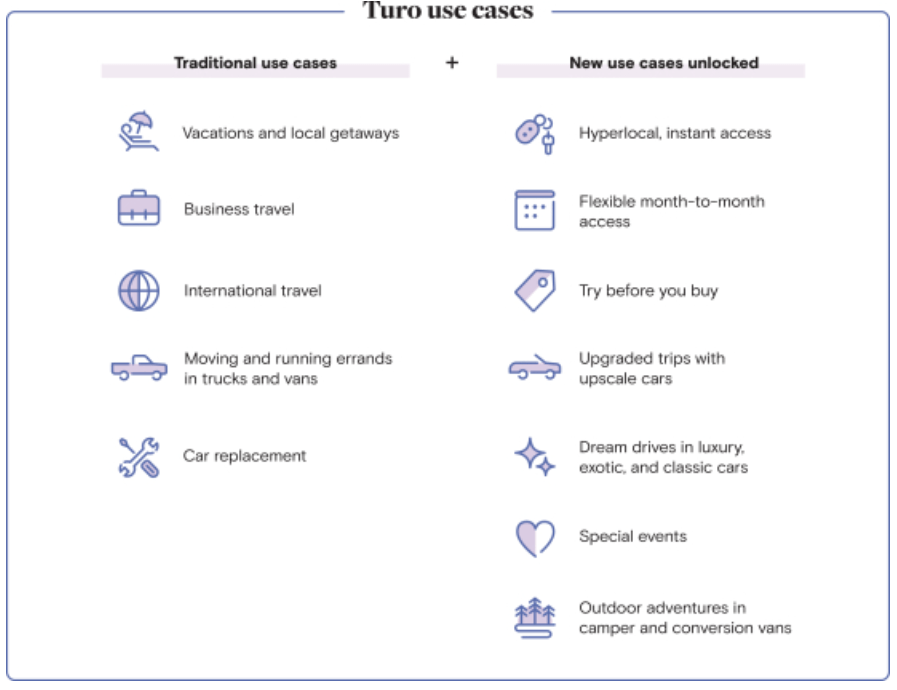

Each Airbnb and Turo delight themselves on having a wider number of merchandise than their conventional counterparts. Airbnb customers can select to remain in treehouses, tents, or igloos as a substitute of simply deciding on the variety of lodge rooms. For Turo customers, they will select from the utilitarian Toyota to the premium Lamborghini from a big selection of pickup places.

Turo’s S1

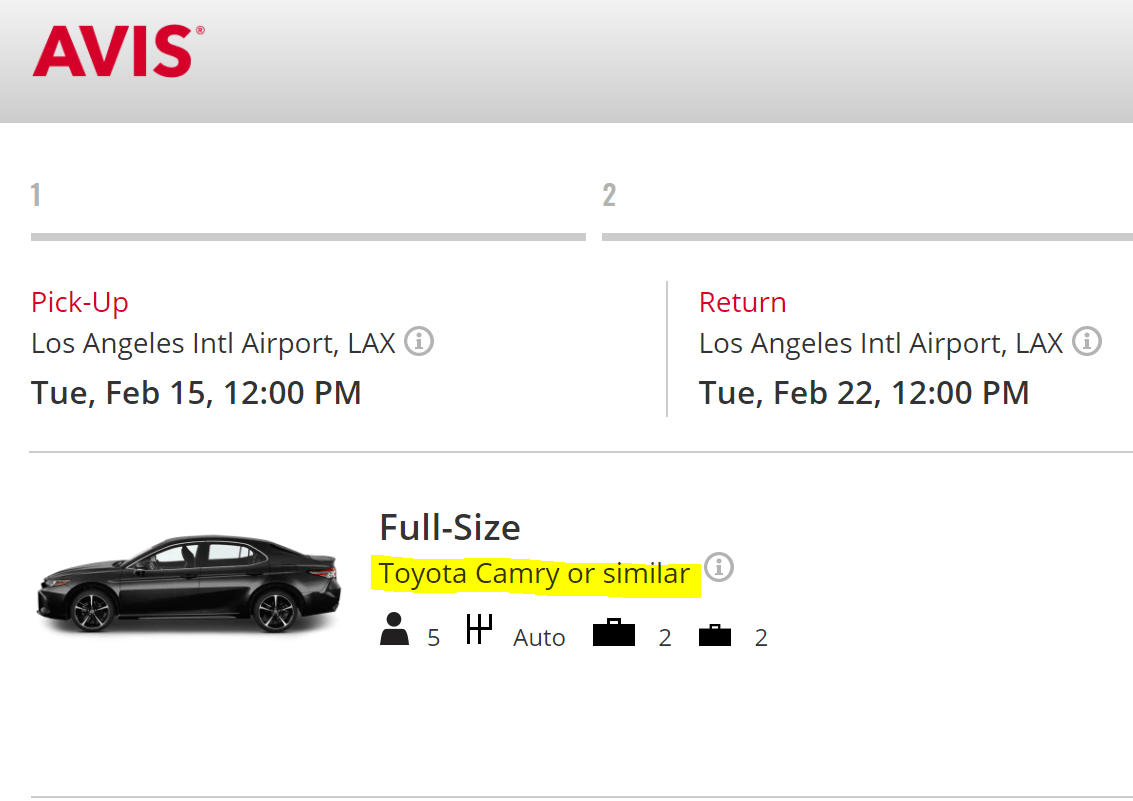

Moreover, Turo customers can make certain that they are going to be getting no matter they booked. As proven under, automobile rental corporations aren’t all the time in a position to promise the mannequin obtainable as a result of having restricted fleets. This helps in increasing the use circumstances for Turo when customers can select their desired fashions for various events, even utilizing it as a take a look at drive. Consequently, OEMs can use Turo as a advertising and marketing platform to advertise their new merchandise, permitting events to hire their in any other case idle automobiles which might be often used free of charge take a look at drives. An instance of this was the collaboration with Porsche final yr, a win-win state of affairs for each events.

Avis.com

Financials & Metrics

Bookings & Income

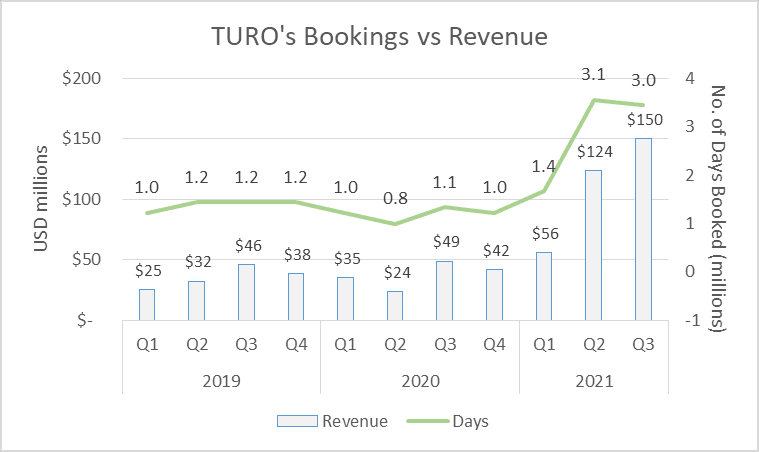

Days would be the true reflection of the natural development for Turo’s enterprise, much like Airbnb’s variety of Nights. Income is simply acknowledged upon check-in.

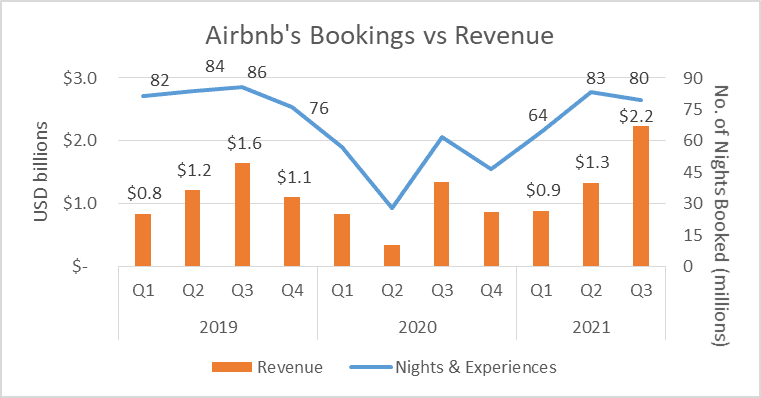

Evaluating each charts, related journey seasonality is seen the place Q3 is the most well-liked journey interval. The distinction is that the lead time between bookings and check-in is shorter for Turo as income follows bookings traits extra carefully.

In 2020, it seems that COVID hit the home-sharing enterprise tougher than the car-sharing enterprise. Following that interval, Turo has been propelled to new heights whereas Airbnb recovered to earlier highs. This was partly attributable to the elevated consciousness gained by the general public in utilizing Turo for home travels. With worldwide journey nonetheless partially restricted, extra have realized they will merely hire their neighbor’s automobile to go on an area highway journey.

Personal charts utilizing information from Airbnb Shareholder Letters & 10-Q

Personal charts utilizing information from Turo’s S1

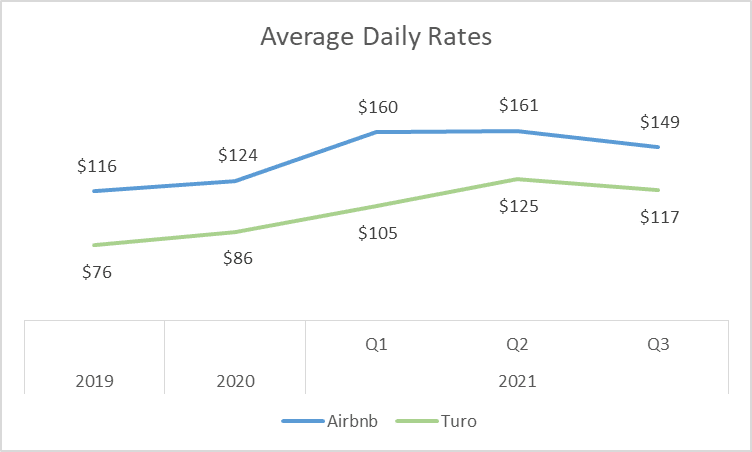

The principle motive for the surge in Turo’s bookings & income is a provide scarcity. Rental automobile corporations had decreased their fleets throughout the onset of the pandemic as a result of liquidity issues. When journey demand picked up, it performed proper into Turo’s arms. This was additionally mirrored within the rising every day charges of Turo listings. The rising reputation of home journey, particularly within the US, helps each corporations take pleasure in elevated every day charges when demand outweighs provide.

Personal charts utilizing information from each corporations’ SEC Filings

Margins

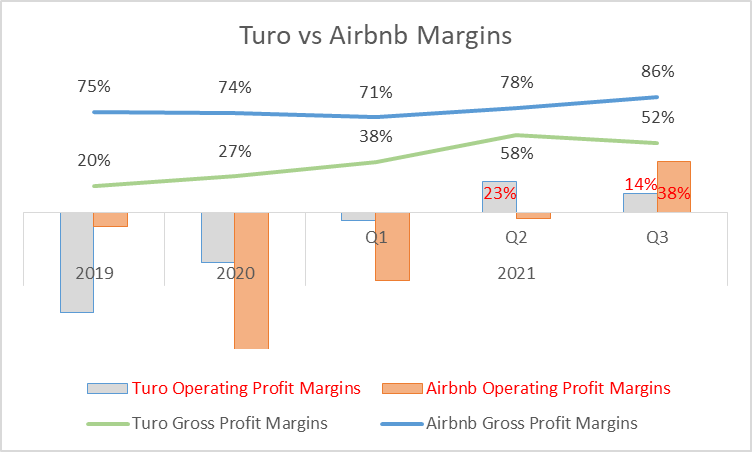

Regardless of being an asset-light market enterprise, Turo’s gross revenue margins seem dangerous though it has improved over the previous couple of years. One motive for it may be excessive insurance coverage payouts within the earlier years which Turo wasn’t in a position to forecast, coupled with the negative-margins Turo Valet program that was discontinued in Jan 2020. The introduction of Turo Danger Rating in Apr 2020, which customizes people’ market charges backend primarily based on fraud and danger evaluation, helped in bettering the margins. This might be one thing to observe to evaluate Turo’s functionality of being a real asset-light enterprise.

Personal charts utilizing information from each corporations’ SEC Filings

(Airbnb 2020’s working margin was abnormally low as a result of its year-end IPO leading to elevated share-based compensation (“SBC”).)

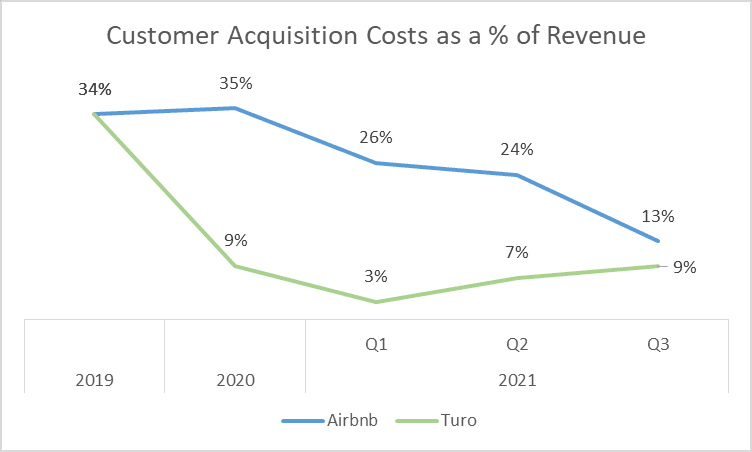

Advertising Bills

Each corporations had additionally decreased their headcounts and drastically reduce advertising and marketing bills throughout 2020 when the pandemic struck. This once more validated the natural development of Turo, since there wasn’t any ramp-up in buyer acquisition prices (“CAC”) in 2021.

Personal charts utilizing information from each corporations’ SEC Filings

(Airbnb doesn’t reveal its CAC, thus gross sales & advertising and marketing bills have been used for the above diagram. 2020’s proportion was increased as a result of its year-end IPO leading to elevated SBC.)

Taking one other perspective, the comparability exhibits that Turo is a comparatively conservative enterprise. Turo is simply spending 9% on buying clients and is already operationally worthwhile. Even at its scale, Airbnb is spending 13% of its income on gross sales & advertising and marketing. Based on its CEO Brian Chesky in its Q3’21 earnings name,

Airbnb is a very well-known model that’s a noun and a verb used all around the world. And due to this, greater than 90% of our site visitors was free or unpaid in Q3.

And so we consider advertising and marketing as actually training. Model advertising and marketing is actually about educating folks which might be extremely differentiated product. After which efficiency advertising and marketing for us isn’t actually a approach to purchase clients. It’s the best way the laser in on balancing provide and demand. So we expect this can be a actually distinctive method. And I feel that it’s simply actually all about frequently investing in our model.

Since Airbnb is already well-known globally, they will afford to chop down on efficiency advertising and marketing comparable to search engine advertising and marketing. They as a substitute doubled down on its model advertising and marketing marketing campaign – Made Potential by Hosts in Mar 2021.

Turo’s new advertising and marketing marketing campaign appears to reflect this playbook. Using on its 2021 success, Turo pushed out its Discover Your Drive marketing campaign in Oct’21, highlighting the distinctive vehicles and experiences made obtainable by their hosts. Nonetheless, Turo continues to be at its early levels of development. Along with the model advertising and marketing, we really feel that Turo can afford to ramp up its CAC to extend its 160,000 energetic listings & 1.3 million energetic visitors. They need to even discover increasing abroad to create the identical world community impact as Airbnb, the place happy vacationers within the US can select to change into hosts of their dwelling nations.

CEO’s Credentials

The CEO’s potential to execute and develop the enterprise shouldn’t be a priority. CEO Haddad had many years of expertise working marketplaces, ranging from his time managing a European digital market that was acquired by eBay (EBAY). He laid out steps of rising a market by all the time focusing and over-serving the primary 100 clients and never blindly chasing extra bookings in a 2018 market group convention. This in flip will result in distinctive buyer expertise, which is able to generate continuous word-of-mouth opinions, aiding within the acquisition of extra customers into the platform.

Based on the e-book The Airbnb Story, this was additionally what Paul Graham from Y Combinator taught to the Airbnb founders in its early days.

It’s a lot, a lot better to have 100 customers who love you than a million customers who “kind of such as you.”

This led to them flying instantly to New York from their San Francisco base to get nearer to their first customers, to attempt understanding and fixing their ache factors.

Regulatory Issues

Simply because it occurred to Airbnb and Uber (UBER) once they gained scale, there’ll all the time be regulatory issues when such technological disruptors proceed to realize market share. Airbnb and Uber had their justifiable share of battles with inns and taxis corporations respectively within the earlier days (documented within the e-book The Upstarts by Brad Stone).

Airport

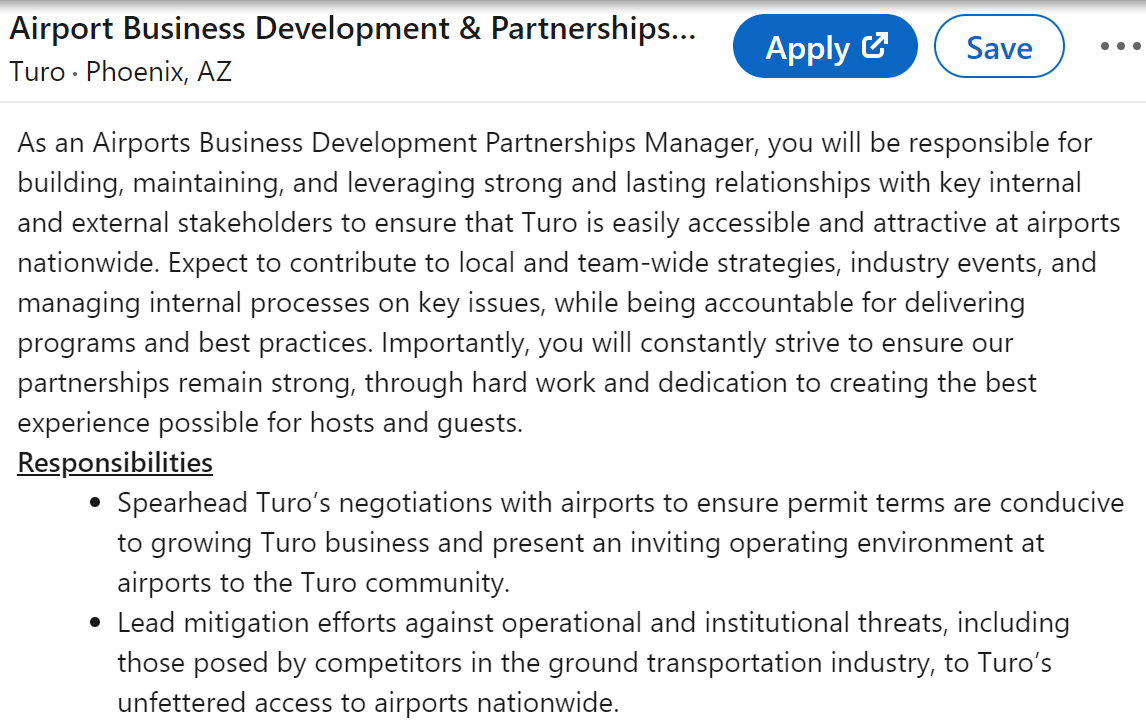

Turo has allowed its hosts to do supply to their visitors on the airport to boost its aggressive place in opposition to the incumbents. Nonetheless, this has led to ongoing lawsuits from varied authorities. Some examples are the Massachusetts Port Authority for the usage of Boston Logan Worldwide Airport in Jun’19, and Dallas/Fort Value Worldwide Airport Board in Oct 21.

These lawsuits centered across the operational ease Turo hosts get when selecting up visitors from airports, when not having any rental automobile firm allow. Turo by no means acknowledged itself as a rental automobile firm and by no means conformed to paying rental automobile charges for airport permits. Nonetheless, the corporate clearly acknowledges the necessity to work with airports, thus the precise position to handle airports’ relationships. In addition they suggested their hosts on the airports that permit supply to scale back conflicts.

Turo’s Linkedin

State

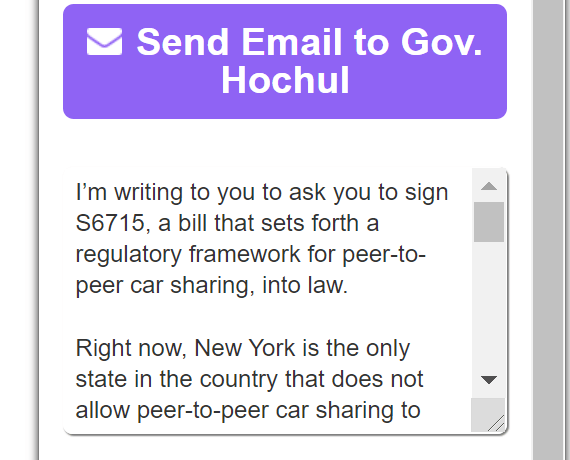

Equally, some states need to prohibit car-sharing, comparable to Hawaii. The states have been involved by the unequal tax therapy Turo enjoys over conventional automobile rental corporations. As well as, New York had banned Turo from working since 2013 as a result of state insurance coverage legal guidelines. It was partially allowed again in 2021, with solely Business Hosts (Registered unbiased automobile rental firm) listings.

The corporate is making an attempt to make the most of its happy clients to foyer in opposition to native authorities by way of the OpenRoad initiative. There are presently 3 ongoing campaigns in New York, Connecticut & Hawaii.

OpenRoad’s New York Marketing campaign

This initiative seems to be emulating what Uber did once they have been increasing quickly in lots of states. Termed because the “Travis Legislation” within the e-book The Upstarts, named after Uber’s co-founder/former CEO Travis Kalanick,

Our product is so superior to the established order that if we give folks the chance to see it or attempt it, in anyplace on the planet the place authorities must be no less than considerably aware of the folks, they’ll demand it and defend its proper to exist.

Automotive Rental Firms

The incumbents are those calling for equal tax charges therapy for Turo, particularly in airport permits. Nonetheless, additionally they selected to miss the preferential gross sales tax therapy they get when shopping for their fleet. Attaining a completely equal therapy for either side won’t be the perfect state of affairs a state needs as it will lead to decrease gross sales taxes collected.

Valuation

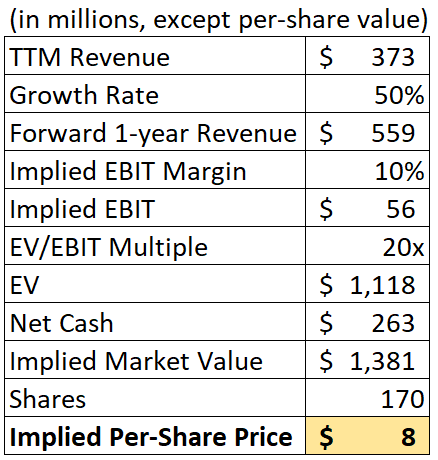

Since Turo continues to be within the midst of the IPO course of and restricted info is launched, it will be formidable to undertaking a 5-year chart for valuation. As a substitute, a tough ahead 1-year estimate from its trailing twelve months (“TTM”) income might be used.

Turo has greater than tripled its income year-on-year (“YoY”) for the previous 2 quarters. We anticipate related ranges of income for the upcoming quarters since bookings & every day charges stay excessive, Nonetheless, we assume solely a 50% ahead 1-year development as a result of its already elevated income ranges for the previous 2 quarters. Readers do have to notice that every day charges are anticipated to go down when worldwide journey absolutely returns. And Turo might be hit tougher than Airbnb because it solely serves in 3 markets, and inbound vacationers exterior these markets can have minimal consciousness of such car-sharing companies.

An earnings-before-interest-and-tax (“EBIT”) margin of 10% is implied primarily based on its TTM working margins.

For the Enterprise Worth (“EV”)/EBIT a number of, we’re taking reference from mature on-line journey aggregators – Expedia Group (EXPE) & Reserving Holdings (BKNG). Each are buying and selling at multiples round 15x-25x for the previous 5 years, with gross revenue margins averaging above 80% whereas annual development at lower than 20%. Bearing in mind Turo’s excessive development & low margins, we take a conservative midpoint of 20x for valuation.

Personal estimates

With the above assumptions and including in internet money worth, we derived an implied per-share worth of $8. It stays to be seen what the market sentiment might be like on its IPO day.

Closing

Turo positively has the best playbook to repeatedly develop its enterprise, and the pandemic has introduced extra consciousness to its worth proposition. The one impediment it would face might be its restricted geographic attain. Airbnb has profited from its world presence because it permits the enterprise to be adaptable to any journey traits. Within the mid to long-term, as worldwide journey returns to pre-covid days, Turo development may be impacted if it doesn’t ramp up its consumer acquisition or discover worldwide growth.