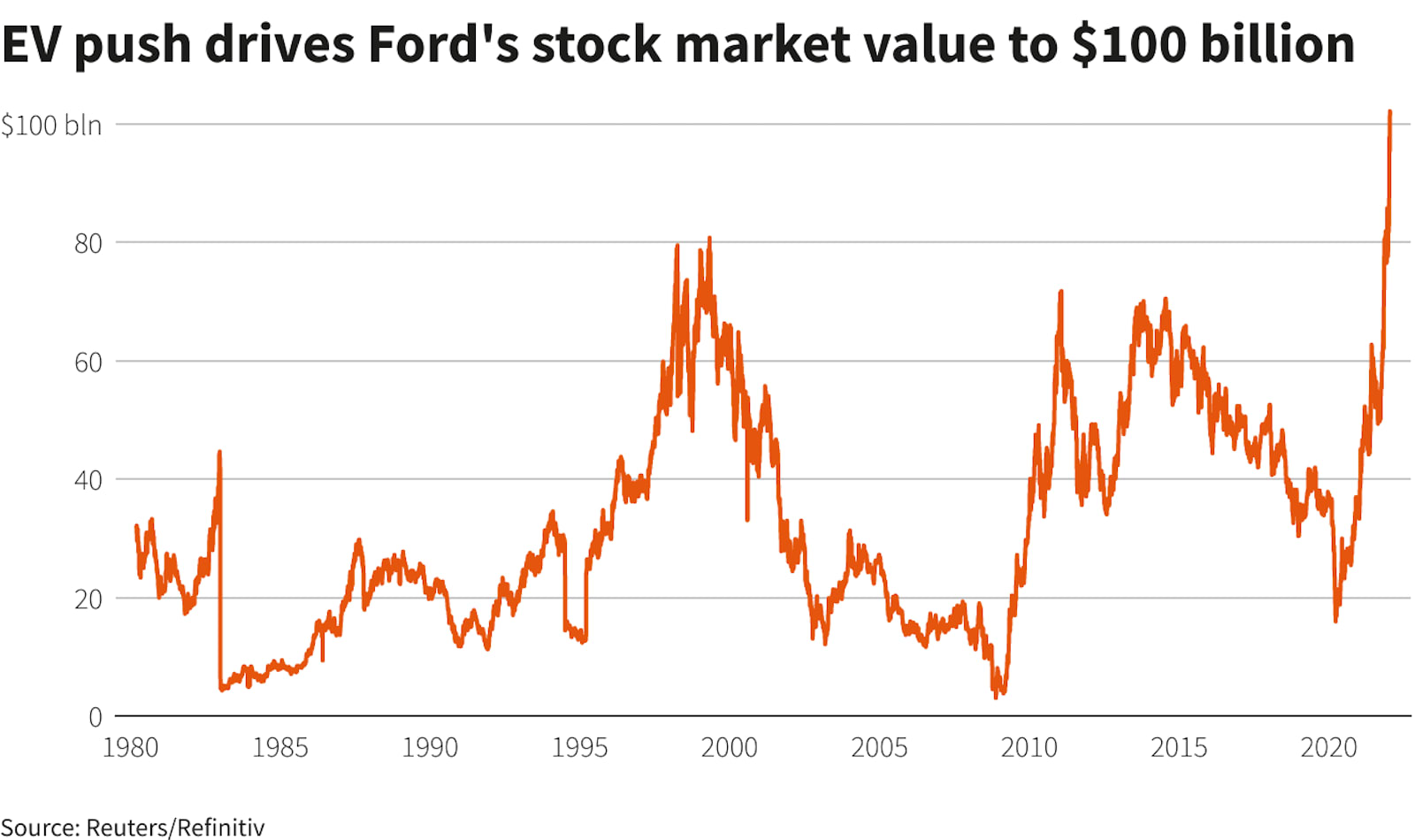

Ford’s market worth breached $100 billion for the primary time on Thursday, as extra traders guess on the Detroit automaker’s electrification technique.

The corporate’s shares, which have greater than doubled in worth final 12 months, had been up 3.7% in afternoon commerce after hitting a greater than two-decade excessive earlier.

Ford is now value greater than its century-old rival Normal Motors, whose market cap stands at about $88.61 billion and EV start-up Rivian Automotive, whose worth is about $77.8 billion.

However, the automakers are nonetheless dwarfed by EV chief Tesla, which has a market cap of over $1 trillion.

Shares of Tesla had been down 4.7% on Thursday after a report mentioned the corporate up to date its Cybertruck mannequin webpage to take away references to the 12 months 2022.

Ford’s features come amid its plans to double manufacturing capability for the electrical model of its massively in style F-150 pickup truck to 150,000 autos as a part of Chief Government Jim Farley’s aggressive electrification technique.

Demand for the F-150 Lightning electrical pickup has been pink sizzling and Ford has needed to cease taking reservations for the truck forward of its arrival this spring at U.S. sellers.

Ford’s Farley, who took over as CEO in 2020, has pledged to take a position greater than $30 billion on EVs, together with battery growth, by 2030.

The EV technique has buoyed Wall Avenue brokerages, with Deutsche Financial institution the newest to boost its value goal on Ford.

“We see room for Ford’s fourth quarter efficiency to come back in above consensus expectations, primarily based on continued sturdy pricing offsetting rising uncooked supplies headwinds,” Deutsche Financial institution analyst Emmanuel Rosner mentioned in a analysis be aware, whereas elevating its value goal to $24 from $18.

The median Wall Avenue value goal is $21.85.

Associated video: