Earlier than the worldwide pandemic struck, auto OEMs have been accustomed to regular funds will increase as expertise reworked enterprise processes, fashions, and techniques. COVID-19 completely modified their strategy to expertise, future mobility and corresponding investments.

The pandemic additionally uncovered the key provide chain weaknesses, together with demand surges and drops, commodity shortages, diminished productiveness, supply delays and storage and product dealing with points. Consequently, COVID-19 turned an eye-opener for the adoption of resilient in-house provide chain and administration options. And so, the stakeholders of the automotive trade rushed to make native preparations.

“In 2021 a whole lot of investments have gone into digitisation throughout the worth chain. A significant a part of the investments was on product growth for electrical autos and tweaking the manufacturing setup accordingly. Investments have additionally gone into the event cycles of the merchandise for the forthcoming security and emission rules,” Ashim Sharma, accomplice and group head – enterprise efficiency enchancment consulting, Nomura Analysis Institute, mentioned.

In a 12 months of market oscillation, auto OEMs recorded USD 13 billion (~INR 99,000 crore) funding in India throughout all deal sorts, essentially the most outstanding being for electrical mobility. Combining each the legacy gamers and the startups, nearly half of the gross investments (~ INR 48,400 crore) was on electrical structure growth.

Whereas OEMs and startups centered extra on electrical and future mobility within the short-to-medium time period, suppliers spent extra on technological upgrades and software program assets.

After a interval of pandemic-induced slowdown that resulted in subdued spending, market watchers say that client sentiments began trying up from January, 2021. This prompted firm leaders to expedite spending.

Throughout this era, automotive industries additionally witnessed disruption within the provide chain of microchips. This disaster continues, and an unavoidable concern needs to be raised on whether or not the semiconductor crunch will affect or reverse the R&D and the tech spending methods within the coming months.

Listed here are some developments that drove the course of investments this 12 months:

Investments obtained electrified: Spending in the direction of future-mobility applied sciences continued all through the pandemic. Analysis exhibits that about 48% (~INR 48,400 crore) of the overall investments was in inexperienced and future mobility and associated infrastructure growth, particularly within the aftermath of the COVID disaster.

That is because of the large variety of battery-operated electrical propulsion expertise developments and system integration round automation, connectivity, electrification, and good mobility (ACES) options. Out of ACES, e-mobility has emerged as the primary characteristic of funding in accordance with ETAuto Analysis, notably round battery expertise and administration programs, e-motors, and energy electronics.

Electrification additionally obtained a significant enhance with the arrival of latest age corporations. About 90% of startups within the auto trade are working and growing merchandise associated to EVs.

This, nonetheless, attracts a pointy distinction to the early days of 2020 when e-mobility area was highlighted as one of the negatively impacted areas resulting from COVID-19.

Software program was on the core: Though companies made substantial cuts in spending in nearly each class, there have been growing expertise budgets for many of the automakers (OEMs) and tier-1 suppliers. Within the R&D areas of spending, corporations have been allocating substantial budgets on software program and software-related characteristic growth. General, the funding pattern highlights that the main target has been shifting within the automotive trade, each from the OEM and the provider views. Stakeholders have been inserting software program growth on the forefront resulting from its vital function within the car of the longer term.

Automobile navigation software program, multi-operating infotainment programs, built-in cybersecurity and autonomous ADAS options have been among the many focus areas drawing the eye of the automakers.

Automation is one other space the place corporations diverted their software program funds. Workforce shortages required organisations to search for alternatives to automate processes, store flooring and to cut back human involvement.

Startups made a mark: The non-incumbents, in accordance with the Analysis, have remodeled INR 15,615 crore of investments on future-mobility within the final 12 months. Although the quantum is small, the startup group rallied to battle the Coronavirus disaster in one of the simplest ways it knew—with improvements and up to date applied sciences. These enterprise capital-backed newcomers have been those who responded to the disaster with the quick adoption of digital applied sciences.

Though present volumes are restricted, EVs are anticipated to develop in a giant manner. With the federal government concentrate on inexperienced mobility, it’s cheap to count on the inflow of startups on this space they usually type over 32% of investments on this area.

Comparatively, conventional automotive corporations accounted for 67.7%, or roughly INR 32,800 crore of the overall funding on electrical mobility this 12 months.

Provide-chain disruption pushed in-house capabilities: A extra perceptible affect of the pandemic has been on the availability chain entrance. Provide chain issues have been radical not solely due to COVID-19 but additionally due to geopolitical tensions, microchip shortages, and even the blockage of the Suez Canal.

OEMs have been conscious of the truth that supply-side uncertainties could hinder sustainability-related innovation adoption. Subsequently they began investing in new crops, manufacturing traces, and accelerated spending on electrical autos, batteries and various vitality.

Regardless of the current market choppiness, the demand continues to develop very quick. Aside from startups, the try by incumbent corporations to spend their manner out of a post-recession restoration – by pouring cash into under-invested infrastructure – and a rising dedication to decarbonisation are fuelling a sturdy demand in passenger autos not seen in years.

As an example, after a spot of over 15 years, India’s largest carmaker Maruti Suzuki India introduced its plan to spent INR 18,000 crore in a greenfield manufacturing unit in Haryana with a peak annual capability of 10 lakh models

Equally, the Indian wing of Fiat Chrysler Vehicles (FCA) confirmed its intention to spend INR 1,900 crore in increasing its product line to fabricate 4 new SUVs underneath the Jeep model.

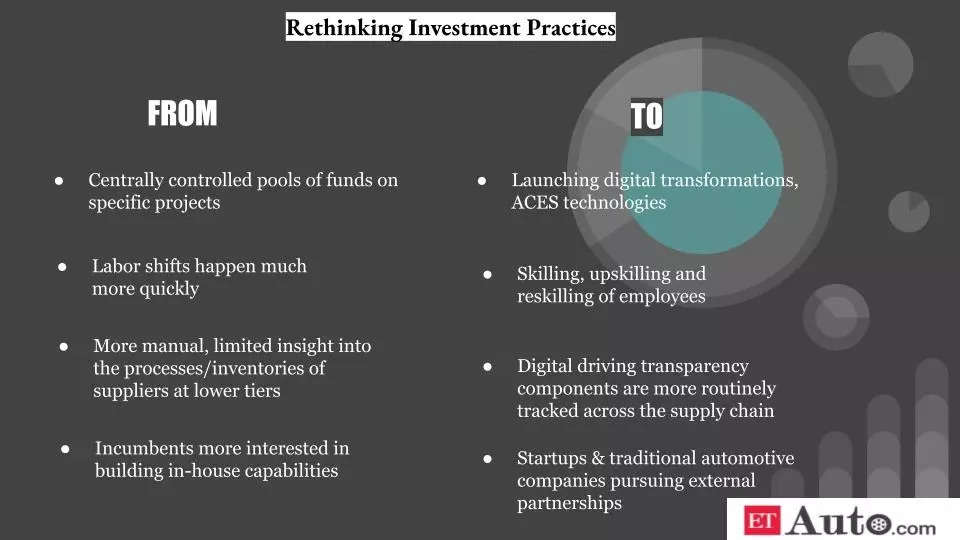

Conclusion: Prior to now 12 months the mobility buyers underscored the rising tempo of change because the COVID-19 disaster added a brand new layer of complexity to an already difficult state of affairs. This means a brief window of time for all mobility stakeholders, together with incumbents, tech giants, and buyers, to arrange their companies for disruption. It’s subsequently obligatory to know the place the market is shifting and why, after which transfer your capital accordingly.

(Disclaimer – The numbers could barely differ from the actuals as these numbers symbolize solely corporations survey by ETAuto)

NOTE: The second a part of ‘Investments in time of COVID-19’ phase will seem on Wednesday. Keep Tuned!