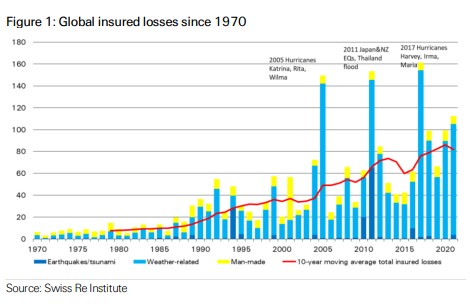

Excessive climate occasions in 2021, together with a deep winter freeze, floods, extreme thunderstorms, heatwaves and a significant hurricane, resulted in estimated annual insured losses from pure catastrophes of US$105 billion, the fourth highest since 1970, in keeping with Swiss Re Institute’s preliminary sigma estimates.

Man-made disasters triggered one other US$7 billion of insured losses, leading to estimated international insured disaster losses of US$112 billion in 2021, stated Swiss Re.

Whereas Hurricane Ida was the most costly pure catastrophe in 2021, winter storm Uri and different secondary peril occasions triggered greater than half of whole losses as the consequences of wealth accumulation and local weather change drive claims in disaster-prone areas, stated the report.

The 2 costliest pure disasters of the 12 months have been each recorded within the U.S.: Hurricane Ida and winter storm Uri. (The report was issued earlier than the losses have been calculated from the tornadoes that ripped by means of central U.S. this week).

Hurricane Ida triggered US$30-$32 billion in estimated insured damages, together with flooding in New York, whereas winter storm Uri wreaked US$15 billion in insured losses. Uri introduced excessive chilly, heavy snowfall and ice accumulation, particularly in Texas the place the facility grid skilled a number of failures on account of freezing circumstances.

The most costly occasion in Europe, in the meantime, was the July flooding in Germany, Belgium and close by nations, inflicting as much as US$13 billion in insured losses, compared with financial losses of greater than US$40 billion, which signifies a really massive flood safety hole in Europe. The flooding was the most costly pure catastrophe for the area since 1970 and likewise the world’s second highest, after the 2011 Thailand flood.

“In 2021, insured losses from pure disasters once more exceeded the earlier 10-year common, persevering with the development of an annual 5–6% rise in losses seen in current a long time. It appears to have change into the norm that not less than one secondary peril occasion equivalent to a extreme flooding, winter storm or wildfire, annually ends in losses of greater than US$10 billion,” commented Martin Bertogg, head of Cat Perils at Swiss Re.

“On the similar time, Hurricane Ida is a stark reminder of the menace and loss potential of peak perils. Only one such occasion hitting densely populated areas can strongly influence the annual losses,” he added.

“The influence of the pure disasters now we have skilled this 12 months as soon as once more highlights the necessity for important funding in strengthening vital infrastructure to mitigate the influence of utmost climate circumstances,” stated Jérôme Jean Haegeli, Swiss Re’s group chief economist.

“Investments in infrastructure assist sustainable development and resilience and must be upscaled. Within the U.S. alone, the infrastructure funding hole to take care of vital and growing old infrastructure is US$500 billion on common per 12 months till 2040. Partnering with the general public sector, the insurance coverage trade is vital for strengthening society’s resilience to local weather dangers, by investing in and underwriting sustainable infrastructure,” Haegeli added.

Additional devastating secondary peril exercise in Europe included extreme convective storms in June, with thunderstorms, hail and tornadoes inflicting widespread injury to property in Germany, Belgium, the Netherlands, Czech Republic and Switzerland. The ensuing insured losses are estimated at US$4.5 billion. Elsewhere on the earth, continued, Swiss Re, there have been extreme flooding occasions in China’s Henan province and British Columbia in Canada, amongst others.

Report Temperatures

On the opposite finish of the intense climate spectrum, Canada, adjoining components of the U.S. and plenty of components of the Mediterranean skilled file temperatures in 2021. Over the last days of June, a “warmth dome” set a brand new all-time Canadian temperature file of almost 50°C (122°F) in a village in British Columbia, the sigma report stated. Temperatures within the Demise Valley, Calif. reached 54.4°C (129.9°F) throughout one in all a number of heatwaves within the southwest.

The distinctive warmth was typically accompanied by devastating wildfires, stated Swiss Re, noting, nonetheless, that the related insured losses have been decrease than in recent times, when the fires affected extra populated areas. In California, wildfires destroyed, specifically, massive forest areas however in distinction to 2017, 2018 and 2020, encroached on areas of decrease property focus.

These sigma disaster loss estimates are for property injury and exclude claims associated to COVID-19. Swiss Re stated loss estimates are preliminary and are topic to vary as not all loss-generating occasions have been absolutely assessed, equivalent to December disaster exercise. COVID-19 has elongated the claims lifecycle, significantly for giant occasions, and it’ll take significantly longer than regular to evaluate the ultimate tally, stated Swiss Re.

{Photograph}: A lady appears at vehicles and homes broken after flooding in Liege, Belgium, Monday, July 19, 2021. Residents in a number of provinces continued to wash up after extreme flooding in Germany and Belgium turned streams and streets into raging torrents that swept away vehicles and triggered homes to break down. Picture credit score: AP Picture/Valentin Bianchi.

Matters

Carriers

Claims

Swiss Re