Tesla Chief Govt Elon Musk bought one other $973 million in inventory to pay taxes after exercising choices on Tuesday, filings confirmed after the electrical automobile maker’s shares rebounded throughout common commerce.

Musk acquired 2.1 million shares price $2.2 billion on the Tuesday closing value and bought 934,091 for $973 million to pay taxes, the SEC filings confirmed.

In a sector surge spearheaded by Rivian Automotive and Lucid Group, Tesla rose 4.1% to shut at $1,054.73, leaving its market capitalization down about $187 billion since earlier than Musk started promoting shares final week.

Rivian’s inventory jumped 15%, with the EV maker now up over 120% since its preliminary public supply final Wednesday.

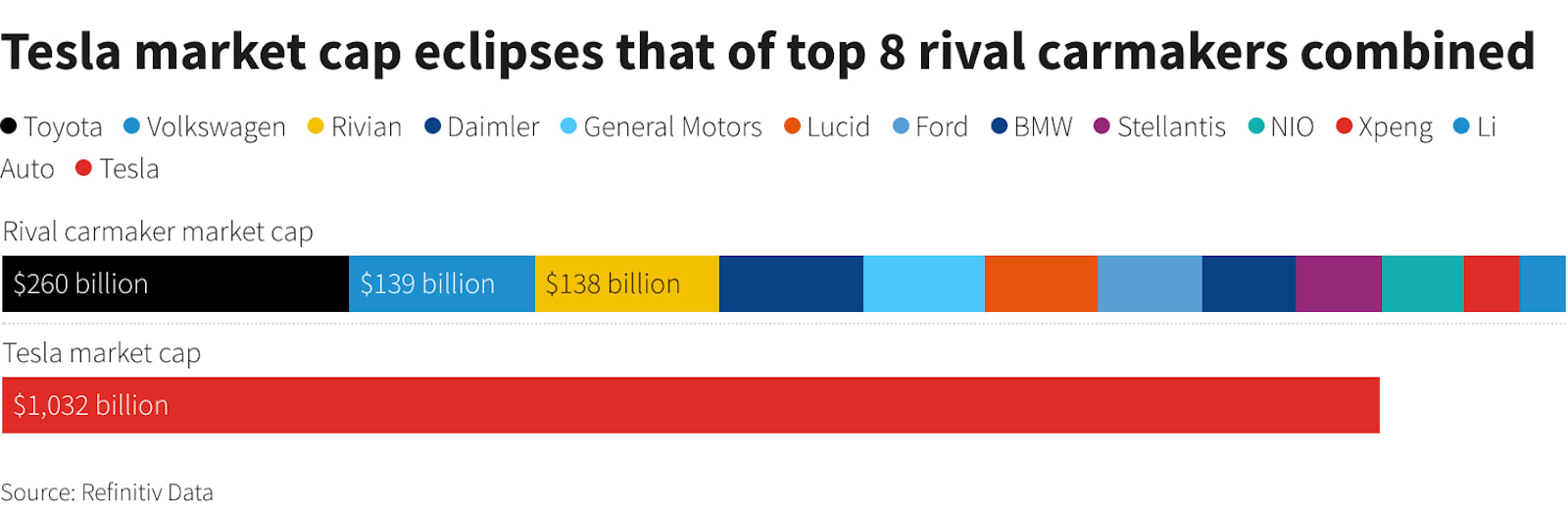

Rivian disclosed in a submitting on Tuesday that its underwriters purchased 22.95 million further shares, boosting the whole dimension of the IPO. Together with these shares, Rivian’s market capitalization rose to $153 billion, overtaking Volkswagen AG by $14 billion and making the Irvine, California, firm the world’s third-most precious carmaker. Tesla market cap eclipses that of prime 8 rival carmakers mixed.

Lucid surged practically 24% after it stated reservations for its automobiles rose to 13,000 within the third quarter and that it’s assured it’ll produce 20,000 of its upcoming Lucid Air sedans in 2022.

The achieve in Lucid’s shares elevated its inventory market worth to $90 billion, overtaking Ford and leaving it $1 billion in need of Normal Motors.

Over the previous week, Musk has bought about 8.2 million Tesla shares for round $8.8 billion. These gross sales fulfill virtually half of his pledge on Twitter to promote 10% of his stake in Tesla.

Musk started promoting shares final week after floating the concept in a Twitter ballot.

With electric-car makers more and more in demand on Wall Road, Tesla’s inventory has surged greater than 150% previously 12 months.

“There’s nonetheless loads of shopping for curiosity as a result of I nonetheless assume finally traders are viewing this as a part and viewing pullbacks as a chance,” stated Craig Erlam, senior market economist at OANDA.

“Should you ask me the place the share value goes to be six months from now, 12 months from now? I might say it is extra prone to be 20% increased than 20% decrease.”

Associated video: